Globally some 1,800 companies in the US, UK, Europe, and Asia are due to release June quarter or June half-year or 2019-20 financial year results this week.

In the US it will be the second busiest week of June 30 reporting season lies ahead of us with more than 1,600 stocks due to release quarterly earnings data, with around 80 in the S&P 500.

Last week the US season saw its peak on Friday with Amazon, Apple, Alphabet, and Facebook reporting combined earnings of more than $US28 billion on combined revenues of $US200 billion.

From now on there will be more and more losses (apart from one-offs like Home Depot, Target, and Walmart for instance).

But the big news this week will come from some of the world’s oil majors which will produce reports full of red ink.

The tide of losses will flow from the energy companies led by BP on Tuesday after Chevron and Exxon Mobile on Friday both reported big blobs of red ink.

Chevron Corp reported an $US8.3 billion loss on asset write-downs of $US5.7 billion and ExxonMobil Corp recorded a second consecutive quarterly loss of $US1.1 billion, its largest-ever quarterly loss.

Shell had earlier report an $US18.3 billion loss after warning of big asset write-downs earlier in the month. Those write-downs totaled $US16.8 billion after tax.

Others due to report include HSBC, Fox Corp, News Corp, Walt Disney, Liberty Global, Loews, and Gannett.

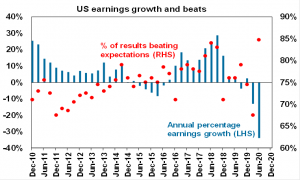

The AMP’s chief economist, Shane Oliver says that so far around 60% of US S&P 500 companies have reported June quarter earnings and results have remained better than expected with a bigger than average 85% beating on earnings by an average 22.7% and 67% beating on sales.

“This has seen significant upwards revision to consensus earnings expectations, with earnings now expected to fall -34%yoy in the June quarter compared to -44% a few weeks ago.

“But this doesn’t include the flood of red ink from energy, especially oil and gas companies that will be released this week in the US and Europe,” he pointed out.