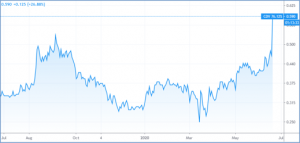

Cardinal Resources – (ASX: CDV, Share Price: $0.59, Market Cap: $295m, coverage initiated @ $0.29 in June 2016 – current gain of 103%)

Key Catalyst

CDV share price up 25% after receipt of 100% cash takeover offer from Shandong Gold at A$0.60 per share, board unanimously recommends Shandong offer in the absence of a superior proposal.

CDV has performed solidly since our coverage initiation back in June 2016, driven by highly successful exploration drilling programs at its flagship Namdini project in Ghana, which in turn has led to the establishment of a multi-million-ounce gold resource base. Whilst CDV pursues additional resource growth, it’s also strongly focused on advancing Namdini to production status, with a recently completed Bankable Feasibility Study (BFS) forecasting low-cost gold production over +15-years. CDV is now focused on securing project funding. CDV has also enjoyed success at its new Ndongo East discovery, 24km north of Namdini, with high-grade near-surface gold mineralisation over a 1.2km strike length that’s hosted within a larger target area measuring approximately 7km in strike length. CDV is also maintaining exploration programs at its Bolgatanga (Northern Ghana) and Subranum (Southern Ghana) Projects.

Latest Activity

Corporate Update

CDV has entered into a Bid Implementation Agreement with Shandong Gold Mining (Hong Kong), which will see the company acquire 100% of the issued and outstanding ordinary shares in CDV at $0.60 cash per share by way of an off-market takeover offer.

The Shandong offer represents an attractive cash premium to CDV’s recent trading. Firstly, it represents a 75.5% premium to CDV’s 20-day unaffected volume weighted average price (VWAP), and a 39.3% premium to CDV’s 20-day VWAP up to 18 June 2020. The offer also represents a 31.1% premium to the Nord Gold SE indicative proposal of $0.45775 on 16 March 2020.

The offer is by way of an off-market takeover offer, with a 50.1% minimum acceptance condition.

The Board of CDV has unanimously recommended the Shandong Gold Offer in the absence of a superior proposal. CDV’s board, who collectively hold approximately 6.37% of the company’s ordinary shares, intend to accept the Shandong Gold Offer in respect of all the CDV shares they own or control.

Technical Significance

CDV says it has carefully considered the Shandong Gold Offer in consultation with the Special Committee appointed in connection with the strategic process, its financial and legal advisors. Accordingly, the company’s board unanimously recommends the Shandong Gold Offer in the absence of a superior proposal.

CDV’s board has been exploring a range of potential transactions to maximise value for shareholders and they consider the Shandong Gold offer to be the best option for shareholders. Accepting the offer will allow CDV’s shareholders to realise certain and immediate value at a significant premium to CDV’s trading price on the ASX and TSX markets.

By accepting the Shandong Gold offer, CDV shareholders will also avoid risks associated with mine development – such as financing, operational and regulatory risks.

Overview

CDV has involved in a strategic process with banks, financiers and other parties, with the aim of realising value from the Namdini Project. Unfortunately, securing project funding has not been an easy process in a tough market environment. As a result, CDV has over recent months received two takeover offers.

The first was a preliminary takeover proposal of $0.45775 per share from its largest shareholder, UK-based Nord Gold SE. Nordgold had increased its interest in CDV to 19.9%, as a result of agreeing to purchase Gold Fields’ 16.6% stake at $0.45775 cash per share.

The second offer is the current cash takeover offer at $0.60 per share by Shandong Gold.

Both offers could be described as opportunistic, as they look to take advantage of a difficult funding environment for emerging production companies, along with the recent volatility on world equity markets, which had led to a significant fall in the market valuations of gold companies with advanced resource projects.

CDV, with its advanced, multi-million ounce Namdini project, therefore represented an ideal candidate – and hence it should come as no surprise that suitors have emerged. Indeed, we have consistently flagged the potential for corporate activity with respect to CDV for, especially in a market environment where securing project developments funding has proven problematic.

What’s more, despite the recent volatility in equity markets and funding conditions, the bigger picture with respect to gold appears to be outstanding – with lower interest rates, a weaker US$ and higher debt levels around the world, providing fertile ground for higher gold prices.

One cannot therefore discount the potential for a rival bidder to emerge.

Project Overview

CDV) is a West African gold‐focused exploration and development company that holds interests in tenements in Ghana. The company is however focused on the development of its Namdini Project, which hosts a published gold Ore Reserve comprising 5.1Moz (138.6 Mt @ 1.13 g/t Au; 0.5 g/t cut‐off), inclusive of 0.4Moz Proved (7.4 Mt @ 1.31 g/t Au; 0.5 g/t cut‐off) and 4.7Moz Probable (131.2 Mt @ 1.12 g/t Au; 0.5 g/t cut‐off).

Bankable Feasibility Study

CDV released the results of its much-anticipated Namdini Feasibility Study during October 2019, confirming it as a gold project with attractive economic returns.

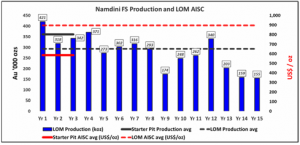

The Study forecasts 4.2Moz of gold will be produced over a 15-year period at an All‐in Sustaining Cost (AISC) of US$895/oz, compared to 3.9Moz at US$769/oz in the Pre‐Feasibility Study (PFS). Namdini will comprise a single, large open‐pit with a conventional process plant design.

The Ore Reserve of 5.1Moz represents a 7% increase on the 4.76Moz Ore Reserve in the PFS. The project is forecast to generate US$1.46 billion in undiscounted, pre‐tax free cashflow over a 15-year mine life at an assumed gold price of US$1,350/oz, increasing to US$2.05 billion undiscounted, pre‐tax free cashflow at a gold price of US$1,500/oz.

Namdini Project Net Present Value (NPV) and Internal Rate of Return (IRR) are forecast to be US$914 million and 43% respectively (pre-tax), along with US$590 million and 33.2% (post‐tax), based on a US$1,350/oz gold price.

Project capex is estimated at US$348 million capital expenditure with a US$42 million contingency, which is down 16% from the PFS capex estimate of US$414 million. Capex payback is estimated at just 21 months based on a US$1,350/oz gold price, with payback falling to just 12 months based on a US$1,500/oz gold price.

The Feasibility Study demonstrates a viable, globally significant, long‐life gold project at Namdini. With more than 1 million ounces of gold slated for production during the first three years, 421,000 oz in Year 1 alone and an average annual gold production of 287,000 oz over a 15‐year mine life, Namdini ranks amongst the world’s largest known, financially-robust, undeveloped gold projects.

The rapid payback period is driven by a combination of early high grades and recoveries, low strip-ratio (and low costs within the starter pit. (AISC) are estimated at just US$585 during the capex payback period.

Summary

CDV, with its advanced, multi-million ounce Namdini project, presents itself as an ideal takeover candidate. Indeed, we have consistently flagged the potential for corporate activity with respect to CDV, especially in a market environment where securing project developments funding has proven problematic.

CDV’s board has been exploring a range of potential transactions to maximise value for shareholders and they consider the Shandong Gold offer to be the best option for shareholders. We will watch developments closely to see if a rival bidder could emerge.