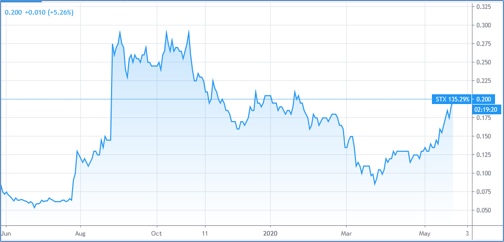

Strike Energy – (ASX: STX, Share Price: $0.20, Market Cap: $299m, coverage initiated @ $0.10 in October 2015 – current gain of 100%)

Key Catalyst

The Strike-Warrego Joint Venture has made a significant gas discovery within the Kingia sandstone as part of the West Erregulla-2 drilling campaign, exceeding all expectations.

We initiated coverage of STX back in 2015. The company’s initial focus was on defining the overall resource size and commercial viability of its emerging Southern Cooper Basin Gas Project (SCBGP), with the ultimate aim of delivering gas under long-term supply arrangements to energy-hungry markets in Eastern and Southern Australia. Along the way, STX has strived to overcome various significant technical challenges. What we now know is that the SCBGP’s coal seams host an enormous amount of gas and with the successful completion of the Jaws-1 wells, with STX now testing the commercial quality of the SCBGP. More recently STX has focused its attention on its interests in Western Australia’s onshore Perth Basin, where it has enjoyed enormous success with its West Erregulla-2 well. This outstanding discovery, from Australia’s deepest-ever onshore gas well, has confirmed STX’s subsurface interpretation of a high-quality reservoir with excellent productivity that could produce some of the lowest-cost gas in Australia.

Latest Activity

West Erregulla Overview

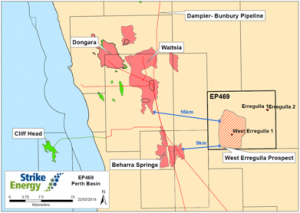

It is timely to provide an overview of the current status of the company’s 50%-owned West Erregulla Project, located within EP 469 in Western Australia. STX is the project Operator in a joint venture with Warrego Energy (ASX: WGO). During August 2019, STX announced it had made a major gas discovery with its West Erregulla 2 well.

Figure 1: Location of the West Erregulla Prospect within the onshore Perth Basin

The drilling program intersected several gas reservoirs, including the Kingia formation, which showed a gross gas column of at least 97 metres. Subsequent flow-testing of the Kingia sandstone delivered a flow rate of approximately 69 million standard cubic feet per day, through a two-inch choke and 700 PSIG wellhead pressure over a one-hour period.

This outstanding discovery, from Australia’s deepest-ever onshore gas well, has confirmed STX’s subsurface interpretation of a high-quality reservoir with excellent productivity. Combined with what are expected to be commercial discoveries within the High Cliff and Wagina formations, STX believes these resources have the potential to produce some of the lowest-cost gas in Australia.

During 2020, STX and WGO will undertake further appraisal drilling in EP 469, and plan to be in a position to take a Final Investment Decision on a development project for the resources in 2H 2020.

WA Gas Market Overview

The quarter saw the commencement of one of the sharpest economic downturns in history, with the outbreak of COVID-19. For energy markets this was coupled with the Saudi/Russian forced oversupply – designed to test the break-even price of other international competitors and to regain market share. The subsequent collapse in oil prices was preceded by a perceived oversupply in global LNG. This in turn was pushing down spot LNG prices to all time historical lows. These three major events have compounded their effects on several prospective LNG projects in WA, which were in the latter stages of major project milestones.

As a result, Woodside Energy (ASX: WPL), operator of both the Scarborough and Browse LNG mega projects, acknowledged the difficulty in progressing in line with their original schedules, with the result that major delays and deferments would occur. Scarborough will now not take an FID until 2021, while Browse has been pushed back without announcing any rescheduled investment horizons.

Chevron has also announced a 20% reduction in total capital investment for 2020. Chevron has been progressing the Gorgon LNG Phase 2 project, which included an increase to their domestic gas production capacity as per their obligations. However, it appears possible that the project timeline for construction and completion of these domestic gas facilities may be at risk.

Technical Significance

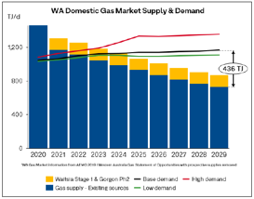

With the Woodside projects’ associated domestic gas making up 70% of the total prospective gas required to come online by the end of the decade, together with uncertainty in the delivery timing of the Gorgon Phase 2 domestic gas plant, the WA gas market looks set to tighten.

This evolving landscape positions STX well to deliver on its aspirations of becoming one of WA’s largest domestic gas producers, as the market and customers generate demand for the acceleration of the targeted Phase 2 West Erregulla volumes.

This is a the AEMO supply and demand chart for the WA domestic gas market, with the prospective projects removed. The yellow section represents Waitsia Stage 1 (20 TJ/d) and the remainder is Gorgon Phase 2 (118 TJ/d). It is possible the domestic gas plant expansion of Gorgon Phase 2 might be subject to delays. As a result, the WA domestic gas market may now be anywhere between 298 and 436 TJ/d short by 2029 unless new projects like West Erregulla Phase 1 & 2 are sanctioned and brought online in a timely manner.

West Erregulla Next Steps

Appraisal activity is the next step with respect to the West Erregulla Project. The proposed Appraisal Plan involves the drilling of the West Erregulla 4 & 5 wells, in addition to the West Erregulla 3 well to be drilled during H2 2020.

West Erregulla 3 has been located with the aim of confirming the continuity of the field on the northern side of the saddle feature that makes up the West Erregulla gas field. Several drilling rigs have been identified as available to drill the West Erregulla 3 well during H2 2020. Civil works for the preparation of the drilling lease at West Erregulla 3 are expected to commence in May.

West Erregulla 4 & 5 are designed to broaden the understanding of the Kingia and High Cliff reservoir quality distribution, as well as to provide well productivity at a notional field development spacing of 500 acres. West Erregulla-4 will also aim to collect the remaining subsurface parameters required to bring the Wagina gas discovery into the field development planning process. Both West Erregulla 4 & 5 are proposed to be drilled and tested to gather the required appraisal data and to be completed as future producers for the planned Phase 1 project. Subject to the timing of requisite approvals and Joint Venture processes, STX is aiming for commencement of these operations during Q1 2021.

Once FEED is initiated, STX will have sufficient ‘firm’ information on its project economics to move from its preliminary inquiries for project financing to commencing formal discussions with select finance partners for the Phase 1 development. Strike is currently in discussions with several Tier-1 lending institutions and will look to broaden the participants this coming quarter. STX is looking to confirm the debt facility over the coming months in preparation for a targeted Q4 2020 final investment decision.

STX has also been working on the necessary inputs to convert EP469 to a Production Licence (PL). During February, the West Erregulla Kingia-High Cliff gas discovery was declared a discovery by the regulator, which is the precondition to the PL application process. This is a positive step towards achieving the permitting milestones for the targeted start-up of production operations during 2022.

Summary

West Erregulla is one of the largest pre-drilled conventional onshore prospects in Australia and recent developments in terms of the understanding of the Wagina discovery are exciting. This outstanding discovery, from Australia’s deepest-ever onshore gas well, has confirmed STX’s subsurface interpretation of a high-quality reservoir with excellent productivity. Combined with what are expected to be commercial discoveries within the High Cliff and Wagina formations, STX believes these resources have the potential to produce some of the lowest-cost gas in Australia.

Furthermore, as a result of recent global economic conditions, two West Australian LNG projects have announced major delays. Both projects had previously been identified as significant contributors to the WA domestic gas market in the mid to late 2020s. As a result of these delays, STX is now forecasting a tightening of WA domestic gas market conditions.