Heading into the busiest five days of the reporting season and dividend cuts, weaker profits, and downgrades have dominated the Australian December half year (and occasional full year) reporting, with the uncertainty caused by the bushfires and China’s coronavirus crisis just starting to emerge, but not yet fully shaped.

Analysis by AMP Capital shows that it’s been a mixed start to the season with around a quarter of ASX 200 companies to have reported so far.

Last week we saw results from the Commonwealth Bank, CSL, Bapcor, JB Hi-Fi, Breville and an update from the NAB help the market to close higher by the end of the session on Friday. AMP reported a big loss though and no dividend.

But they were exceptions. The AMP says that so far 61% of companies have seen their profits rise from a year ago but this is below the long term norm of 65%.

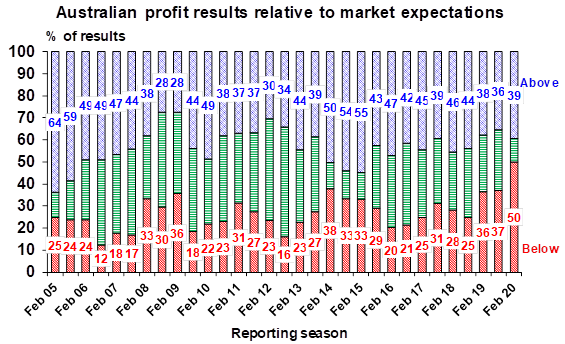

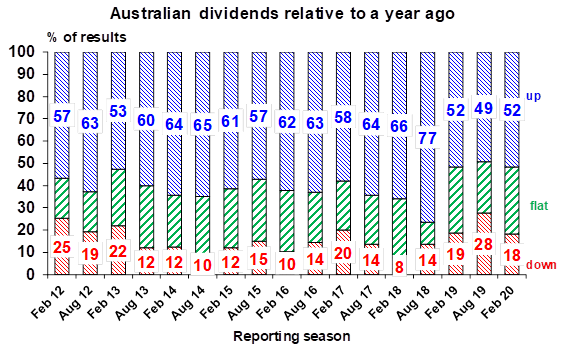

The AMP’s Chief Economist, Shane Oliver says half of the results so far have surprised on the downside which compares to a norm of just 26%, and only 52% of companies have raised their dividends which is well down from the highest of 77% of companies raising their dividends back in August 2018.

The coming week sees around 100 major companies reporting. These include QBE, Brambles, BHP, Cochlear and Coles, Wesfarmers, Tabcorp, Fortescue and Crown, Seven West Media and Seven Group Holdings, Lendlease and Boral (which will confirm the profit fall and dividend cut announced last week).

Others reporting include AP Eagers, Asaleo Care, Scentre, Qantas, Qube, GWA, Medibank Private, Ansell, Stocklands, Pact Group, and Link Administration

The AMP’s Shane Oliver says “Earnings growth is expected to be running around 2-3% led by tech, telco, gaming, health care, and consumer staple stocks, with resources earnings up around 3.5% but banks lagging with just 1% earnings growth.”

“Key points to watch for are a fall in dividends and company comments around the bushfires and coronavirus.”

Source: AMP Capital