Liontown Resources – (ASX: LTR, Share Price: $0.105, Market Cap: $168m – coverage initiated @ $0.025 in February 2019 – current gain of 320%)

Key Catalyst

Updated Kathleen Valley MRE represents an 86% increase from the July 2019 MRE of 74.9Mt @ 1.3% Li2O and a 556% increase in tonnes from the maiden MRE of 21.2Mt @ 1.4% Li2O in Sep 2018.

LTR has been a strong market performer, with investors developing a more thorough appreciation of the significance of the company’s Kathleen Valley lithium project in Western Australia. The robust financial outcomes generated by the recently-released PFS reflect the project’s scale, grade, product quality and proximity to established, modern infrastructure – with the Study establishing a strong foundation for further growth, optimisation and project upside. Recent drilling results have boosted the overall Resource base by 86%, which could potentially justify a much larger mine with higher annual production. This option will be considered as part of the DFS that’s scheduled for release during Q3 2020. LTR has also recently reported maiden Mineral Resource Estimate (MRE) for its Buldania Project – also in Western Australia, confirming a significant new greenfields lithium discovery with growth potential.

Latest Activity

Kathleen Valley Update

Following on from our previous report, where we highlighted further encouraging results from the company’s ongoing resource expansion drilling program at Kathleen Valley, the company has announced an enhanced interim Mineral Resource Estimate (MRE).

The just-released interim Measured, Indicated and Inferred MRE for Kathleen Valley comprises 139Mt @ 1.3% Li2O and 140ppm Ta2O5 (reported above a cut-off grade of 0.55% Li2O) – for 1.8Mt of contained lithium oxide and 43Mlbs of contained tantalite. Significantly, 58% of the updated Mineral Resource is classified as Measured or Indicated.

Technical Significance

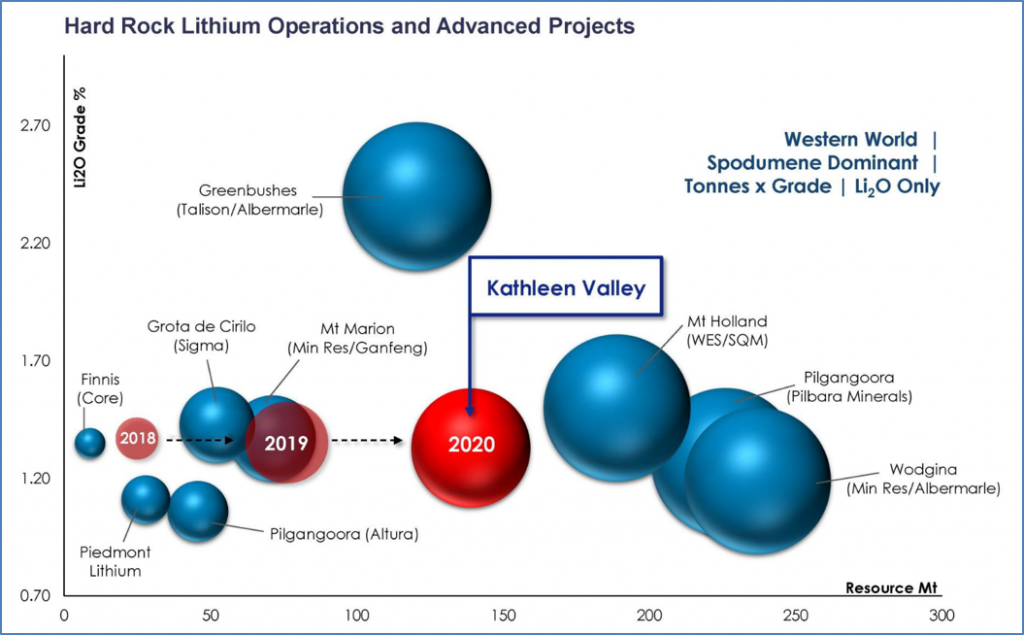

Using the benchmark Lithium Carbonate Equivalent (LCE) measure, the resource contains 4.5Mt of LCE, underlining its position as one of the few new, significant lithium projects of scale currently being progressed towards development in Australia over the next 2-3 years. In terms of scale, the upgrade clearly underlines that Kathleen Valley is a Tier-1 lithium-tantalum deposit, as the graphic below shows.

Figure 1: Kathleen Valley – comparison with other significant lithium deposits

To put things into perspective, the updated MRE represents an 86% increase from the July 2019 MRE of 74.9Mt @ 1.3% Li2O and 140ppm Ta2O5 and a 556% increase from the maiden MRE of 21.2Mt @ 1.4% Li2O and 166ppm Ta2O5 released in September 2018.

What’s important is that while the resource base has grown more than sixfold since the maiden estimate was announced back in 2018, this has not occurred at the expense of grade – with high average lithium and tantalum grades being maintained.

Encouragingly too, the Mineral Resource remains open both along strike and at depth, so there is potential for further growth once all results are received from the ongoing drilling program, which is scheduled for completion at the end of February 2020.

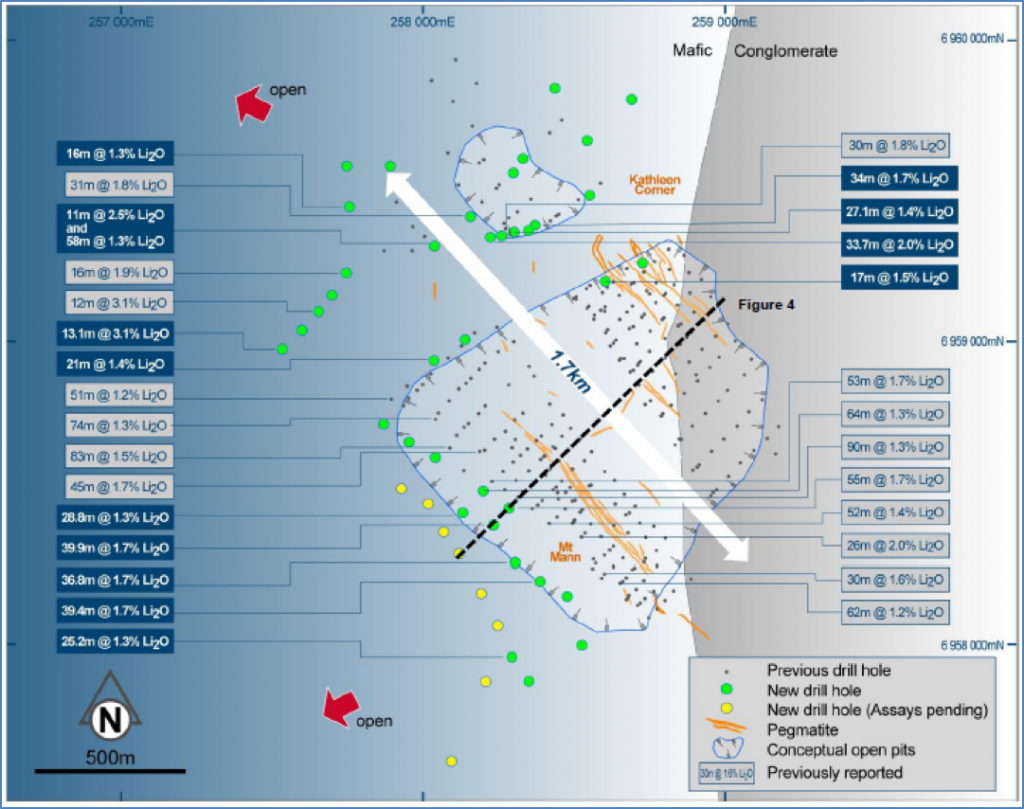

The potential for resource expansion can be seen clearly in the graphic below, with the most recent drilling results confirming both the strike and dip continuity of the Kathleen Valley mineralised system, which has now been defined over at least 1.7km and remains open along strike and at depth, with multiple zones of high-grade mineralisation intersected.

Figure 2: Kathleen Valley – Drill hole plan showing better intersections from current and previous drill hole programs

LTR is investigating both open-pit and underground mining methods. Accordingly, it has selected a cut-off grade of 0.55% Li2O for resource reporting, which strikes a balance between the potential open-pit and underground expected cut-off grades.

Next Steps

In-fill drilling and drilling to define the margins of the mineralised system is continuing at Kathleen Valley, with up to five drill rigs in operation. This drilling is designed to increase the percentage of Measured and Indicated material, which could potentially be converted to Ore Reserves, and also further expand the resource – which remains open along strike and at depth.

Drilling is scheduled to be completed by the end of February 2020 with the subsequent data used to prepare a MRE scheduled for completion in March 2020, which will form the basis for a DFS.

The next MRE will include both open-pit and underground resources, which are anticipated to provide the best outcome for the DFS by providing the opportunity to bring forward the mining of higher-grade mineralisation.

Summary

LTR’s ongoing drilling has confirmed the strike and dip continuity of the Kathleen Valley mineralised system, which has now been defined over at least 1.7km and remains open along strike and at depth, with multiple zones of high-grade mineralisation intersected.

The just-released interim MRE update is a precursor to a MRE scheduled for completion in March 2020 that will ultimately underpin a Definitive Feasibility Study (DFS). The MRE shows that Kathleen Valley is a Tier-1 lithium-tantalum deposit.