Cardinal Resources – (ASX: CDV, Share Price: $0.365, Market Cap: $175m, coverage initiated @ $0.29 in June 2016 – current gain of 26%)

Key Catalyst

CDV has performed solidly since our coverage initiation back in June 2016, driven by highly successful exploration drilling programs at its flagship Namdini project in Ghana, which in turn has led to the establishment of a multi-million ounce gold resource base. Whilst CDV pursues additional resource growth, it’s also strongly focused on advancing Namdini to production status and securing project funding, with a recently completed Bankable Feasibility Study (BFS) forecasting low-cost gold production over +15-years. CDV has also enjoyed initial success at its new Ndongo East discovery, 24km north of its Namdini project, with high-grade near-surface gold mineralisation over a 1.2km strike length that’s hosted within a larger target area measuring approximately 7km in strike length. CDV is also maintaining exploration programs at its Bolgatanga (Northern Ghana) and Subranum (Southern Ghana) Projects.

Latest Activity

Namdini Project Funding Update

CDV has provided an update with respect to project financing negotiations for its Namdini Gold Project in Ghana. The company in conjunction with appointed financial advisers, Cutfield Freeman & Co, have received numerous term-sheets from banks and financiers.

With the release of the Feasibility Study and accompanying NI43‐101 Technical Report during November 2019, additional banks, financiers and corporates have shown interest in project finance participation and have subsequently been granted access to the data room.

In addition, CDV says it is also concurrently evaluating strategic alternatives, in order to bring the Namdini Project into production.

Technical Significance

With the current gold price solidly above US$1,500/oz (as compared to s gold price of US$1,350/oz used in the company’s Feasibility Study), it creates an even more compelling financial model and project valuation, which provides a greater level of confidence to banks, financiers and corporates.

With a robust gold price outlook for 2020 and beyond, CDV’s Namdini project represents an attractive development opportunity, with the potential for significant resource growth that could underwrite a sizeable mine life extension. Along these lines, the company would also likely welcome corporate bidders or project partners, who could generate immediate or near-term value for CDV shareholders.

CDV would obviously like to achieve the re-rating that being a gold producer (instead of a gold hopeful) would bring.

Bankable Feasibility Study

CDV recently released the results of the much-anticipated Feasibility Study for its Namdini Gold Project in Ghana, which confirm Namdini as a gold project with attractive economic returns.

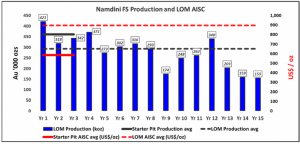

The Study forecasts 4.2Moz of gold to be produced over a 15-year period at an All‐in Sustaining Cost (AISC) of US$895/oz, compared to 3.9Moz at US$769/oz in the Pre‐Feasibility Study (PFS). Namdini will comprise a single, large open‐pit with a conventional process plant design.

Forecasts are based on an Ore Reserve of 5.1Moz, which represents a 7% increase on the 4.76Moz Ore Reserve in the PFS. The project is forecast to generate US$1.46 billion in undiscounted, pre‐tax free cashflow over a 15-year mine life at an assumed gold price of US$1,350/oz, increasing to US$2.05 billion undiscounted, pre‐tax free cashflow at a gold price of US$1,500/oz.

Namdini Project Net Present Value (NPV) and Internal Rate of Return (IRR) are forecast to be US$914 million and 43.0% respectively (pre-tax), along with US$590 million and 33.2% (post‐tax), based on a US$1,350/oz gold price.

Project capex is estimated at US$348 million capital expenditure with a US$42 million contingency, which is down 16% from the PFS capex estimate of US$414 million. Capex payback is estimated at just 21 months based on a US$1,350/oz gold price, with payback falling to just 12 months based on a US$1,500/oz gold price.

The rapid payback period is driven by a combination of early high grades and recoveries, low strip-ratio (and low costs within the starter pit. (AISC) are estimated at just US$585 during the capex payback period.

Technical Significance

The Feasibility Study demonstrates a viable, globally significant, long‐life gold project at Namdini. With more than 1 million ounces of gold slated for production during the first three years, 421,000 oz in Year 1 alone and an average annual gold production of 287,000 oz over a 15‐year mine life, Namdini ranks amongst the world’s largest known, financially-robust, undeveloped gold projects.

Unlike whole-of-ore gold processing plants, CDV has the benefit of being able to produce a concentrate for gold extraction on site, which means that it has a much smaller plant back half, providing a huge positive impact on capital costs. Importantly, potential remains for further improvements in project economics, which will form the basis of ongoing evaluation work

Next Steps

CDV’s board has approved the Feasibility Study and plans to further de‐risk the project by commencing the Front End Engineering Design (FEED) program, along with further enhancement of the project Execution Plan. Early site works and advancement of engineering towards construction, will be funded through the company’s strong cash position of ~A$27 million. First gold pour is targeted for H2 2022 (subject to financing during H1 2020).

Potential remains for further improvements in project economics that will form the basis of ongoing evaluation work. This will include OPEX savings by evaluating a flotation cleaner circuit, with the potential to reduce required regrind power; additional Mineral Resources that are not part of the current Ore Reserve that represent lateral strike and depth extensions to the current LOM pit design; along with additional drilling beyond the current pit design that may also include a new underground mine plan.

Drill-testing of new zones of high‐grade gold mineralisation to define satellite pits will recommence soon. The regional land package may also have potential to define satellite pits with close proximity to Namdini. Recent results from drilling completed within the Ndongo Project, located 24 km north of Namdini, are within hauling distance.

Summary

With the recent release during late 2019 of what was a robust Feasibility Study for the Namdini Project, CDV’s focus is firmly on the successful conclusion of funding negotiations. Given the Namdini project’s large Ore Reserve, low strip-ratio, high conversion of Mineral Resources and rapid payback from the higher-grade/lower strip-ratio of the First Stage Pit, CDV would obviously like to generate attractive project financing terms. The company is also exploring other corporate alternatives, as it looks to realise value from the project and make production a reality.