In more circumstances than not, financial stress centres around the million-dollar question of “will I be ok”? This, of course, can manifest itself in a number of forms that can include, but are not limited to:

- Am I able to retire now?

- When will I be able to stop work?

- Am I able to help my kids buy their first home?

- Can I go on overseas holidays each year?

Now, this list is by no means exhaustive and you could certainly reframe these in a thousand different ways. From my experience, the majority of people hurtling at light speed towards, or already in, retirement, are worried about whether or not they have enough money saved up to be financially secure to control the next stage of their life.

First and foremost, without financial security, decisions are made by others. Your lifestyle in retirement may be decided by the age pension. Your ability to assist others could be a direct concession on your own quality of life.

In order to reduce (or remove) the stress surrounding these decisions we need to be able to answer two questions; 1 – do I have enough money to retire? 2 – how long will be money last? The first of those questions is more of a here and now answer. You either do, or you don’t. The second of which is where most of the stress stems from – the ineffable mystery of if and when my money will run out.

Understanding the Maths

While it is impossible to answer this question with precise accuracy, we can remove a large part of the uncertainty which in turn will remove a large part of the stress. Firstly, we need to know a few things:

- How much money do we have?

- How much do we want to spend each year in retirement?

- What is our annualised rate of return expectation? please note – this is not a guarantee

- What do we assume inflation will be? I assume a long-term average of 3%

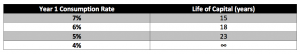

In an ideal world, we do not have to make concessions on lifestyle and for this explanation I will assume in the table below that the amount spent each year is calculated as a percentage of starting capital but stay fixed each year in real dollar terms.

*return assumed to be 7% pa year on year

Importantly, in the real world, markets are volatile and average returns do not exist. With the impact of returns sequence, it is likely that money will run out quicker.

Why is it important to know how long my money will last?

Peace of mind.

If you know that you can turn up each year, knowing you can freely spend your desired amount each year, what is there to worry about?

What are my options if I don’t like where I am headed?

We all have a number of “levers” to pull to change our outcomes. Depending on who you are, each lever could have more or less leverage. The primary ones are:

- Work longer

- Downsize

- Downgrade retirement quality (i.e. spend less each year)

- Take more risk in the lead up to retirement – this could be fraught with danger

Does it really matter if my money is not going to last more than 20 years?

Yes.

The biggest issue facing Australians (from a financial perspective) and financial planners today is the sheer length of lives we are likely to live. It will not be uncommon for Australians aged 60+ today (women in particular) to live until they are 90+. For many of these people that is as long, or longer, than the time they spent in the workforce. A scary thought.

The only options after your money runs out is to rely on the age pension or family.

How can I improve my outcomes?

One of the main differences between financially successful people and the rest is that they have personal goals that are important enough to strive for. If there is a price to be paid, they will pay it in order to reach their objective. At the same time, just wanting something badly enough will not make it happen. You also need a plan that will help you reach those goals.

A good financial adviser will take a careful case history, help you define and rank your personal goals and prescribe a plan or strategy that will enable you to achieve them, but none of this will be effective without your commitment to the goal and your determination to make the strategy work.