I have been a self-managed retail investor for over 30 years so I am a little embarrassed to say that I have finally worked out a way to document every transaction in a capital account in a similar way that my bank statement tells me every transaction in my savings account.

I suspect that professional investors may do something similar as they have sophisticated ways of tracking their capital and calculating their capital gains and losses; and I first heard the expression “capital account” in relation to investing (as opposed to the Capital Account in the National Accounts) as a journalist writing about professional investors. However, I have not seen a spreadsheet or other example of how they or other investors do their tracking, and I am a little surprised that I haven’t come across a good example in my reading over the decades.

It became an issue for me when I wanted to know how much capital I have withdrawn from my share and investment portfolio in the period from 2007 to the present, and how much of the capital changes were due to the Global Financial Crisis, our house renovation, share trading, and living expenses.

To be fair to myself, until now I have felt that I was doing enough book keeping as I have a spreadsheet and several methods for tracking capital movements.

For example, inputting the latest prices into one table in the spreadsheet will show the capital cost and capital value of the portfolio.

Another table, which I use for tax returns, tells me the annual movement of capital at cost and at value of the portfolio at 30 June each year. This is based on the buying and selling of assets and share price changes, but it only gives the big picture and not a lot of other detail.

Another tax table gives me the capital gain or loss of each realized investment and the running totals for each year and overall.

Another table details each share and investment transaction. It tells me why I bought or sold a share or asset, how much capital went into or out of the portfolio, and how much capital I should have available to reinvest based on my starting year. But this also could not answer my query.

Nor could the bank account for the portfolio. Part of the problem was that I had been mixing capital with income, mixing the cash from realized investments with the cash from dividends, distributions and interest. The account could tell me each deposit or withdrawal but not much more as there was no clear delineation between the cash that was capital and the cash that was income. I was investing or withdrawing cash but not identifying if it came from capital, income or a mixture of both.

With all these tables I had been thinking that I was adequately tracking my capital, but in reality it was a job only partly done. I needed something better.

My solution was two fold. Firstly, I had two bank accounts so one is now solely for capital and the other is solely for income. Separating them makes it much easier to think in terms of capital and income. Each account has its own rules. The cash in the income account is much more fluid, while the cash in the capital account is in the first instance solely for new investments, and withdrawals for other purposes must be important, not just casual expenses.

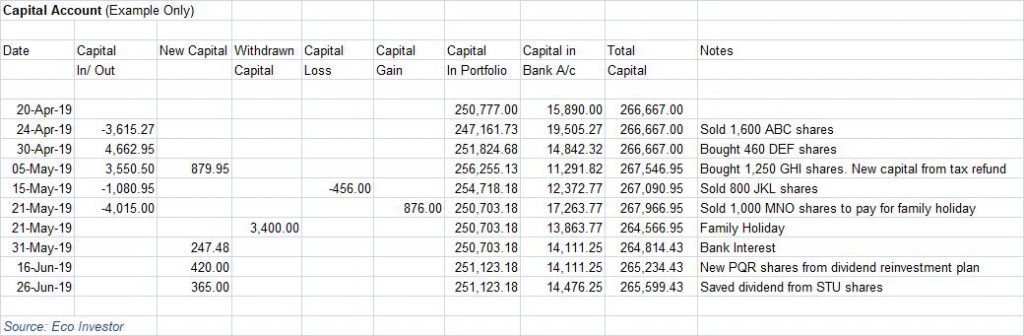

The second change was another table on the spreadsheet. The basic design of this can be seen in the below graphic.

This is able to clearly document every capital change with the details I need, and do so for every dollar and cent. At any time I know exactly how much capital I have, both in the portfolio and in the bank. When I sell an asset the capital simply moves from the portfolio to the bank account, and when I buy an asset it moves back to the portfolio. If I add new capital or withdraw capital I can see exactly how much, and for which transactions.

The table measures everything at cost, and is easy to use. Each transaction is on one line, with the nature of the transaction explained in the Notes section. The Notes could be as simple as, for example, Bought ABC shares, Sold DEF shares, New capital from tax refund, or Withdrew capital for house extension.

The first entry is simply the value of the portfolio at cost which is entered in the Capital in Portfolio cell, and the amount of capital in the bank account which is entered in the Capital in Bank Account cell. These are added together in the Total Capital cell to give the total size of the capital account.

The Capital In/ Out cell is the value of an investment or divestment. If an investment is sold, I enter it as a minus amount. The amount in the Capital in Portfolio cell goes down by that amount and the amount in the Capital in Bank Account cell goes up by that amount. The Total Capital cell stays the same.

If an investment is bought, the amount in the Capital In/ Out cell is a positive number. The reverse then happens: the number in the Capital in Portfolio cell goes up, and the number in the Capital in Bank Account cell goes down. Again, the Total Capital cell number stays the same.

Where a new investment is funded by the bank account and additional capital, the amount from the bank account goes in the Capital In/Out cell and the extra capital goes in the New Capital cell. This raises the Total Capital number. The New Capital cell is also for adding in bank interest that is capitalized, new shares from dividend reinvestment plans, and dividends that will later be reinvested. If interest or dividends are moved to the income bank account for spending then there is no entry.

Where an investment is sold at a loss, the amount of the loss is recorded in the Capital Loss cell. This lowers the Total Capital number.

Where an investment is sold at a profit and I wish to keep the profit for reinvestment, the amount of the gain is recorded in the Capital Gain cell. This raises the Total Capital number.

I back dated the table to February this year and have found it works well. Another benefit is that I feel I am better able to look after my capital. I think this comes from having a number for my capital that is always up to date. This is the same with savings accounts where you can see the amount rise or fall with every transaction and you know the reason why.

The system now seems so simple that I’ll probably feel silly for some time for not having done it before now, and I definitely regret not having had or being shown such a system when I began investing.