This year, I have tried to keep this column focused on the key thematics that matter and how as investors you can position yourself to profit. So far many of these key and central themes have been playing out with more evidence pointing to these only strengthening not dissipating despite the significant repricing we have seen in the underlying assets.

As a recap our main thematics and strategies have been:

1) Long Australian bonds (lower interest rates)

2) Short Australian dollar

3) Long high yielding infrastructure

4) Stocks picking based on individual company thematics

During the promotion of the above thematics we have seen bond rates drop by 100 basis points as the collapsing property market has created significant ripple effects throughout the Australian economy. Yesterday’s unemployment figure rising from 5.0 to 5.2% gives little basis for the RBA to not cut rates.

This has driven the Australian dollar to new lows as the ongoing appeal of what was a high yielding currency in absolute and relative terms continues to head in reverse. Australia’s bond rates continue to trade at a wider discount to the US which is just recipe for persistent pressure on the local currency.

Lower bond yields, lower Australian dollar, slowing economy are all factors driving funds into my “yield crunch” thematic where the attractive yields on infrastructure stocks will see huge ongoing buying interest. Sydney Airports and Transurban both making fresh record highs.

This also leads to why the local gold stocks and in particular Newcrest Mining (NCM) is also breaking through to multi-year highs. I discussed the huge potential for NCM in my article here on February 8th with the probability that a substantial re-rating in the stock would be seen, based off the rising gold price in Australian dollar terms, a better production profile and now I include the potential for corporate activity. Barrick earlier this year made a hostile takeover bid for Newmont to the tune of US$18 billion in an attempt to create the largest gold producer globally. Instead the two will now combine their Nevada operations into a joint venture, but I don’t believe that the aspirations of a major acquisition have totally been put to rest.

We have seen with Wesfarmers – and probably far too clearly – how capacity for acquisitions can create an urgency to spend (first Lynas, next Kidman). I would not at all be surprised to see Barrick take some interest in Newcrest considering its size, production levels and low production costs (US$720/ounce), not to mention, that with the declining Australian dollar the takeover price for NCM keeps dropping too.

While it’s not my base case for owning NCM, it is a factor that I don’t think can be dismissed. Put another way, I wouldn’t be surprised if it did occur. One of the action points I did take on NCM this week, was close out one leg of my long call spread. Since my article in February I have had on the prop book a long $27/$30 NCM call spread expiring in June. That is, I bought the $27 calls and sold the $30 calls. This helps reduce my outright purchasing cost but also caps my upside – at $30.

As the stock has grinded higher over the past few months the $30 call has dropped in value (the share price hasn’t risen fast enough to increase the option price) and with both NCM share price now looking spectacular and the risk of corporate activity, I no longer want to cap this upside. I closed the sold $30 call option for a profit and now am left long $27 calls. Perfect.

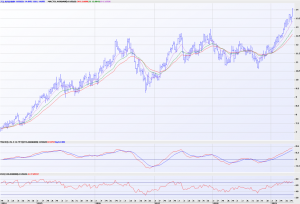

Perfect because NCM looks to be on the brink of a takeoff point. Below I show the weekly formation of NCM back 10 years. NCM is breaking through to its highest level in two years leaving behind a multi-year cup-and-handle base formation. One of my favourite formations. The trend is developing identically to that of 2016 when in May to July the share price surged from $18 to $27. As we head into the middle of May this breakout could result in a similar price move giving a target towards $36. Note this is well through the $30 level I had capped my previous options trade at.

The technical indicators of RSI and MACD are in similar positions to that of 2016, further convincing me that NCM is poised for a repeat of 2016. What was happening in 2016 to cause that rally – not a lot. The Australian dollar was choppy and the gold price rose $100 from $1250 to $1350. Same levels at which we trade now. However, the Australian dollar is getting crunched, giving a major boost to the Australian dollar gold price that is trading at near record highs. A perfect combination especially in the event that the US/China trade war creates a catalyst for a spike in gold – it could be and one I expect – to be a perfect combination for NCM.

AS I stress to the traders in my office, the formation on NCM takes years to develop. If I am wrong so be it. That’s markets, but if I am correct and this does explode higher and you are not part of this once in a multi-year rally, frankly, there are no excuses to let such an exceptional opportunity pass.