Despite global share markets falling heavily in the last quarter, 2018 was a strong year for dividends across developed markets, with $A1.8 trillion paid out to shareholders, a $200+ billion, or 12.6%, increase1 from the year before according to research by Plato Investment Management.

“More than half, some 59%, of companies worldwide increased their dividends per share,” said Dr. Don Hamson, Managing Director of Plato Investment Management. “In excess of 1300 companies in the Plato analysis increased their dividend per share payment, in comparison to only 148 decreasing. Just 1.8% of dividend-paying companies cut their payout to zero in the fourth quarter.”

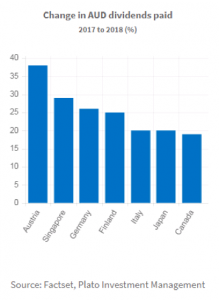

Dividends rose across almost all developed market countries, with significant rises in Austria, Singapore, and Germany. In contrast, Israel and New Zealand reported no increases.

In Australia, dividends (excluding tax effective buy-backs) rose 8% in 2018, even though bank dividends were flat and Telstra cut its dividend by 30%.

In the US, some 70% of US companies that pay dividends, increased or initiated them in Q4, versus only 5% that cut dividends. (Some, 45% of US companies don’t pay regular quarterly dividends. By comparison, in Australia only 15% of companies in our universe didn’t pay dividends in 2018.)

“Globally, all sectors, except for Materials, saw growth in the AUD dividends paid versus the previous corresponding quarter,” added Dr Hamson. “The largest percentage increase globally (33%) was from Information Technology. This was driven by names including Broadcom (51%) and Visa Inc (31%). The next largest sector increase was Consumer Staples (17.9%).”

Interestingly, Australian Materials stocks bucked the global trend, with their dividends rising 26% year on year.

Plato’s proprietary dividend outlook model also provides insights into future dividends and suggests there is only a small chance (around 10%) of dividend cuts around the world at present.

Plato urges local Australian dividend income investors, including retirees and self-managed super funds, to look further afield for sources of income beyond Telstra and the big four banks.

“Investors should be wary of this concentration as there are many other good companies that offer both consistent dividend income and better potential for capital growth in Australia and globally,” Dr. Hamson said.

“2018 has clearly been a very strong year for equity income generation – here and around the world – and we expect this will continue into this year.”

1 A broadly weaker $A explains 4% of the increase, meaning dividends in local currency terms still increased on average by over 8%.

Methodology

Each quarter Plato Investment Management analyses the income paid by global companies to highlight trends for yield investor clients. The universe used is the MSCI World IMI, which covers the developed global markets. The underlying data is provided by Factset. Dividend paid (US$) for each stock in each calendar quarter is calculated as the shares outstanding as of quarter end multiplied by the total DPS paid out in the calendar quarter. The DPS paid excludes spin-offs but includes capital returns and special dividends. Conversion to AUD is done using the prevailing WM/Reuters London exchange rates at the time of dividend payment. Full year dividend paid (US$) is the summation of dividend paid (US$) from Q1 to Q4 using the methodology (1). DPS movement is based on total DPS paid out (in LC) over each calendar quarter. DPS movement from quarter to quarter is then categorised as initiating, increasing, unchanged, decreasing and cut to zero.

About Plato Investment Management Limited

Plato Investment Management Limited (Plato) (ABN 77 120 730 136) is an investment management firm specialising in maximising retirement income for pension phase investors and SMSF investors.

Plato was founded in Sydney by Dr. Don Hamson and currently manages over $4.9 billion in FUM (30 June 2018). Plato is majority owned and operated by its investment staff and supported by its minority equity partner, Pinnacle Investment Management Limited, a leading multi-affiliate investment management firm. For more information please visit www.plato.com.au