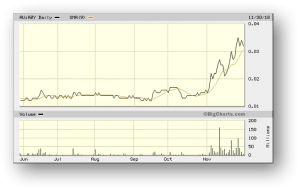

Antipa Minerals – (ASX: AZY, Share Price: $0.032, Market Cap: $58m, coverage initiated @ $0.024 in Oct 2015)

Key Catalyst

Commencement of airborne electromagnetic survey at the Citadel Project in Western Australia as part of the $60M farm‐in by Rio Tinto Exploration Pty Limited.

AZY has proven to be somewhat of an enigma since our initial coverage began back in October 2015, surging to a high close to $0.07 before retreating and giving up all of its gains. Our rationale for following the stock remains the same however – AZY maintains a 1,335 sq km package of prospective granted tenements in Western Australia’s Paterson Province, known as the Citadel Project.

Citadel lies 75km north of Newcrest Mining’s (ASX: NCM) Telfer gold-copper-silver mine and includes gold-copper-silver±tungsten Mineral Resources at the Calibre and Magnum deposits, along with the high-grade polymetallic Corker deposit. Under the terms of a Farm-in and Joint Venture Agreement, Rio Tinto Exploration can fund up to $60m of exploration expenditure in order to earn up to a 75% project stake. Furthermore, Rio has been building its own ground position and there are strong rumours of a major discovery within the region.

Latest Activity

Citadel Project Update

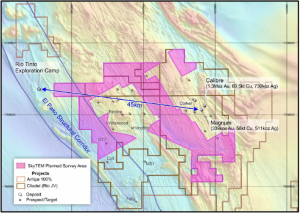

AZY has announced the commencement of a 600 sq km airborne electromagnetic (AEM) survey as part of the $60M farm‐in by Rio Tinto Exploration Pty Limited. The Citadel Project is located in the prospective Paterson Province, 80km north of Newcrest’s Telfer gold‐copper‐silver mine in northern Western Australia.

The AEM survey has the objective of defining EM conductors with the potential to represent semi‐massive to massive sulphides associated with gold and/or copper mineralisation. The survey area covers all remaining regions of the Citadel Project not previously covered by state-of-the-art AEM geophysical systems.

Technical Significance

AEM has been an instrumental tool in several significant Paterson Province discoveries and this is the first geophysical survey of this type over this area. A geophysical survey conducted by AZY during 2011 using similar technology, VTEM, identified the Magnum gold‐copper‐silver deposit and led to the discovery of the Corker polymetallic deposit.

The AEM Survey was not included in the original Rio Tinto exploration program and budget for this field season and represents a decision by Rio to undertake additional regional geophysical work in the current year, with the objective of generating targets that can be followed up and potentially tested during 2019.

Figure 1: Plan view illustrating the proposed 600 sq km Citadel Project SkyTEM survey area, deposit and prospect locations.

Other Recent Activity

Paterson & North Telfer Projects Update

AZY has also provided an update with respect to recent air-core and RC drilling results at its Chicken Ranch prospect, as well as RC drilling at Minyari Dome – which form part of its 100%‐owned Paterson and North Telfer Projects respectively.

AZY’s Chicken Ranch deposit and Minyari Dome resources are located 15km and 40km respectively from Newcrest’s Telfer gold mine and 100km from Rio Tinto’s newly-established exploration camp in Western Australia’s Paterson Province.

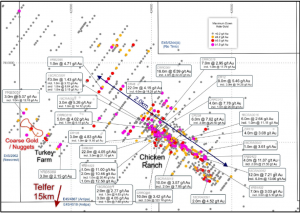

Figure 2: Plan view of the Chicken Ranch and Turkey Farm area showing maximum down-hole gold values, significant drill intersections and location of Turkey Farm coarse gold (including nuggets) approximately 1km west of the Chicken Ranch deposit.

Chicken Ranch

The Chicken Ranch air-core program (195 drill-holes for 10,105m) was focused on identifying new mineralisation in proximity to the existing high‐grade gold mineralisation, including parallel trends. Best results include 13.0m at 1.43 g/t gold from 47m down-hole in 18CRC0001 and 3.0m at 4.05 g/t gold from 63m down-hole in 18CRC0011.

Available results together with historical drill intersections confirm the high‐grade gold potential of the Chicken Ranch area, positioned just 25km south of AZY’s existing Minyari Dome Mineral Resources. The company will focus on delivering a maiden Mineral Resource for the Chicken Ranch deposit during the first quarter of 2019.

Turkey Farm

In other exploration activities undertaken across the broader Chicken Ranch area, a prospecting exercise identified significant coarse gold, including gold nuggets, within surface laterite oxide material at the company’s Turkey Farm prospect. located just 1km west of the Chicken Ranch deposit.

The identification of coarse gold in combination with significant historic drill intersections grading up to 12.1 g/t gold, from broad 200m spaced drill-holes, confirms the company’s view on prospectivity, including the potential for additional shallow gold resources.

Minyari Dome

A new zone of gold mineralisation at Minyari North has been identified approximately 720m north of the current Minyari resource. While the target remains preliminary in nature, mineralisation appears to remain open along strike and requires follow up drilling, with key intercepts including 4.0m at 1.02 g/t gold from 60m down-hole in 18MYC0176 and 1.0m at 1.47 g/t gold from 104m down-hole in 18MYC0174.

Also, a new zone of copper + gold‐cobalt‐silver mineralisation has been identified at depth and approximately 1.6km northwest of the defined Minyari resource. Drill-hole 18MYC0171 is located on the north‐eastern edge of the Gonzo co‐incident AEM conductivity and magnetic anomaly that measures approximately 500m by 220m and returned 3m at 0.36% copper and 0.10 g/t gold from 213m down-hole in 18MYC0171.

Rio Tinto Farm-in Terms

The farm‐in agreement with Rio Tinto requires the following expenditure to be incurred (or paid) by Rio Tinto to earn up to a 75% joint venture interest in the Citadel Project:

- $3M exploration expenditure within 18 months of the date of execution of the farm‐in agreement (execution date: 9 October 2015). This has now been satisfied and no JV interest was earned by the incurring of this amount.

- $8M exploration expenditure within a further 3-year period commencing 11 April 2017 to earn a 51% JV interest – Rio Tinto is currently in the second year of this stage

- $14M exploration expenditure within a further 3-year period to earn a 65% JV interest – AZY may elect to contribute at this point and maintain a 35% JV interest.

- $35M exploration expenditure within a further 3-year period to earn a 75% JV interest.

- Rio Tinto has a right to withdraw from the farm‐in at the completion of each annual program.

Project Overview

AZY’s Citadel Project is located within the Paterson Province and consists of seven exploration licences covering an area of approximately 1,335 sq km of highly prospective, but grossly under-explored, Proterozoic stratigraphy.

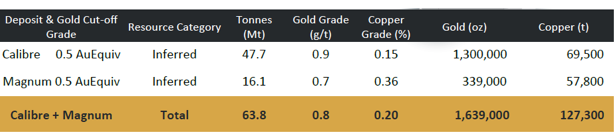

The Citadel Project hosts the Calibre gold-copper-silver-tungsten deposit and the Magnum gold-copper-silver deposit, with combined (JORC 2012) Mineral Resources that are open in all directions of 1.64M ounces of gold and 127,300 tonnes of copper.

Citadel Project Mineral Resources

The Calibre Deposit was an Antipa 2012 greenfield gold-copper-silver-tungsten discovery, located 1.5km northeast of the company’s Magnum deposit and 100km north of Newcrest’s Telfer gold-copper-silver mine. The deposit lies beneath 70 to 85m of weakly consolidated and lithified cover, largely of Permian age.

Magnum comprises a gold-copper-silver+/-tungsten mineral system that measures 2km in length, up to 400m in width and 600m in depth – and is open in all directions. It hosts a significant low-grade, high-tonnage gold-copper-silver deposit, as well as significant high-grade gold and copper mineralisation in several lenses. Significant exploration upside exists with an isolated drill intercept 600m south of the resource location of 1.4m @ 1.72 g/t Au, 6.79% Cu & 32.03 g/t Ag and untested electromagnetic conductivity targets (both DHEM and surface EM).

Additional Projects

AZY also boasts an additional 1,310 sq km of granted exploration licences, known as the North Telfer Project, which hosts the high-grade gold-copper Minyari and WACA deposits. This extends its acreage holding within the Paterson Province to within 20km of the Telfer Gold-Copper-Silver Mine and 30km of the O’Callaghans tungsten and base metal deposit.

AZY has also acquired from the Mark Creasy-controlled company Kitchener Resources Pty Ltd, additional exploration licences within the Paterson Province that are now all granted and cover 1,573 sq km. AZY also owns a further 138 sq km of exploration licences (including both granted tenements and applications), which combined are known as the Paterson Project, which comes to within 3km of the Telfer mine and 5km of the O’Callaghans deposit.

Rio Tinto Discovery Rumours

Highly regarded resources journalist Barry FitzGerald has written many articles over recent times where he has outlined the case for a major Rio Tinto discovery within the region. Evidence for the discover case comes in the form of Rio Tinto apparently building its own airstrip on site. Rumours continue to circulate that “this could be Rio’s best find in 25 years,” he writes.

“The most recent satellite fly-over shows there has been lots of activity at the discovery, 120km north-north-west of the nearest point of civilisation, Newcrest’s once-great Telfer gold-copper mine,” he writes. Furthermore, FitzGerald notes that since he first reported whispers of the find in April 2018, the drill-lines have extended south by another 400m.

Rio has also expanded its ground position enormously, having expanded its project interests from 1,000 sq km in its own right and 1,335 sq km in joint ventures, to more than 11,000 sq km in its right and 1,760 sq km under joint venture. Meanwhile Fortescue Metals (ASX: FMG) has acquired 5,300 sq km in its own right.

Summary

AZY was already well advanced in terms of its exploration status prior to the Rio Tinto JV exploration funding deal, boasting a sizeable +1.6M gold-eq oz JORC-compliant resource. There’s little doubt the resource will continue to grow, so it now becomes a question of scale, grades and potential development economics. It’s fair to say that the market had hoped that progress would have been somewhat more rapid in this regard, which explains the mediocre share price performance over recent years. The Citadel joint venture arrangement with Rio Tinto provides near-term funding certainty and active exploration. Things are certainly hotting up in the Paterson Province.