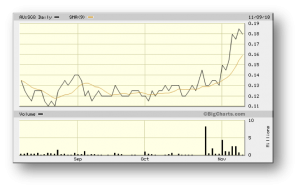

St George Mining – (ASX: SGQ, Share Price: $0.18, Market Cap: $52m, coverage initiated @ $0.175 in May 2016 – currently steady with initiation price)

Key Catalyst

Ongoing drilling to test EM conductors at the Investigators Prospect has over the past week returned respectively both the highest-grade and the widest intercepts of nickel-copper sulfide mineralisation, continuing SGQ’s 100% strike rate of high-grade nickel-copper sulphide conductors across the Cathedrals Belt. SGQ’s share price over the past month reflects this.

SGQ has figured highly in our coverage universe since our coverage initiation in May 2016, based on its strong commitment to regional exploration at its Mt Alexander project in WA’s goldfields region. SGQ set the market alight during late 2017 on the back of exciting high-grade drilling results that intersected nickel-copper-cobalt-PGE sulphides. The latest drilling results have reinforced the project’s overall prospectivity.

Drilling has so far established recurrent high-grade mineralisation over a significant proportion of the 4.5km strike length within the Cathedrals Belt – at the Investigators, Stricklands and Cathedrals Prospects. The composition of the mineralisation at the Cathedrals Belt, with its elevated copper-nickel ratio, cobalt and PGE values and basalt host rocks, is more akin to an intrusive mineral system – like Raglan, Voiseys Bay and Norilsk – rather than the typical Kambalda-style extrusive deposits in the Yilgarn.

Latest Activity

Mt Alexander Exploration Update

We recently highlighted results from hole MAD126 at the Investigators Prospect – one of three key prospects within the Mt Alexander project area – with drilling work at Investigators specifically designed to test a series of very interesting EM (electro-magnetic) conductors.

MAD126 encountered a 14.37m interval of nickel-copper sulphide mineralisation commencing from 177.5m down-hole. Most significantly, between 185m and 190.25m, it intersected massive sulphides with average XRF readings of 8.8% Ni and 4.5% Cu. The massive sulphides include coarse-grained pentlandite, as evidenced by spot XRF readings ranging from 28% Ni to 37% Ni.

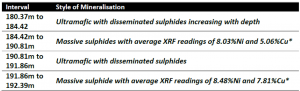

SGQ has announced another exciting result in the form of hole MAD127, which has identified sulphide mineralisation between 180.37m to 192.99m down-hole, including 6.92m of aggregate massive sulphides from 184.42m to 190.915m and again from 191.86m to 192.39m, with average XRF readings of 8.03% Ni and 5.06% Cu.

Technical Significance

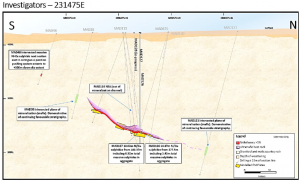

Holes MAD127 & MAD126 are significant because they both have delivered intersections of massive nickel-copper sulphides. Both drill-holes are situated on the MAD111 Line, which is interpreted as lying within a channelised lava flow. In the case of MAD127, it was drilled to test the southwest extension of the high-grade mineralisation intersected in MAD126.

Hole MAD126 lies down-plunge of the previously intersected mineralised ultramafic on the MAD111 Line and has confirmed a significant 200m down-dip extent to the known mineralisation on this line. MAD127 was completed to a down-hole depth of 210m to test southwest of the massive sulphides intersected in MAD126.

MAD127 has intersected the MAD120b:X1 conductor approximately 5m to the southwest of the MAD126 pierce point. The thicker massive sulphides intersected within MAD127 have confirmed the repeatability of the strong mineralisation in this conductor, suggesting the mineralisation thickens towards the southwest.

Whilst the XRF grades themselves are outstanding, what’s just as significant from a bigger picture perspective is the existence of additional strong conductors located up-dip and down-plunge of the massive sulphides so far identified. It provides confidence that drilling could intersect more massive sulphides within what could potentially become a significant channelised flow.

The mineralised ultramafic at the Investigators Prospect has an east-west strike of 1.5km and dips to the north at an angle of about 30 degrees. The company’s geological model supports the potential for continuity of high-grade mineralisation at depth in the northerly down-dip direction. Current exploration at Investigators is successfully testing this model, providing confidence that the large mineral system continues at depth, with potential for significant increases to the known high-grade mineralisation.

Figure 1: Schematic cross-section of the MAD111 Line showing MAD126 and MAD127 and the EM plates modelled on this Line.

Next Steps

MAD128 is currently being drilled and is targeting the MAD120b:X1 conductor approximately 15m to the southeast of the MAD126 pierce point. DMEM surveys will be completed in MAD126, MAD127 and MAD128 next week.

Summary

From a bigger picture perspective, there are strong conductors located up-dip and down-plunge of the massive sulphides identified by MAD126 & MAD127. This provides confidence that drilling could intersect more massive sulphides within what could potentially become a significant channelised flow.

SGQ to this point has a strike rate of 100% in terms of EM conductors leading to massive sulphide mineralization, with drilling so far establishing recurrent high-grade mineralisation over a significant proportion of the 4.5km strike length within the Cathedrals Belt – at the Investigators, Stricklands and Cathedrals Prospects.

The DHEM surveys at Investigators have been successful in identifying further conductors down-plunge from known high-grade mineralisation, which fits with the company’s geological model. The east-west strike of mineralisation at Investigators is more than 1.5km, suggesting that any extension of mineralisation to the north will substantially increase the volume of high-grade mineralisation at Investigators.