Sheffield Resources – (ASX: SFX, Share Price: $1.13, Market Cap: $259m, coverage initiated @ $0.50 in Sep 2015 – current gain of 126%).

Key Catalyst

Northern Australia Infrastructure Facility (NAIF) offer financial assistance via the provision of long-term debt facilities totalling $95 million to support the development of the Thunderbird Project.

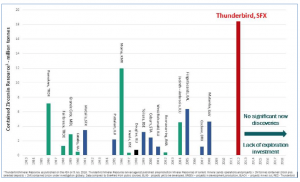

Since its 2010 listing, SFX has remained focused on exploration, appraisal and development of its 100%-owned Thunderbird deposit in Western Australia. Thunderbird is a remarkable and rather unique asset, representing one of the world’s largest and highest-grade undeveloped zircon-rich mineral sands deposits. SFX was in the right place at the right time to acquire the project when RIO sold it in the wake of the GFC. SFX completed a high-quality Bankable Feasibility Study (BFS) on the project during 2017, highlighting its robust economics, low technical risks and long operating life of 42 years.

Once in full production in 2020, Thunderbird will provide the market with approximately 6% of the world’s zircon and approximately 3% of the world’s ilmenite. SFX’s share price has firmed solidly (but without much fanfare) since September 2017 on the back of growing market appreciation of its Thunderbird project, hitting a record high this week.

Recent Activity

SFX’s strong share price performance has coincided with significant Thunderbird project development activity, in particular between Q4 2017 and Q3 2018 – predominantly involving important milestones related to product off-take, project financing and construction readiness.

NAIF Finance Facilities

The Northern Australia Infrastructure Facility (NAIF) today advised that it had made an Investment Decision to offer financial assistance for the development of SFX’s Thunderbird Mineral Sands Project, via the provision of long-term debt facilities totalling $95 million. It will comprise a $30 million Project Development Facility and a $65 million Infrastructure Development Facility.

The facilities will enable Sheffield to construct on-site LNG power generation and storage facilities at Thunderbird, in addition to enabling the upgrading of mine site roads, in-sourcing of mine site accommodation, along with facilitating the construction and revitalisation of ship loading and logistics assets within the Port of Derby in Western Australia.

Technical Significance

The Thunderbird Bankable Feasibility Study (BFS) released in March 2017, contemplated the provision of on-site power generation and accommodation facilities by third parties on an outsourced Build-Own-Operate (BOO) basis, inclusive of capital recovery charges payable to third party service providers.

The long-term tenor and concessional arrangements approved by NAIF would, following satisfaction of the various pre-conditions, enabling SFX to in-source the power generation and accommodation facilities on commercially attractive terms, as well as reducing overall operating costs following removal of BOO-related capital recovery charges.

Furthermore, SFX will no longer require the US$25 million contingent instrument facility provided by Taurus Mining Finance Fund.

Native Title Approval

SFX earlier this month provided an important update with respect to the National Native Title Tribunal (NNTT) process at Thunderbird. The NNTT has reconsidered the test of good faith, as directed by the Full Federal Court back in late 2017 and determined that SFX acted in good faith with respect to its negotiations with the Mount Jowlaenga Polygon #2 claimant group (the Traditional Owners).

What this means is that the Full Federal Court can lift the stay on the determination made by the NNTT back in June 2017. It will enable the Department of Mines, Industry Regulation and Safety to now finalise the grant of the Mining Lease 04/459 for the Thunderbird Project.

Technical Significance

The positive determination made by the National Native Title Tribunal is a very significant step, as it removes any impediment to the Native Title process. Accordingly, SFX believes it will be able to finalise Native Title agreement during the final quarter of 2018 – one of the final components required before the company can give the formal go-ahead to the project’s development. Significantly, SFX has managed to agree non-binding and indicative terms with the Traditional Owners, even before formalisation and authorisation of an Agreement.

Figure 1: Discovery timeline for significant zircon deposits

Summary

The NAIF Facilities are a significant demonstration of support for the Thunderbird project. Whilst the facilities won’t reduce total funding requirements, the proposed structure provides a pathway for SFX to own the asset infrastructure and provides for lower operating costs when compared to the Thunderbird BFS.

Thunderbird has been demonstrated to be a large-scale, technically low-risk project, supplying one of the highest-grade sulphate feed-stocks available globally. This of course hasn’t just happened overnight – a lot of hard work has been invested in the project over the past eight years. Encouragingly, the market is now beginning to fully appreciate the project’s value. An improving mineral sands market is also providing a positive backdrop. We look forward to more positive news-flow during 2018.