Investing, as opposed to trading should focus on long term objectives. Every once in a while it’s healthy to step back and assess what has happened historically, how your investments compare to the averages and ask yourself if you should reconsider your asset allocations?

This year’s ASX Russell long term investing report, which assesses returns on a 10 and 20 year time span up to 31 December 2017, shows some surprising results.

One that you may have guessed is that residential property has been the star performer over both periods returning 8 per cent per annum over 10 years and 10.2 per cent over 20 years. But can you guess which asset classes take second and third spots on the podium?

Over 10 years, global hedged shares returned 7.2% while global hedged fixed income returned 7.1%. Forth was Australian fixed income returning 6.2%. Australian shares were poor performers, after taking account GFC losses of 40.4% in 2008, placing seventh, returning 4%.

These results are interesting because of our preference to invest in what we know and most of that is local. However global asset classes outperformed, reiterating calls from commentators that investors should consider global diversification.

The 20 year horizon shows many of the asset classes in a tight range. Residential property was still number one with a 10.2% return, Australian shares at 8.8% while four asset classes all returned just over 7% per annum.

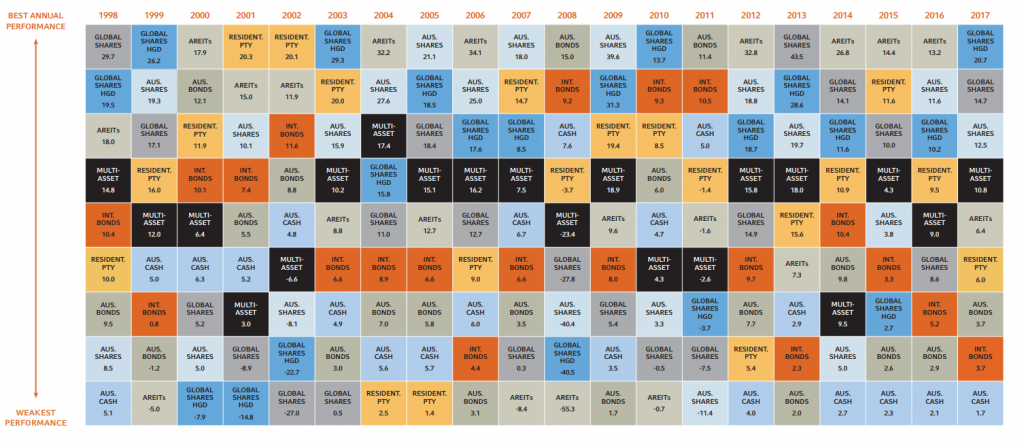

The most interesting part of the report is a chequered, coloured graphic arranging asset class performance by year.

Figure: Value of diversification diagram with residential property

Source: Russell Investments/ASX Long Term Investing Report 2018

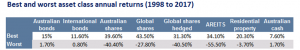

I’ve also summarised the best and worst statistics, see the table below.

Source: Russell Investments/ASX Long Term Investing Report 2018

Note: Residential property measure is a population weighted average return calculated across major capital cities.

Prices obtained from Real Estate Institute of Australia, data from ABS is used to make adjustments for capital improvements

Australian shares use the S&P/ASX All Ordinaries Accumulation Index

Australian bonds measure is derived from the Bloomberg Australian Bond Composite 0+ yr Index, including government and corporate bonds

Australian listed property is based on returns implied by the S&P/ASX 300 Property Trust (Accumulation) Index.

Cash is based on the Bloomberg AusBond Bank Bill Index

The AREITs – Australian real estate investment trusts were the most volatile asset class swinging from a high 34.1% return in 2006 to the deepest low over the 20 years at -55.3%, just two years later in 2008.

Cash is the most consistent performer but also the weakest in terms of its peak return at just 7.6% in the year the GFC struck in 2008. Other defensive assets such as Australian and international bonds also outperformed in 2008, with Australian bonds the best performing that year, returning 15%, followed by international bonds that reported 9.2%. Every other asset class had a negative return that also happened to be its worst as well.

Looking at the table, Australian shares, global shares and REITs often performed well together – while Australian bonds, international bonds and cash tended to perform well together. Diversifying and including a range of risk assets, not just all cash and low risk bonds, nor just all higher risk growth assets should help smooth returns and limit losses especially in case of a GFC type event.

The report highlights sequencing risk – that is the order and timing of returns. Most investors would know someone that retired or was due to retire in 2008. Those with high allocations to growth assets suffered significant declines in capital and either had to adjust retirement expectations or keep on working and delay retirement if that was possible.

That is why superannuation experts talk about dynamic asset allocation with a focus on growth when members are young and becoming more defensive as they age to protect savings. For example, Q Super has a ‘Lifetime’ program where investment strategy is linked to age and Lifetime balance – there are eight strategies in total. Twice a year they reassess each individual’s situation and alter strategies if needed.

What can we learn from the report?

- Diversify – Relying on one asset class increases risk. All asset classes are subject to market volatility except cash. If you compare returns from the past 20 years, leaving all investments in cash would have greatly reduced returns.

- It is important to assess risk adjusted returns and account for volatility and possible loss, not just absolute returns.

- Past returns do not guarantee future returns.

- While property has been the market darling, median prices rose by just 6% in 2017 with wide discrepancies between some regions and cities.

- Many asset classes are considered over-valued. When investing, research broadly and understand the risks before investing.

- Investing takes effort and persistence, many investments are not ‘set and forget’, be prepared to put in the effort or consider using professional advisers and services to help manage your portfolio.

For more information go to www.russellinvestments.com/au/insights/russell-asx-long-term-investing-report.