There’s something innately attractive about property. It’s tangible; it can be beautiful or have cultural, historical or sentimental value. Coupled with attractive negative gearing benefits for high income earners, the asset class has a lot going for it.

However, direct property investment might not always be the best way to have property exposure in your portfolio, especially in a low growth environment when its disadvantages (lack of liquidity and diversification) are exacerbated.

The fixed income asset class offers alternatives.

For example, investors can acquire a senior bond in Stockland or Mirvac offering a known return and a known maturity date. There is no guesswork in trying to locate growth hotspots or uncertainty regarding return on investment as it is known from the outset. Investors at all times are beneficial owners of the bonds and can buy and sell at their discretion.

However, the focus of this article is on another way to access property through fixed income via Residential Mortgage Backed Securities (RMBS).

RMBS are a type of fixed income security issued by a special purpose trust (SPT) which holds the collateral pool of home loans backing the RMBS. Different classes of RMBS offer a spectrum of risk and some of these risks are mitigated through structural and pool quality features such as:

- High underwriting standards

- Conservative loan to value ratios (averaging around 70%)

- Full recourse to the borrower, if the borrowed amount can’t be recovered from the proceeds of the property sale

What are Residential Mortgage Backed Securities?

Residential Mortgage Backed Securities are a type of debt security secured by a pool of home loans. RMBS are a subset of a larger group of Asset Backed Securities (ABS) which can be built around many types of cashflow receivables including residential mortgages, commercial mortgages, credit card payments and auto loans.

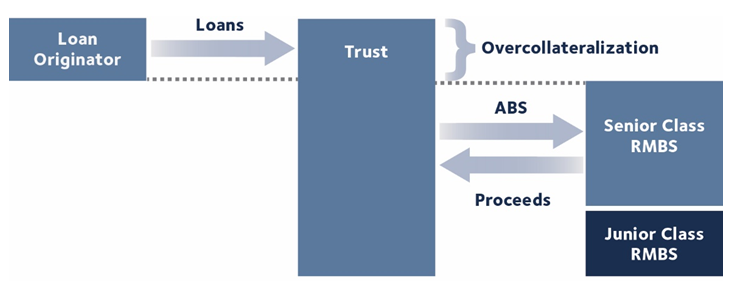

They are a structured product designed to help banks and non banks fund their lending operations. The originator (a bank or other lender) sets up a bankruptcy remote Special Purpose Trust (SPT) then transfers a pool of mortgage assets to the SPT in exchange for a lump sum payment, allowing the originator to free up capital and on lend to other customers (see Figure 1). The SPT then offers a range of investments in the pooled assets, repayments of which are funded from interest and principal payments made on the underlying home loans by the borrowers in the pool.

An RMBS trust will offer a range of seniority, risk and return in the RMBS, allowing investors to target the most appropriate tranche to suit their goals. Most often, the originator will hold the most risky tranche. RMBS have in the past been a way that a government related entity has historically, and could in future assist bank liquidity by buying tranches of RMBS.

RMBS come about due to the need of lenders (banks and other financial institutions) to source funding for their lending activities. RMBS provide another source of funding for bank lenders in addition to customer deposits and corporate borrowings. Virtually all Australian Prudential Regulation Authority (APRA) regulated lenders use RMBS as a source of funding. Non bank lenders such as Liberty, Pepper and La Trobe are overseen by ASIC but legislation is in train for them to also be regulated by APRA. Investors in RMBS include super funds, insurance companies, high net worth investors, and the Commonwealth government.

According to the Securitisation Forum, there is $75bn RMBS on issue.

The RMBS process

Source: FIIG Securities Limited

Who are the key players in an RMBS transaction?

There are a number of key players in an RMBS structure. An understanding of these key parties and their roles forms part of the analysis of any RMBS investment.

- Originator – the originator is the organisation that originates the home loan. In the case of RMBS, examples of originators are banks, credit unions and specialised home loan providers. The quality of the loans within an RMBS is affected by the quality of the lending procedures of the originator, and is taken into account in the assessment of credit ratings and of the quality of the RMBS

- Trustee – the trustee is the issuer of the bonds

- Servicer – the key management of the loan pool is undertaken by the servicer, which is usually also the originator. This includes the calculation and charging of fees; interest and principal; the collection of payments (excluding any arrears); issuance of borrower statements; performance reporting on the loan book and monitoring insurance.

- Banker – provides banking services to the trust. This may include providing liquidity facilities and interest rate swaps, as well as normal banking services

- Rating agencies – the rating agencies play a key role in RMBS and in its analysis. The rating agencies get full access to the details of the underlying loans which form the asset pool and undertake detailed analysis of the individual loans. They prepare and issue quarterly statements for investors about the performance of the RMBS

As part of its review, the rating agency will consider the quality and history of the key players in the structure such as the originator, service providers, counterparties, as well as the underlying structures of the cash flow waterfall, and liquidity provisions, which we’ll cover in more detail in Part 2 of the series.

To learn more please see Chapter 12 of “The Australian Guide to Fixed Income” or Listen to the RMBS Webinar – While a few years’ old (including pricing) the principles still apply.

– While a few years’ old (including pricing) the principles still apply.