Look, what can I say? It is an irresistible temptation following Philip Lowe’s rise to the top of the Reserve Bank to pun on his name. Sorry, but I can’t promise to stop it.

He made a big speech this week which is worth spending some time on because it was mainly about the big economic issue of our time – low wages growth. Not that he had any surprising answers to the problem, or any answers at all to be honest, but I think he key thing was that, during the Q&A session at the end, he acknowledged that if wages growth stays at 2%, “we won’t get back to 2.5% inflation”.

Here are few other points from the speech worth mentioning:

- The global outlook has improved. “The pessimism of earlier years has given way to cautious optimism. Forecasts are being revised up, not down.”

- He discussed the recent strength in employment, although he qualified that with: “there are other labour market developments that are causing concern in the community. There is a degree of underemployment, wage growth is slow and job security is an issue for more people.”

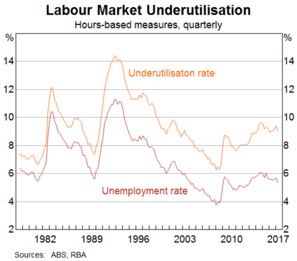

On this subject, he provided this chart, which clearly showed the widening gap between labour “underutilisation” and unemployment, in turn indicating that unemployment itself is no longer an accurate measure of labour market slack (although he didn’t say that, exactly).

- · On wages, he said that the Bureau of Statistic’s Wage Price Index is growing at its slowest pace on record, and the GDP measure of wages is doing something similar. This has led to a fall in expectations of future income growth which is weighing on consumer spending. High household debt is likely to exacerbate this issue.

- In casting about for an explanation for low wage growth, he produced a few, including: the unwind of the mining boom, slower productivity growth, and competition from globalisation and technology.

- On the future of wages he was pessimistic. He noted that countries at full employment could possibly see some sort of catch-up in wage growth and, “inflation pressures could emerge quite quickly,” that “would seem, though, to have a fairly low probability in Australia, especially in light of the continuing spare capacity in our labour market. The more likely case here is that wage growth picks up gradually as the demand for labour strengthens.” In the Q&A session, he said that the RBA’s “business liaison” showed no signs of accelerating wage growth.

- He discussed the impact ofhigh levels of debt: “over recent times you would have noticed that we have been paying close attention to the risks in household balance sheets. Household debt is high and rising faster than the unusually slow growth in incomes. These developments have had a bearing on the setting of monetary policy,” but the stability of the unemployment rate had allowed the Bank to be patient in waiting for inflation to recover (something that Wednesday’s CPI report suggests may be happening).

- In the Q&A session, Lowe was asked about competitiveness and said it was really more about the level of the Australian dollar than the level of wages. He also commented that a “lower exchange rate would be helpful.”

Overall, it all boils down to nothing doing on monetary policy for a while because Lowe’s RBA is focused on spare capacity in the labour market, with household debt as focus number 2 and house prices No.3.

As I’ve been writing for a while: can’t cut, can’t hike, and can only watch the exchange rate from the sidelines and hope it comes down, which it’s not yet, and is only trending higher, which is a bugger.

At some point, Lowe will have to give up and start hiking, to “normalise” interest rates just like the Fed, but it’s likely to take longer here because both interest rates and unemployment are higher.

To see more of Alan Kohler visit The Constant Investor for his Weekly Overview, exclusive stock tips, investment ideas, podcasts and much more. Click here to learn more.