Global equity markets were mostly in the red last week, with former FBI director James Comey’s testimony and the British election weighing on the market.

- The S&P/ASX 200 declined by 1.9%, its worst weekly performance of the year. The S&P 500 ended the week down 0.3% and the Nasdaq 100 dropped 2.4%, following wide-spread selling in the technology sector on Friday. Bearish domestic equity ETFs (BBOZ and BEAR) were amongst the top performing funds for the week, whilst domestic property ETFs (SLF, MVA and VAP) were amongst the poorest performers.

- The Australian dollar ended the week 1.1% higher, pushing back above US 75c. Pound sterling dropped over 1% following the British election outcome.

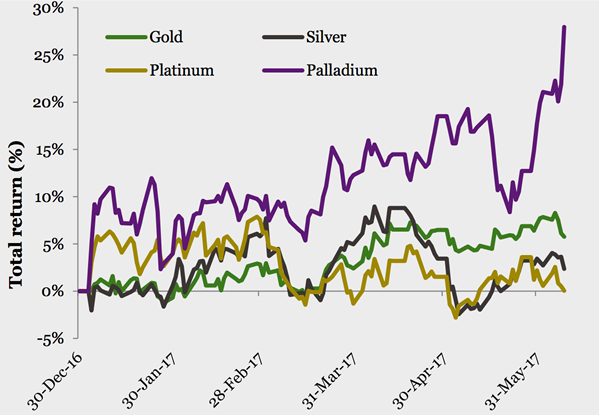

- WTI crude dropped 3.8% following news of higher than expected US inventories. Iron ore fell by 5.9% on slowing Chinese growth. ETFS Physical Palladium ETF (ETPMPD) was the top performing fund for the second week running, returning 5.7% for the week and 27.2% year-to-date. Demand for the metal, mainly from the auto industry, has spiked recently pushing prices to 16 year highs.

- The Australian ETF market saw inflows of A$85m and outflows of A$5m from domestically domiciled ETFs.

You can view the ETF Securities Australia weekly monitor by following this link.

- To sign up for future ETF Securities Australia email: infoAU@etfsecurities.com

- To find out more about ETF Securities Australia products, visit www.etfsecurities.com