The prospect of growth for an investor brings to mind emerging Asian economies, start-ups or mining companies. Over the last few years the US, as the world’s largest economy, has provided phenomenal growth from soaring share-prices. As the world-economic wheel turns and the US markets get to full-value we look to see how and why Europe if offering reliable income, growth and stability.

Growth performance

To put international growth in perspective we look at the dominance of the US (S&P 500) over the Australian share market (XJO) in recent years:

- 1 year +4%

- 2 years +11%

- 5 years +42% as shown in the chart below.

Over this same period, Australia’s standard growth options of Asia and mining companies have dramatically underperformed. This throws the Australian perception of ‘growth’ out the window and highlights the importance of international diversification in the portfolio. “Australia is undeniably a strong economy but that doesn’t mean it consistently performs better than others around the world” says Kris Walesby, Head of ANZ ETFS.

“Diversification is the founding principle for solid portfolio management, in common-sense terms it says to an investor – don’t put all your eggs in one basket. By diversifying internationally Australian investors are able to take part in other regions, which is the beginning of having your eggs in multiple baskets;” says Walesby.

“By investing internationally an Australian investor is opening themselves to a world of opportunity and, if applied carefully, is reducing the risk within their portfolio for the same level of return;” says Walesby.

Where in the world to look for growth?

With the benefit of hindsight, investors can see that the strong driving force behind the US dominance of recent years was the Federal Reserve (‘Fed’). Although many economists caution of the US markets running out of puff; “Australian investors should consider value too – the US is strong, but everyone knows this, and therefore this is reflected in their company values;” says Walesby.

“The US is considered by most as the strongest of all the major economies, having recovered most convincingly versus its peers from the GFC;” says Walesby.

“However, it is often forgotten that Europe’s European Central Bank made a similar commitment to do ‘whatever it takes’ to allow the EU to recover and, although this commitment was several years after the US launched their own quantitative easing (QE) schedule;” continues Walesby.

Herein lies the opportunity – the strong recovery of the US looks to have written the play-book for Europe’s recovery that is a few years behind the US, just like the start of their QE program. In Europe, the effects of their QE are emerging, “the results are starting to bear fruit with unemployment beginning to come down significantly in the peripherals and manufacturing (PMI) and industrial indicators showing material success (see charts below);” says Walesby.

How important is Europe?

“Europe as a region is 20% of the world market by market capitalization, and 22% by global output;” explains Walesby.

When investing in Europe, is worth understanding the distinction within Europe. “Europe is not just one economic bloc; in the same way that North America is in fact three distinct prospects – the US, Canada and Mexico;” says Walesby.

“Europe has really two main blocs – the Eurozone, made up of countries sharing the Euro currency – and the others, which include the U.K, Switzerland, Sweden and Norway. This is important for investors to consider as, European exposure must be considered by investors, not all parts of Europe are equal;” explains Walesby.

“The Eurozone’s GDP, for example, is recovering to be close to that of Australia and the US. This may not be the case for other non-Eurozone countries.”

.png)

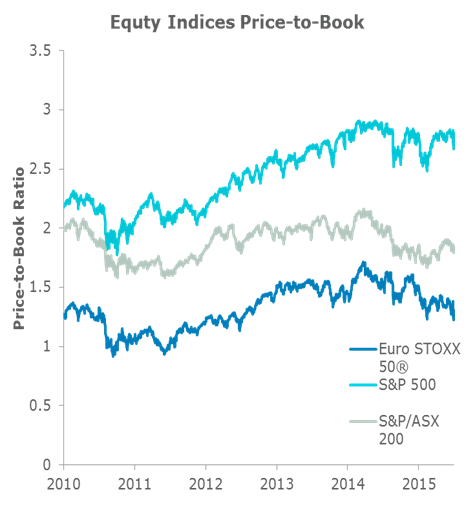

“If one looks on metrics like Price to Book or Price to Earnings, it’s easy to see why many consider Europe to be very undervalued when considering the potential future upside.”

Europe looks poised to offer investors new opportunities. ANZ ETFS is bringing to market an ETF that is designed to provide a Blue-chip representation of the super sector leaders in the Eurozone (so there’s no exposure to UK post-Brexit); the EURO STOXX 50® Index. We will keep you informed on its developments as it happens.