In recent years, many people have become more aware of the social and environmental impact of their investments and have decided they want their funds to support worthwhile initiatives.

This phenomenon, known as ‘socially responsible investment’, means there is a growing appetite for investments that are consistent with a range of social values.

One example of a ‘socially responsible investment’ is green bonds. A green bond is a bond that helps fund projects that have positive environmental and/or climate benefits. Some of the specific environmental categories include: alternative energy, energy efficiency, pollution prevention and control, sustainable water, and green building.

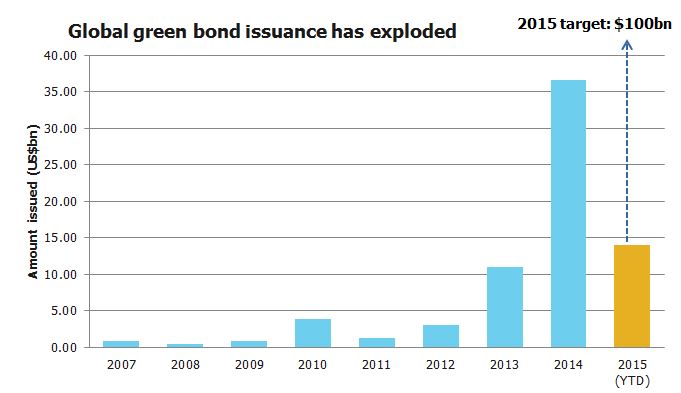

The first ever green bond was issued back in 2007 jointly by two development banks – the European Investment Bank and the World Bank. The market was slow to develop but gained momentum in 2013 when the first USD1 billion bond was launched by IFC, part of the World Bank Group, and sold within an hour.

According to the Climate Bonds Institute, global green bond issuance last year was USD36 billion, with issuance this year of USD14 billion until 31 May 2015. Their 2015 target is a huge USD100 billion.

Source: CBI, FIIG Securities

On the domestic front, the World Bank was again first to the market, launching Australia’s first green bond last year with a $300 million issue. NAB was the first domestic bank to follow suit, raising $300 million in 2014 and late last month ANZ also came to the market raising a significant $600 million.

The ANZ bond was senior unsecured maturing in June 2020 with a fixed interest rate of 3.25% or 80 basis points over semi-quarterly swap. The funds support loans to wind and solar projects and green star rated commercial property. Importantly, the bonds are certified by the Climate Bond Institute and verified by independent auditor Ernst and Young.

The bonds were issued in the over-the-counter market and bought by a diverse range of investors including governments, asset managers, superannuation funds, councils, not-for-profits such as schools and charities, banks and insurance companies. At the moment, individual investors would need to invest $500,000 to own the bonds directly, putting them out of reach for most people.

The returns on green bonds have been low to date, reflecting the very low risk of the institutions issuing them. There are now high yield green bond issuers in the global market and we expect over time to see high yield green bonds with more attractive returns in the domestic market.

While the market is developing and there’s a limited supply of green bonds, we expect they will be tightly held by investors who need to satisfy fund mandates. In time they should become available in smaller parcels for individual investors.

There are some individual investments in community organisations such as Australian National University, NSW Schools and Royal Women’s Hospital that may meet your own investment parameters. These bonds are inflation linked with returns from 4.6 per cent to 5.7 per cent per annum and available from $50,000.

If you are keen to invest in a socially responsible way there are a number of superannuation funds, banks and investment managers offering socially responsible investment options. I think it’s important to fully understand what the funds invest in and if the investments are accredited by the Climate Bond Institute or other recognised bodies and that the accreditation has been verified by an independent third party.

Supporting socially responsible investment or worthwhile institutions is admirable, but like any investment, you’ll need to assess the risks and if the returns provide adequate compensation.