Australian interest rate investors tend to keep an eye on future moves in the cash rate cycle and what the Reserve Bank of Australia is likely to do next. This can help investors decide whether or not they are going to lock their money away in a term deposit for 30 days or five years or somewhere in between. If investors think that rates will rise in the near term, they will not want to lock their money away in long term TDs and are more likely to opt for short term TDs and other highly liquid instruments.

The market itself has no more knowledge about what the RBA will do next than the next person, but the market is sensitive to changes in macroeconomic indicators like CPI, unemployment, business confidence and the balance of payments as well as external influences such as what the Federal Reserve is doing in the US.

One of the easiest ways of by checking out what the market is predicting for the future of rates is to check out the RBA Rate Indicator. The RBA Rate Indicator shows market expectations of a change in the official cash rate and calculates a percentage probability of an RBA interest rate change based on the market determined prices in the ASX 30 Day Interbank Cash Rate Futures. As such, the RBA Rate Indicator provides market participants with a market monitor for official cash rate expectations in Australia. The RBA Rate indicator can be accessed at any time here.

The indicator can be fairly volatile and subject to quite a bit of daily change. Cash rate expectations rose last week, for instance, on the back of rising longer term rates and an economy that seemingly has inflation under control.

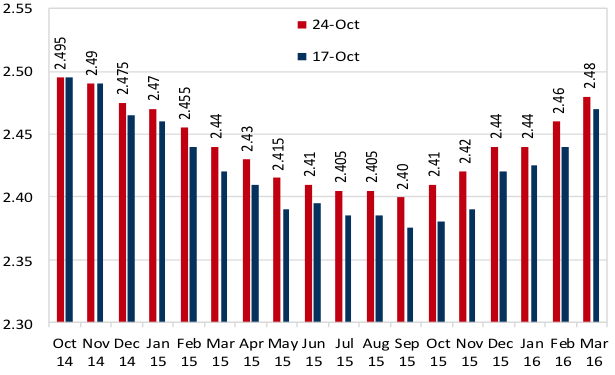

The RBA Rate Indicator indicates that the low in the cash cycle is now being priced at 2.40 per cent in September 2015 with a 40 per cent chance of a rate cut by then. Even with rate expectations rising from there onwards, the market is not pricing in a rate increase by March 2016.

The chart below shows how cash rate expectations can change from one week to the next.

Cash Rate Expectations %

|

Paul McNamara is an editor and journalist with over 20 years’ experience. His career includes spells with the Financial Times, Euromoney, BRW Media, Asia-Inc and Banker Middle East. At present he is editor of YieldReport. YieldReport is a digital newsletter that carries comprehensive pricing and commentary on Australian interest rate securities in a monthly and weekly report. Each issue covers bank bills, cash accounts, term deposits, government bonds, semi-government and corporate bonds, hybrids, ETFs, managed funds and more. Click here for a free trial subscription. |

|