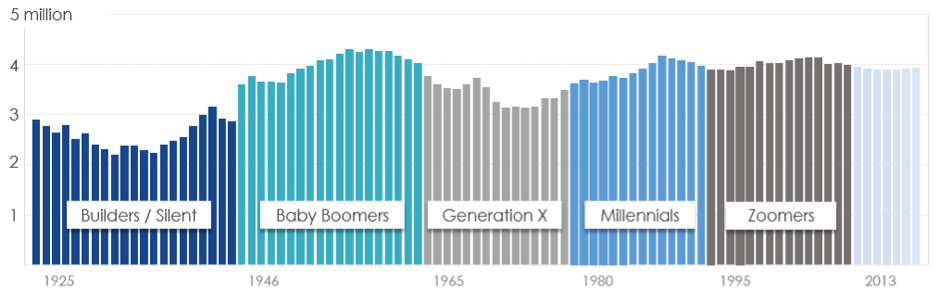

Every 15 to 20 years, a new generation is defined. Generations are identifiable by their music, fashion, and events that happened during the generation’s formative years.

Baby Boomers have been the most influential generation in terms of commerce and world markets since World War 2. In 1946 the population of the US was 140 million. It is now 330 million, yet more babies per year were born between 1946 and 1965 than during any other generation. Around 75 million baby boomers were born in the US following World War 2.

Figure 1: Number of US births by year and generation

Source: US Department of Health and Human Services National Centre for Health Statistics

This group has driven the US economy for decades and it still today makes up 50% of the wealth of the US. Consider the rise of the consumer during this time and how markets responded to Baby Boomers.

- In 1948 when the leading edge of this big population group was turning two years old, someone recognised that kids love toys so created Toys R Us.

- In 1955, as some baby boomer approached nine years old, the McDonald brothers combined a child’s love of burgers, family dining and speed to create the modern fast food restaurant.

- Jump forward a few years. This population group is exiting their 20s and wants to stay active and young. Enter a sportswear company already established in the Pacific Northwest: Nike listed in 1980.

- In 1992 when the leading edge of this generation was turning 46 years old and needed a pick-up, Starbucks listed on the stock exchange.

You get the point. These companies, and many like them, were created and were successful by following a simple business concept: sell a good or service that is needed and wanted by a big population group. While Baby Boomers have been the biggest driver of markets over the last 50 years in the US and other developed nations, we think Chinese Millennials are the Baby Boomers of the future.

There are a number of reasons we think this group of consumers will drive markets over the coming decades.

Firstly, according to World Bank, by 2024 China’s GDP will surpass the GDP of the US. China is experiencing the fastest expansion of the middle class the world has ever seen, during a period when the global middle class is already expanding at a historically unprecedented rate. By 2027, it is estimated that 1.2 billion Chinese will be in the middle class, making up one quarter of the world total.

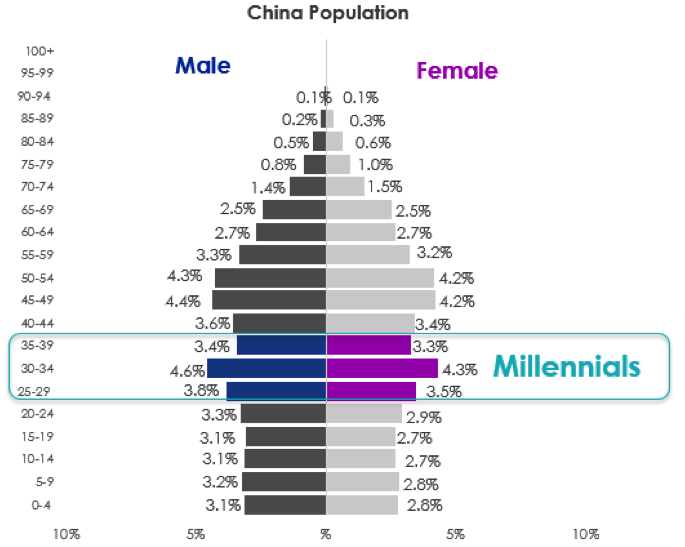

Unlike aging populations in Europe and Japan, China’s population is young, as illustrated in the chart below. In the late 1980s and 1990s, China experienced a population growth of 45%, almost its own baby boom. Thirty years on, this privileged generation has grown up during a period of economic reforms and the opening up of the country.

Figure 2: China’s population pyramids

Source: United Nations, Department of Economic and Social Affairs, Population Division. World Population Prospects: The 2019 Revision.

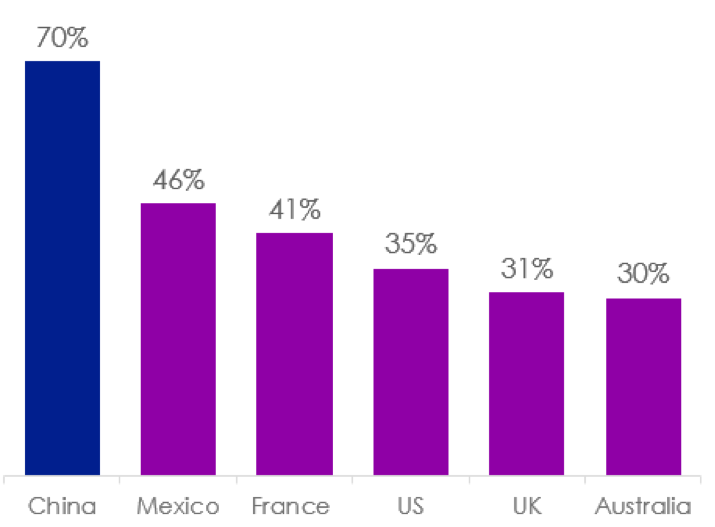

The similarities in the consumer behaviour and attitudes of Chinese Millennials compared to the Baby Boomers are stark. Like the Baby Boomers at the same age, Chinese Millennials are more likely to spend money on entertaining and experiences and increasingly look to shopping as a source of entertainment. They are eating out more, they buy cars which will make them seem more successful and they like to travel. And like their Baby Boomer counterparts as they head into their mid-life, they aspire to the American Dream: The perfect family unit and home ownership – 70% of Chinese Millennials own their own home compared to 35% in the US and 30% in Australia.

Figure 3: Percentage of Millennials who own their own home

Source: Source: HSBC ‘Beyond the Bricks: The Meaning of Home’ Report, 2017, Australian data from Corelogic’s Perceptions of Housing Affordability Report, 2019

China will soon become the world biggest economy and it is China’s younger demographic that is driving economic growth:

There are 350 million Chinese Millennials. This the is new generation that will drive markets and by number there is more of them than the 75 million US Baby Boomers in what became the world’s biggest economy. The numbers are amazing.

Take the alcoholic beverage Baijiu as an example. It is the most commonly consumed alcohol spirit in the world. Baijiu accounts for 35% of the world’s spirit production and 99% of it is consumed in China, where it is the nation’s traditional spirit. China’s largest Baijui companies, Kweichow Mouati and Wuliangye, have a market capitalisation of $565 billion and $248 billion, respectively, 31 May 2021. This is astounding when you consider the biggest beverage company in the west, ABinBEv, has a market capitalisation of just $197 billion.

Consider too, fashion. When the global fashion brands first went to China a number of years ago they were highly sought after by the newly wealthy generations. Now, local brands are taking over from foreign brands, driven forward by Millennials. From “Made in China” to “Designed in China”, mainland brands are taking over. Take for example Peacebird, a mainland fashion brand. When COVID-19 hit, Peacebird rapidly adapted, inviting superstars, online celebrities, and even corporate CEOs to sell goods in live broadcasts and develop a new virtual connection with their existing customers. It quickly reorganised and retrained staff in online sales. Once the economy re-opened, Peacebird, which had around 1,600 stores at the start of 2020, opened 120 new stores and it continues to grow (For reference, Country Road has over 600 in Australia and New Zealand). Peacebird’s online sales reached 30% of total sales revenue in 2020 and helped increase margins, leading to a 59% increase in profit.

Given the huge size of the Chinese economy, all investors need some exposure to the mainland China market, especially to Chinese A-Shares, which are companies incorporated and listed in China. It is these companies that compete in the world biggest consumer market. Accessing those companies and sectors with the greatest exposure to the next generation that will drive markets in coming decades is paramount.

This opportunity is not easy to access. Investing in some China A-shares is no simple feat and only a handful of Australian institutional investors, including VanEck, have a Renminbi Qualified Foreign Institutional Investor (RQFII) license enabling it to invest directly in all A-shares.

The VanEck Vectors China New Economy ETF (ASX: CNEW) gives investors easy access to China A-shares and the enormous potential growth opportunities in China’s New Economy sectors being:

- Technology;

- Healthcare;

- Consumer discretionary; and

- Consumer staples.

This Vector Insights is an adaption of a recent presentation I did. For a full version of the presentation – click here