by Frank Uhlenbruch, Investment Strategist, Australian Fixed Interest Team

We knew growth was going to fall the most in Q2 as a result of the COVID-19 lockdown measures and the National Accounts have revealed by just how much. With a fall of 7%, the June quarter GDP was in line with our forecast.

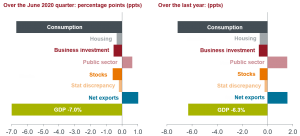

Chart 1: National Accounts Q2 2020

This recession is in a class of its own as it was not caused by traditional business cycle triggers such as supply side shocks or mismanagement of policy settings, it reflects lockdown measures driven by public health policy.

As part of the broader COVID-19 response, public health policy measures were matched in real-time by unprecedented fiscal and monetary support.

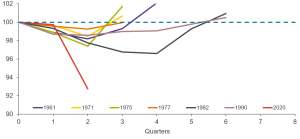

The recovery period for sequential recessions (consecutive periods of falling output) since the quarterly national accounts began in 1959 fall into two groupings:

- Four out of the seven events identified saw lost output recovered in three to four quarters.

- Two out of the seven events saw lost output recovered in six quarters.

Our expectation is that it will take at least until H1 2022 for lost output to be recovered, though there remains a high degree of uncertainty about this.

Chart 2: Real GDP Index (quarterly Date): Various recessions*

While our expectations for the road to recovery is based on the current data at hand, the final outcome will be determined by the progress made in overcoming the COVID-19 epidemic, including the successful control of infections and outbreaks, the development of a vaccine and the speed at which the economy can be opened up and border controls removed.