There has been a widespread revival in a number of small cap stocks, many of which have reversed course unable to sustain their upward trajectory because the underlying business isn’t ready or won’t be ready for any meaningful improvement. Such companies have the ability to drain your capital rather than add to it, so its very important to understand what the market potential and trajectory of the business in question is.

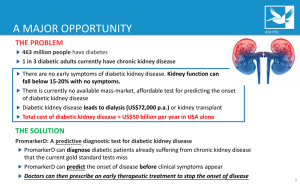

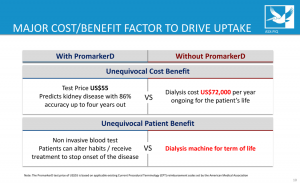

One that has excited me of late is Proteomics (PIQ). Not only has its share price been moving higher with some solid momentum but its underlying business is also approaching an inflexion point. PIQ has the world’s first predictive diagnostic test for diabetic kidney disease that can predict the onset of the disease up to four years in advance. This naturally is a huge benefit for the patient (to receive the appropriate care and make lifestyle changes) while for healthcare systems it is a game changer in being able to reduce the huge costs in the treatment of kidney disease (dialysis can cost over $US70,000 p.a or the requirement for a kidney transplant).

The slide below from the Company’s recent presentation really stood out to me in highlighting the current problem and the true essence of the solution PIQ has with its Promarker D predictive diagnostic test.

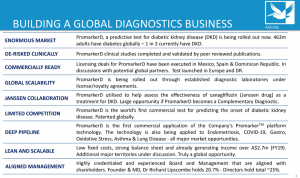

PIQ has licensing deals executed in Mexico, Dominican Republic and Spain for the Promarker D test and sales are commencing while they seek to obtain approvals in other countries – namely the USA. Importantly, PIQ is using the technology behind these tests to also create tests for Covid-19, Endometriosis, Asthma and lung disease, providing a wider range of opportunities.

I find when delving into these smaller cap biotech and healthcare companies there is a high element of risk, considering most have no revenue, high cash burn and are often still clinically unproven. Often their focus can be on relatively small markets. These risks have largely been nullified with PIQ as the slide below shows with clinical studies complete, the company is already generating revenues, is focused on a huge global market and significantly directors have been buying shares on market in the past two months.

Currently, PIQ is working in collaboration with Janssen (a subsidiary of Johnson & Johnson) in studying the performance of Promarker D in a Janssen completed trial. This relationship was extended in March to determine if Promarker D can help the effectiveness of the current drug used for Type 2 diabetes – canagliflozin – as a treatment for diabetic kidney disease. The goal is for PIQ’s test to be used as a process of monitoring a patient’s risk of developing chronic kidney disease.

PIQ’s Promarker D test is thus working to be the industry standard in identifying patient groups at risk of kidney disease to introduce earlier treatments, lower drug dosages and ultimately better results for patients. The process of FDA approval which is the holy grail has the potential to be accelerated using the data in its collaboration with Janssen. Discussion with global partners is ongoing.

With a market cap of $53 million and considering the size of the market, the significance of the Promarker platform to rollout other diagnostic tests for other diseases plus limited competition, PIQ certainly has the capacity to back up its recent share price appreciation. In fact this is one of my favourite biotechs at the moment and reminds me very much of the early days when I was investing in Volpara health (VHT) that has enjoyed significant success rolling out its breast density screening technology.

PIQ’ share price may have enjoyed some success in the past couple of weeks moving to recent highs of 60c but as the chart below shows this is still only just marginally above its decade long resistance. This spells to me that the above factors are real underlying fundamental trends that can support a solid but sustainable re-rating. A market cap above $100 million or double current levels wouldn’t seem excessive in my view so it’s one I am willing to back and will accumulate more, focusing on the significance its tests have in predicting key diseases.