Investment markets and key developments over the past week

Global share markets rose strongly over the last week as prospects for even more stimulus in the US after the Georgia Senate elections offset concerns about surging coronavirus cases. Reflecting the positive global lead Australian shares also rose strongly, more than reversing their soft end to 2020 with stocks leveraged to recovery in the energy, material, financials and consumer sectors leading the charge and more than offsetting weakness in health, property and IT stocks. Bond yields rose and oil, metal and iron ore prices also rose. The $A continued to push higher briefly breaching $US0.78, despite a slight rise in the US dollar.

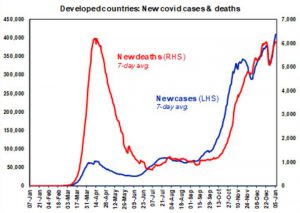

The news on coronavirus cases globally unfortunately remains bleak. After pausing a bit over the holiday period – likely reflecting reduced testing and reporting lags – the rising trend in in new cases has resumed, particularly in developed countries. The US and Europe have seen rising trends resume, the UK has seen new cases almost quadruple to over 60,000 a day over the last month thanks to a new 70% more contagious strain and the trend also remains up in Canada and Japan with a new rising trend in South Africa also based on a new strain.

Source: ourworldindata.org, AMP Capital

![]()

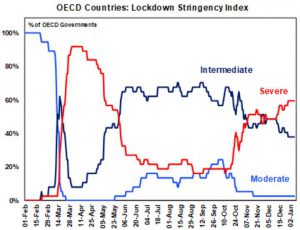

While the measured mortality rate in developed countries has collapsed to around 2% reflecting more testing and better treatments, deaths are pushing above their April highs and hospital systems have come under ever increasing pressure. This is continuing to drive more severe lockdowns – with the UK announcing a third nationwide lockdown and Japan moving towards another state of emergency for Tokyo and surrounding areas.

While the measured mortality rate in developed countries has collapsed to around 2% reflecting more testing and better treatments, deaths are pushing above their April highs and hospital systems have come under ever increasing pressure. This is continuing to drive more severe lockdowns – with the UK announcing a third nationwide lockdown and Japan moving towards another state of emergency for Tokyo and surrounding areas.

Source: University of Oxford, AMP Capital

The indications so far are that the new UK and South African coronavirus strains are close enough to the original such that the vaccines that have been developed will remain highly effective. The vaccines are now being rolled out in various countries (and in Australia from mid-February) and should help significantly from the second half as more people are vaccinated and herd immunity is reached. Of course, they won’t help much with current waves of new cases and the more infectious strains may mean that more people will need to be vaccinated to reach herd immunity. At least their roll out and the prospect of reaching herd immunity is allowing share markets to continue to mostly look through the current problems with the virus and their economic impact.

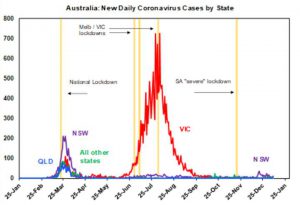

Fortunately, in Australia the outbreak of new cases that began in Sydney just before Christmas seems to have been brought under control thanks to partial lockdowns, massive testing, contract tracing and quarantining. It’s way too early to relax though and the return of international travellers to which all outbreaks can be traced (Victoria in June, SA in November, the recent Avalon and Berala clusters and now the risk of one in Brisbane) remains a high source of risk, particularly with the more infectious version of coronavirus now having made its way into Australia and having escaped quarantine in Brisbane via an infected quarantine hotel cleaner. So far the economic impact of the restrictions announced since the Avalon cluster in Sydney and now a three day stay at home lockdown in greater Brisbane (which accounts for about 10% of Australian GDP) is likely to be minor in terms of the national economic recovery (albeit its horrible for those businesses and workers that are directly affected). And if the number of new local cases remains very low further wider lockdowns can be avoided which in turn will see the economic recovery remain on track.

Source: covid19data.com.au; AMP Capital

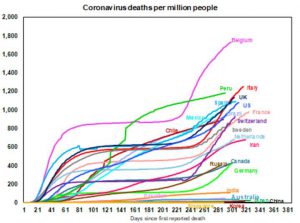

Australia’s better management of coronavirus can be seen in the next chart. Australia has so far lost 909 people to coronavirus but our level of deaths per million people is at the low end of the scale in line with several other Asian countries. If we had the same number of covid deaths per capita as the US, we would have lost an extra 27,200 people. So, despite getting personally caught up in a lockdown over Christmas/New Year I reckon the sensible expert driven approach being taken in Australia is well and truly worth it as its helped save the lives of something like 27,200 fellow Australians. And to this should also be allowed the longer-term adverse health consequences of coronavirus for some of those who get it but survive.

Source: covid19data.com.au; AMP Capital

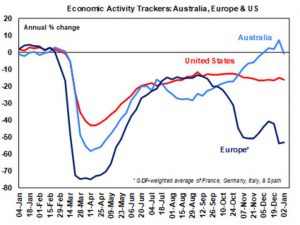

Our weekly Economic Activity Trackers remain divergent. In Europe they have fallen back to November lows over the last few weeks pointing to continued weak economic activity. Our US tracker is little changed over the last few weeks and still points to some slowing in economic conditions since September.

Source: AMP Capital

Our Australia Economic Activity Tracker has fallen sharply over the last week or so reflecting the latest coronavirus scare, tighter restrictions and border closures but remains well up from its lows and far stronger than in the US and Europe suggesting that the recovery remained strong into late last year. Of course, much now depends on keeping new coronavirus case numbers low with early action which will in turn head off deeper lockdowns and enable the recovery to continue.

In the US it’s been a big start to the year with Kim and Kanye splitting followed by Trump and Pence! More importantly, Congress has confirmed that Biden won with Trump committing to “an orderly transition” (even though he “disagrees with the outcome”). As unbelievable as Trump’s quixotic efforts to overturn the election result have been – through numerous failed court challenges culminating in his egging on of his supporters who stormed the Capitol resulting in several deaths – they have now failed. Senate Majority Leader McConnell denounced efforts to reverse the result, challenges to state results received little Senate support and Vice President Pence refused to block Congress’ confirmation of the election outcome on the grounds that he has no power to do so. Trump has less than two weeks left before Joe Biden is inaugurated on January 20. My inclination is to see the invasion of the Capitol as the last gasp of the Trump era as by showing the utter disrespect Trump and his supporters have for US institutions and how it leads to violence it has further alienated another big group of mainstream Republicans and Americans. Trump has left behind much damage and division and the deeper problems in US society that Trump tapped into have not gone away posing challenges for Biden. But US democratic values have been upheld in the face of Trump’s onslaught by thousands of US election officials, judges and politicians (on both sides of politics) following the law and doing their duty.

Meanwhile, the Democrats have achieved a clean sweep following victories in the two special Senate seat elections in Georgia (albeit they are both yet to be certified). The Republicans should have won the Georgia special Senate elections given the losing party from a presidential election normally benefits in subsequent elections and GOP votes were easily ahead of Democrat votes in the same senate seat elections on November 5. But Trump’s “we was robbed” antics over the last two months including an extraordinary request to Georgia Secretary of State Brad Raffensperger to conjure up 11780 votes for Trump to reverse the state outcome in the presidential election put paid to that with both Senate seats now looking like they will be confirmed for the Democrats which will give them 50 Senate seats and hence a majority with VP Harris’ vote.

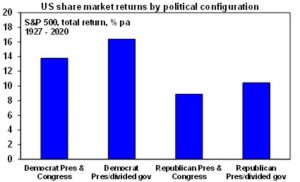

This is not quite the blue wave that Democrats had hoped for prior to the election as their margin is wafer thin but it does make it easier to get things done. In particular, it likely means another $1.5 trillion in fiscal stimulus (including $2000 stimulus payments and other pandemic measures in the next month or so, followed by more on climate and infrastructure later in the year) and likely corporate and top income tax rate increases (which will be necessary to pay for the extra stimulus over 10 years under the budget reconciliation process). It also makes it easier for Biden to get appointments confirmed and it should avoid stoushes over government funding and debt ceiling increases for the next two years. However, Biden will likely still be a centrist and moderate Democrat senators will limit tax hikes and any leftward lurch particularly ahead of the 2022 mid-term elections. A corporate tax rate hike (say from 21% to 25%) is still a negative for shares but its likely to be offset by more near term fiscal stimulus. Historically US shares have done best with a Democrat President and Republican control of at least one house in Congress, but a Democrat President with a Democrat Congress has been a good second best. See the next chart. The combination of a higher US corporate tax rate and more fiscal stimulus is on balance more positive for global, including Australian, shares as it benefits global growth but makes non-US shares more attractive.

Source: Bloomberg, AMP Capital

Over the Christmas period the US agreed another $900bn fiscal stimulus. This included $600 stimulus payments for most Americans, expanded unemployment benefits and more funding for the Paycheck Protection Program. While its less than the $2 trillion plus that the Democrats wanted, at 4% of GDP it will still provide strong support for the US economy in the March quarter at a time when coronavirus is threatening to further slow the economy. And as noted in the previous paragraph its now likely to be added to with the stimulus payments pushing up to total of $2000.

Brexit trade deal also reached. This headed off a hard exit for the UK from the EU which could have knocked 2 to 3% of the UK economy next year. So, given that this has been averted its good to the extent that it’s positive for global growth. That said the deal leaves significant uncertainty over services trade and still sees the return of customs checks at borders and will still leave the UK economy 0.5% or so per annum worse off over ten years relative to what would have happened if it had remained in the EU. It clears the way for free trade deal negotiations between Australia and the UK, but this may take years and while it may help a few agricultural producers (like wine makers) it’s overall impact on the Australian economy is likely to be marginal.

The developments over the last few weeks and particularly since the start of the year don’t change our view on the outlook for investment markets but they reinforce it. First, having run hard since November shares remain overbought and vulnerable to a correction particularly once seasonal strength around Christmas New Year runs its course. As such a 10% or so correction in February would not be particularly surprising. Rising coronavirus cases and associated lockdowns add to this short-term risk.

However, beyond the short term noise more upside is likely this year as momentum is very strong, the rally in shares is being confirmed by gains in other reflation trades such as higher commodity prices, cyclical shares and commodity currencies, shares are still cheap relative to ultra-low interest rates and bond yields and investors are yet to fully discount the potential for a very strong economic and profit recovery this year as even more US stimulus combines with vaccines. So, 2021 is likely to see solid returns overall.

The transition from pandemic to recovery will ultimately continue to benefit cyclical stocks like resources, industrials, financials and travel related companies. This should also benefit the more cyclical Australian share market relative to the tech heavy US share market – particularly if the US corporate tax rate is increased which would have the effect of making Australian companies relatively more attractive. The $A is likely to continue to head higher on the back of rising commodity prices and a falling US dollar, but is starting to look like it will blast through our year end forecast for a rise to $US0.80. RBA quantitative easing will likely only be able to slow the $A’s ascent as opposed to stop it. The declining US dollar is also positive for bitcoin which has more than doubled over the last month as more have jumped on to its bandwagon, but it remains hard to value and hard to take seriously as a currency given its extreme volatility.

86 years ago, in Tupelo Mississippi Elvis Aaron Presley was born. While his music from the 1950s helped revolutionise popular music his best came from the late 1960s and 1970s including Suspicious Minds and Always on My Mind. (I love the strings in the latter.)

Major global economic events and implications

US data released over the last three weeks was mostly good with a surprising strength in the December business conditions ISMs and strong readings for durable goods orders, home prices and construction spending and a fall in jobless claims.Personal spending, home sales and the ADP employment survey fell though.

Japanese data has been mixed with a fall in unemployment, a rise in the ratio of job openings to applicants and stronger than expected household spending but continuing falls in wages.

Chinese business conditions PMIs fell back slightly in December but remain at strong levels consistent with ongoing economic expansion.

Australian economic events and implications

Australian economic data releases over the past three weeks have generally been solid with another surge in November retail sales (up 7% month on month as Victoria reopened), further gains in building approvals, another strong rise in job ads (which are now actually up 5% year on year) and a strong rise in imports and another strong rise in home prices in December leaving them up 2% through 2020. Credit growth remained soft but looks like it might be bottoming and APRA data showed that the share by value of housing loans in deferral had fallen to just 2.8% from 11% in May, suggesting that the winddown of bank payment holidays won’t pose a major problem for the property market.

Of course, this data was all before the latest coronavirus scare in NSW.While new cases now look like they are coming under control again the scare compounded by partial lockdowns and a return to border closures will weigh a bit on confidence which may not be enough to stop the recovery but it could slow it. This along with the reality that we still have a long way to go to get to full employment and the continuing surge in the value of the $A will act as a dampener on the recovery will all likely see the RBA remain under pressure to maintain easy money. So, a rate hike remains several years away and the RBA is still likely to extend its QE program beyond April to match other central banks QE programs in order to help slow the rise in the $A.

What to watch over the next week?

In the US, expect a slight rise in core CPI inflation for December (Wednesday) to 1.7% year on year, a 0.2% gain in industrial production but a slight fall in December retail sales and a slight decline in New York region manufacturing conditions in January (all due Friday). Fed Chair Powell is expected to signal that the Fed remains ultra-dovish (Thursday) and data for small business optimism and job openings will also be released.

Chinese CPI inflation for December (Monday) is expected to move back to zero from -0.5%yoy, trade data (Thursday) is expected to show some slowing in export growth but a pick-up in import growth and credit growth is likely to remain solid.

In Australia, expect final November retail sales data (Monday) to confirm a 7% gain led by Victoria’s reopening, ABS job vacancies (Wednesday) to show a further rebound for the three months to November and housing finance commitments (Friday) to show a further 2% gain.

Outlook for investment markets

Shares are at risk of a short term correction after having run up so hard recently (with coronavirus and associated lockdowns being the main near term threat) and 2021 is likely to see a few rough patches along the way (much like we saw in 2010 after the recovery from the GFC). But looking through the inevitable short-term noise, the combination of improving global growth helped by more stimulus, vaccines and low interest rates augurs well for growth assets generally in 2021.

We are likely to see a continuing shift in performance away from investments that benefitted from the pandemic and lockdowns – like US shares, technology and health care stocks and bonds – to investments that will benefit from recovery – like resources, industrials, tourism stocks and financials.

Global shares are expected to return around 8% but expect a rotation away from growth heavy US shares to more cyclical markets in Europe, Japan and emerging countries.

Australian shares are also likely to be relative outperformers helped by better virus control, enabling a stronger recovery in the near term, stronger stimulus, sectors like resources, industrials and financials benefitting from the rebound in growth and as investors continue to drive a search for yield benefitting the share market as dividends are increased resulting in a 4.4% grossed up dividend yield. Expect the ASX 200 to end 2021 at a record high of around 7200.

Ultra-low yields and a capital loss from a 0.5-0.75% or so rise in yields are likely to result in negative returns from bonds.

Unlisted commercial property and infrastructure are ultimately likely to benefit from a resumption of the search for yield but the hit to space demand and hence rents from the virus will continue to weigh on near term returns.

Australian home prices are likely to rise another 5% or so this year being boosted by record low mortgage rates, government home buyer incentives, income support measures and bank payment holidays but the stop to immigration and weak rental markets will likely weigh on inner city areas and units in Melbourne and Sydney. Outer suburbs, houses, smaller cities and regional areas will see relatively stronger gains in 2021.

Cash and bank deposits are likely to provide very poor returns, given the ultra-low cash rate of just 0.1%.

Although the $A is vulnerable to bouts of uncertainty about coronavirus and China tensions and RBA bond buying will keep it lower than otherwise, a rising trend is still likely to around $US0.80 over the next 12 months helped by rising commodity prices and a cyclical decline in the US dollar.