Despite the headwinds they’ve been facing, Australian financial institutions, particularly the big 4 banks, have been a reliable source of income for investors for many years in the form of interest payments from term deposits and franked dividends from shares or hybrid securities. But there is an underappreciated bank issue that is garnering investor interest in the current market environment, subordinated debt.

Since APRA enforced new capital requirements in response to the fallout of the GFC, Tier 2 capital, also known as ‘subordinated debt’, forms part of the buffer that banks are required to have in order to absorb potential losses in the event of financial distress. This capital is used to protect depositors and policyholders, so that they can feel confident their money is safe. It also protects taxpayers from costly bail-outs.

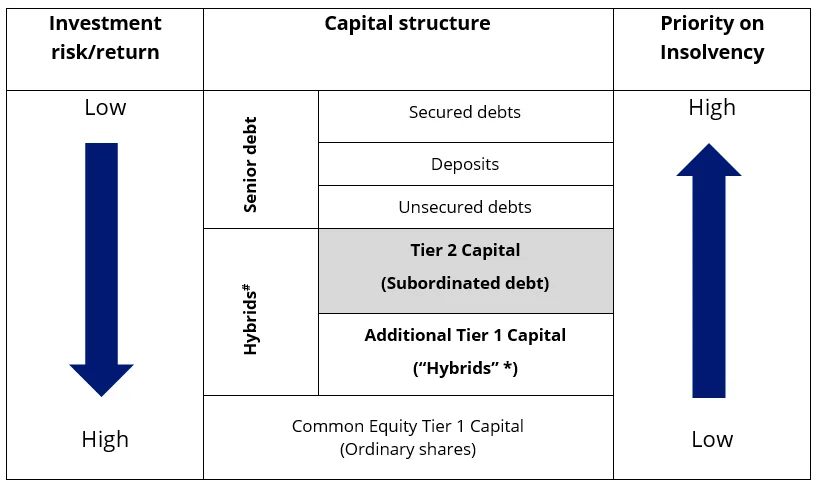

Subordinated debt has similar characteristics to traditional bonds, however in times of financial stress it can be converted to shares or may be written off completely. It is called ‘subordinated’ because it sits below ‘senior debt’ or traditional bonds in the capital structure, but it also sits above and takes priority over ordinary shares and hybrids, in the event of insolvency. See the shaded area in the chart below.

The following chart provides a simplified example of the capital structure in a financial institution to illustrate how different securities issued by financial institutions rank in priority of payment in the event of collapse.

Figure 1. Simplified capital structure of a financial institution

#Per ASIC Report 365. *Per market convention.

You can see from the above chart that in the event of bankruptcy, priority is given to deposits and other senior debt. Shareholders get paid last, if at all. Subordinated debt securities (also known as ‘subordinated bonds’) rank above ordinary shares and Additional Tier 1 Capital but below senior debt, including traditional bonds, deposits and unsecured debt obligations. For this reason, subordinated bonds carry more risk than deposits and traditional bonds but are considered less risky than shares and other hybrids.

Since subordinated debt ranks below traditional bonds and above hybrids, it is therefore considered more risky than traditional bonds and less risky than hybrids1. As a result, financial institutions typically offer subordinated bonds with a higher interest rate than traditional bonds, but a lower interest rate than hybrids.

What is interesting is that in the current environment, due to a number of factors, subordinated debt is offering yields comparable to bank shares and hybrids despite their higher position in the bank’s capital structure.

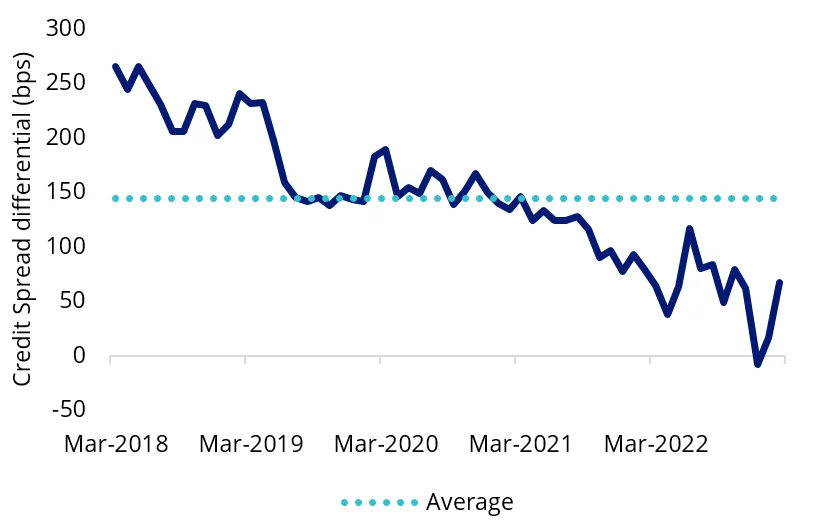

Subordinated bonds versus bank hybrids credit spreads

As noted above, you would expect the yield on subordinated debt to be lower than bank hybrids, because hybrids sit lower on the capital structure. However, the credit spread differential (the difference of the yields) between Australian subordinated bonds and bank hybrids, including franking, has been compressing since March 2018.

Australian bank hybrid credit spreads have continued to tighten, contrary to both Australian and global bond yield trends. Credit spreads on corporate and subordinated bonds have widened following concerns about rising inflation and interest rates impacting debt serviceability and heightened geopolitical tensions. This provides an opportunity for bond investors to earn a similar yield for subordinated bonds as bank hybrids, despite the differing credit risk.

Figure 2: Australian subordinated bonds versus bank hybrid credit spread differential

Source: IHS Markit, Bloomberg and VanEck; Subordinated bonds is the iBoxx AUD Investment Grade Subordinated Debt Mid Price Index; Aus Bank Hybrids Hybrids is an equally weighted basket of Westpac, ANZ, NAB, Macquarie and ANZ Additional Tier 1 Capital Securities live from March 2018. Past performance is not indicative of future performance. You cannot invest in an index.

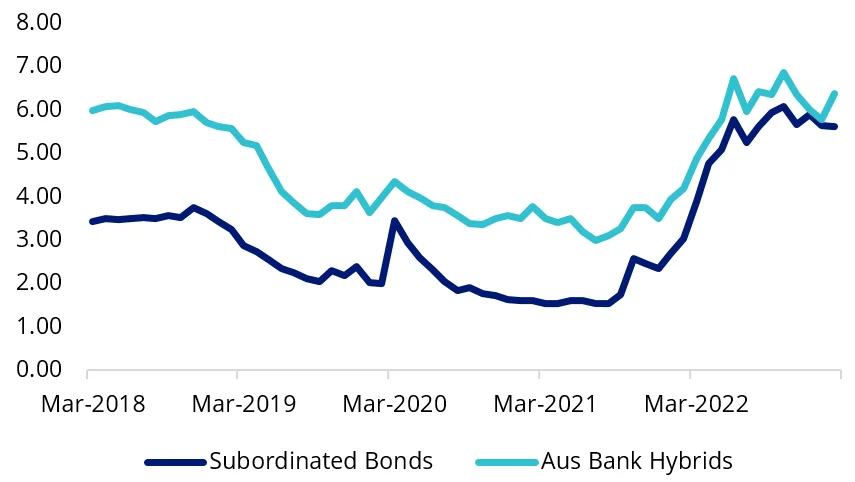

Figure 3: Yield to Worst comparison

Source: IHS Markit, Bloomberg and VanEck; Subordinated bonds is the iBoxx AUD Investment Grade Subordinated Debt Mid Price Index; Aus Bank Hybrids Hybrids is an equally weighted basket of Westpac, ANZ, NAB, Macquarie and ANZ Additional Tier 1 Capital Securities live from March 2018. Past performance is not indicative of future performance. You cannot invest in an index.

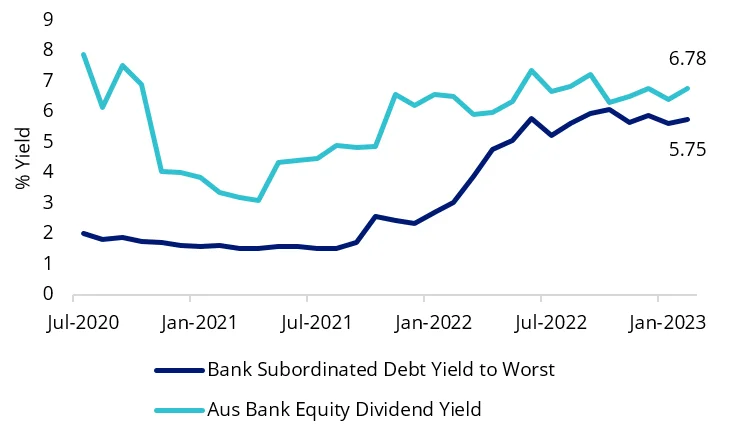

Australian Subordinated Debt versus Australia Bank Equity

The rising interest rate environment and corresponding increases in credit risk (the risk of losses from borrowers not repaying loan obligations) as a result of the uncertain economic outlook, has improved yields on corporate bonds including subordinated debt. Australian subordinated debt yields are now comparable with the 12 month trailing dividend yield (including franking) on Australian bank equity.

Figure 4: Yield comparison: Bank subordinated debt versus Australian bank equities

Source: Bloomberg, Bank Subordinated Debt as iBoxx AUD Investment Grade Subordinated Debt Mid Price Index, Aus Bank Equity as S&P/ASX 200 Banks Index. As at 16 February 2023. You cannot invest in an index.

For investors, subordinated bonds can serve two important roles in a portfolio:

- Increase return for a commensurate increase in risk – for investors with large holdings of traditional senior bonds, who are willing to take more credit risk, subordinated bonds issued by financial institutions can enhance income;

- Decrease risk – for investors with large holdings in hybrids or bank shares who are seeking to reduce their overall risk, subordinated bonds may perform a useful role. At the moment, for a variety of reasons, subordinated bonds are offering similar yields to bank shares and hybrids. While these similar yields will not always be the case, subordinated debt can potentially provide a reduction price volatility relative to shares and hybrids.

How to access the Australian subordinated debt market

VanEck Australian Subordinated Debt ETF (ASX: SUBD), the only one of its kind in Australia, giving investors access to a portfolio of investment grade subordinated debt via a single trade on ASX.

SUBD tracks iBoxx AUD Investment Grade Subordinated Debt Mid Price Index which is designed to reflect the performance of investment grade subordinated bonds denominated in AUD. The index only includes AUD denominated floating rate bonds issued by financial institutions that qualify as Tier 2 Capital under APRA’s2Rules (or equivalent foreign rules), and which hold an iBoxx credit rating of investment grade.

As always, we recommend you speak to a financial adviser to determine if an investment in subordinated bonds is right for you. Past performance is by no means indicative of future performance.

Key risks

An investment in the ETF carries risks associated with: subordinated debt, bond markets generally, interest rate movements, issuer default, credit ratings, fund operations, liquidity and tracking an index. See the PDS for details.

ENDNOTES

1Please note: Although the term “hybrid” is used by ASIC to refer to both Tier 2 Capital and Additional Tier 1 Capital, this term tends to be used in the market (by advisers and the media) to describe only Additional Tier 1 Capital securities or ‘capital notes’. In this document, the word “hybrid” refers to Additional Tier 1 Capital securities or capital notes and “subordinated bonds” or “bonds” refers to Tier 2 Capital or subordinated debt.

2A reference to APRA in this context includes any equivalent foreign prudential regulatory body.