By Jamie Hannah – Deputy Head of Investments & Capital Markets

All of the major news outlets are covering this cost of living crisis. It seems to have been caused by a number of factors, an almost ‘perfect storm’ of inflation:

- Insufficient workers to fill jobs, pushing wages higher;

- Lockdown issues in China impacting the manufacture (supply) of day to day goods;

- Supply chain issues around the world preventing the export and import of key components to complete many products;

- War in Ukraine; and

- Energy prices spiking globally.

I’d like to focus on the current energy price issue.

Australia produces a huge amount of natural gas and coal which is used to produce electricity. As a nation, we extract more natural gas and coal than we require locally and therefore sell our coal and gas to other countries generating income for the mining companies. The price at which these commodities are sold is dependent on global market factors which impact supply and demand. Therefore, if more people around the world want to buy coal and gas and there is a limited supply then the prices of these commodities will increase.

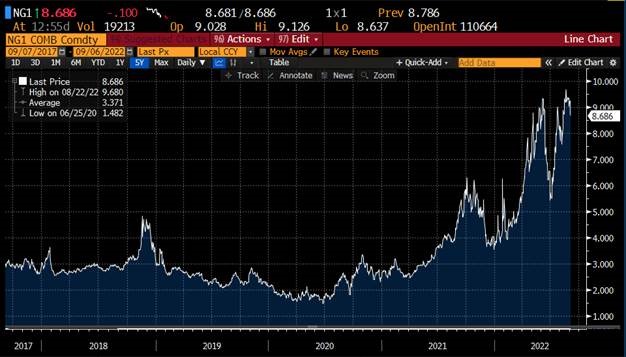

The price of coal and natural gas have skyrocketed this year.

COAL

NATURAL GAS

The response

There is a transition to renewable energy in Australia in the form of hydro, wind and solar.

These make up a growing portion of our electricity needs and at times during the day nearly half of our use is covered by renewables. But it doesn’t cover the majority of the day yet and renewables aren’t producing enough electricity at the moment to cover our overall use. Renewable energy will be the future but it will take years of investment and build time before we are producing enough. In this transition period we are still reliant on coal and natural gas electricity production.

What this means is that the price of coal and gas are inputs into the cost of producing our electricity. As the price of coal and natural gas have spiked substantially over a short period of time it is the unfortunate reality that the price of our electricity and gas will also spike.

The government does have various levers it can pull to minimise the impact, but using some of them risk fallout in terms of companies operations and our standing globally in a precarious geopolitical environment, so they may be reluctant to use them.

What is an investor to do?

In addition to assessing portfolios, many Australians are already assessing their energy suppliers using various comparison tools online.

During times of inflation, there are some companies that tend to do better than others. These tend to be assets backed by something physical, sometimes these are called ‘real’ assets. Examples include infrastructure, and gold and other commodities. The miners of these commodities also tend to do better.

Australian resources companies have performed relatively well so far in 2022. As the Australian market is dominated by resources, our own market has been resilient compared to many other major markets. Many of these companies recently posted results which were generally strong. That will come as no surprise, because a company previously selling something for $100, but is now getting $400 for it, will make more money, assuming input costs do not rise.

One way to access Australian resources is via an ETF. An ETF allows you to spread your risk across multiple companies via a single ASX trade rather than trying to pick one winner.

The VanEck Australian Resources ETF, which has the ASX ticker MVR has returned 18.66% over 12 months to 31 August 2022, whereas the broader Australian share market as represented by the S&P/ASX 200 Index has fallen 3.43%. But as always, past performance is not indicative of future results.

The new ‘energy crisis’ is not limited to Australia. It’s a global problem and every country is suffering from these sharp rises. Unfortunately, there does not appear to be any immediate short-term solutions, but there have been a number of energy crises during recent history. Some, like the 1970s oil crises (1973 & 1979) were resolved by a calming of geopolitical tensions and increases in alternate supplies, that may be a viable way out here. It remains to be seen.

Key risks

An investment in the ETF carries risks. These include risks associated with financial markets generally, individual company management, industry sectors, fund operations and tracking an index. See the PDS for details.