Recently, China has eased some domestic and international travel rules, boosting prospects for the nation’s gradual economic reopening. With vaccination levels now rising to 89 per cent of the population, and 56 per cent for a booster dose, there is an increasing expectation that China may exit its COVID zero strategy towards the end of this year.

The COVID eradication policy has weighed on China’s growth and consumption, and also created uncertainty for equity market investors.

The potential reopening of a country with 1.4 billion residents offers investment opportunities, particularly within Australian sectors that have high revenue exposure to China.

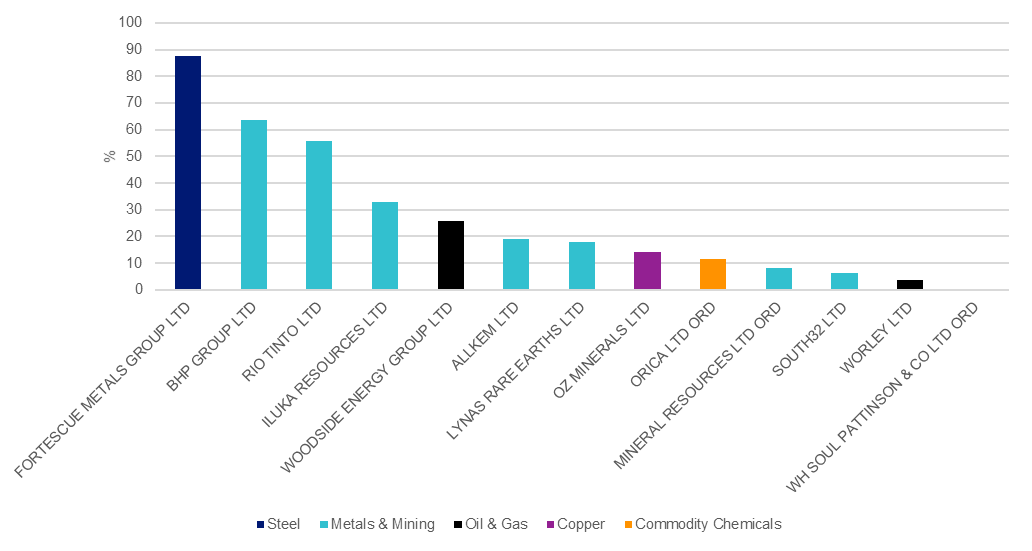

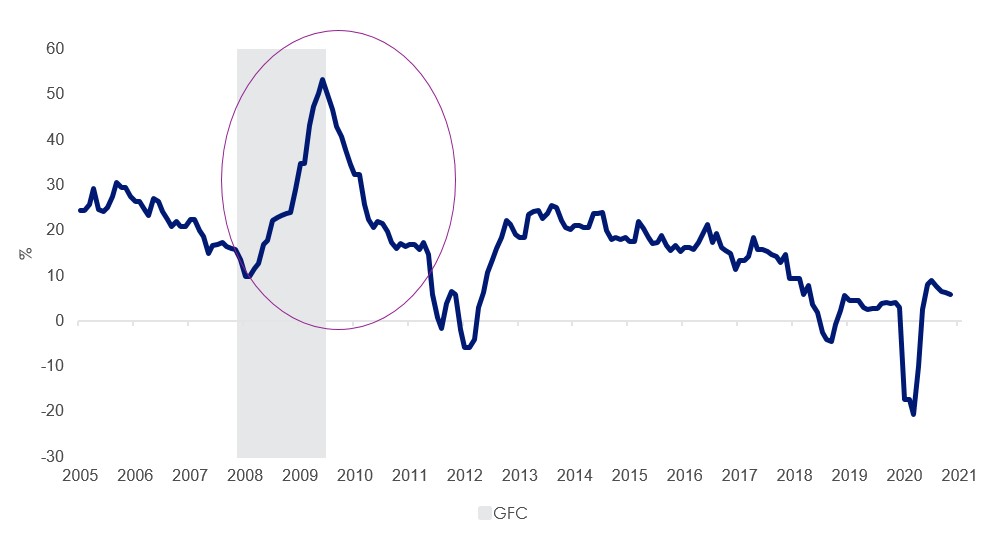

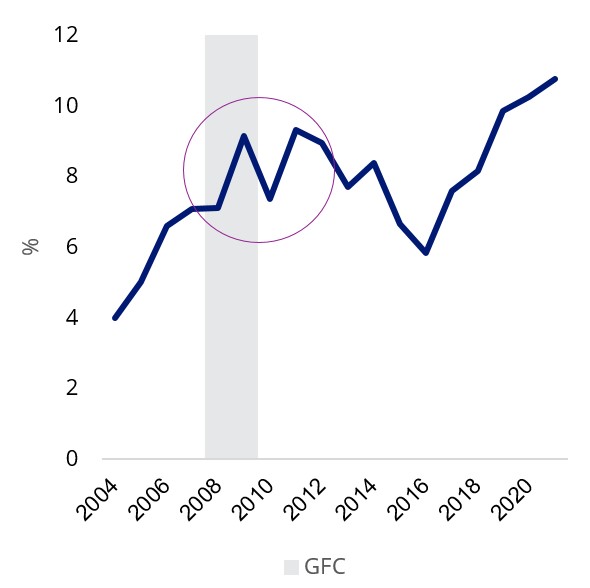

Chinese President Xi Jinping has cited infrastructure spending as the government’s main lever to rescue economic growth. The Australian resources sector could be a major beneficiary of this investment, as it was during the Global Financial Crisis (GFC).

At the end of 2009, China’s year on year infrastructure investment sky rocketed to 54 per cent, from 10 per the previous year. The spending, helped resurrect economic growth during the lows of the GFC. As a result, Australian commodity export prices soared, and mining as a percentage contribution of Australian GDP jumped, boosting Australian resource companies.

Figure 1 – China Infrastructure Investment YoY

Source: Bloomberg.

Figure 2 – RBA Commodity Export Price Index

Source: Bloomberg.

Figure 3 – Mining as a share of Australian GDP

Source: ABS

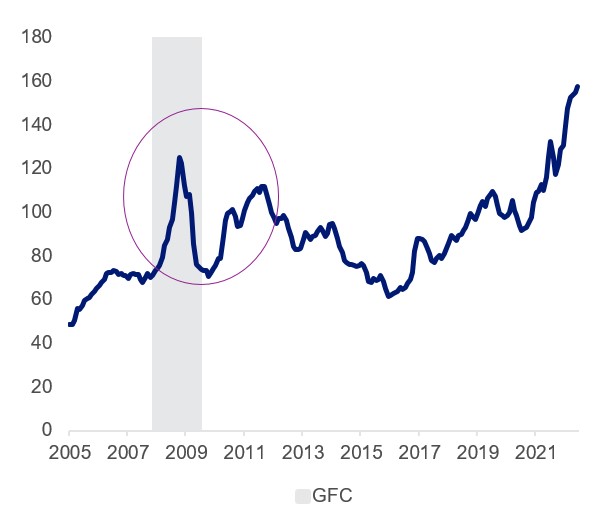

Despite geopolitical tensions, and Chinese sanctions on some major Australian exports, China remains reliant on Australian mining resources. 19 per cent of Australian mining revenue is attributed to China, based on the constituent weighting of MVIS Australia Resources Index.

Figure 4 – Australia resources revenue attributed to China

Source: Factset, As at 30 June 2022.

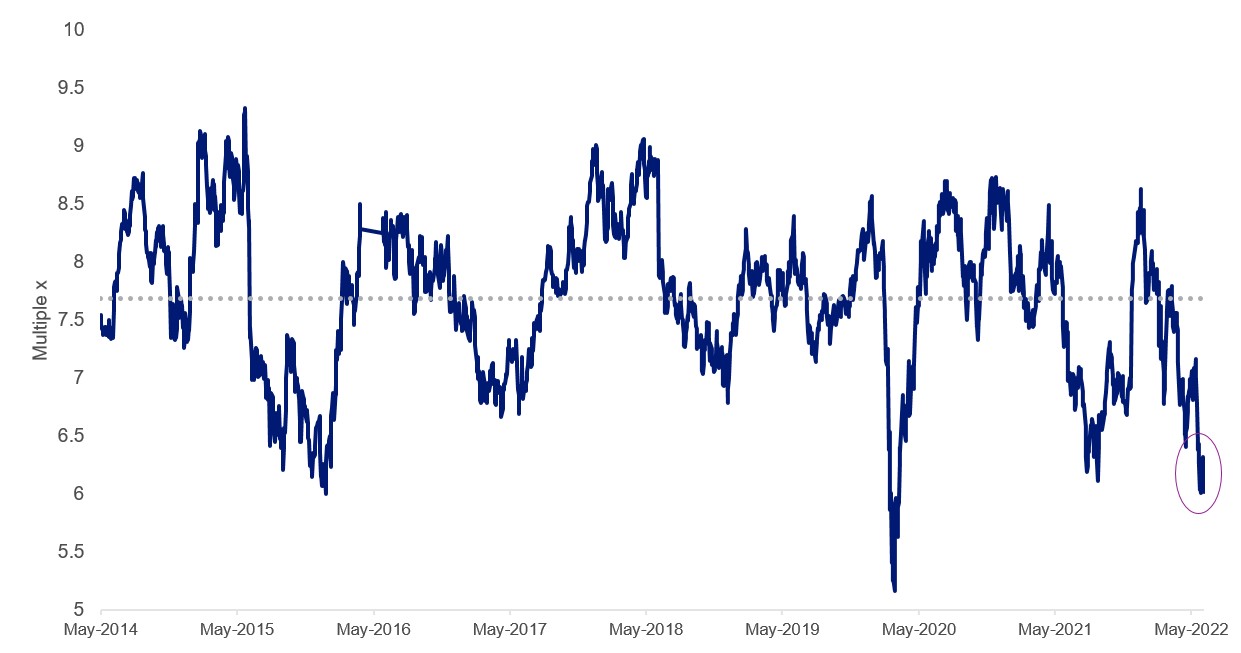

The recent downturn in global markets has also improved the valuation profile of Australian resources. Price to 12 month forward cash flow is at a 6 year low, excluding the COVID-19 downturn.

Figure 5 – Price to 12 month forward cash flow

Source: Bloomberg

Access to Australian resources

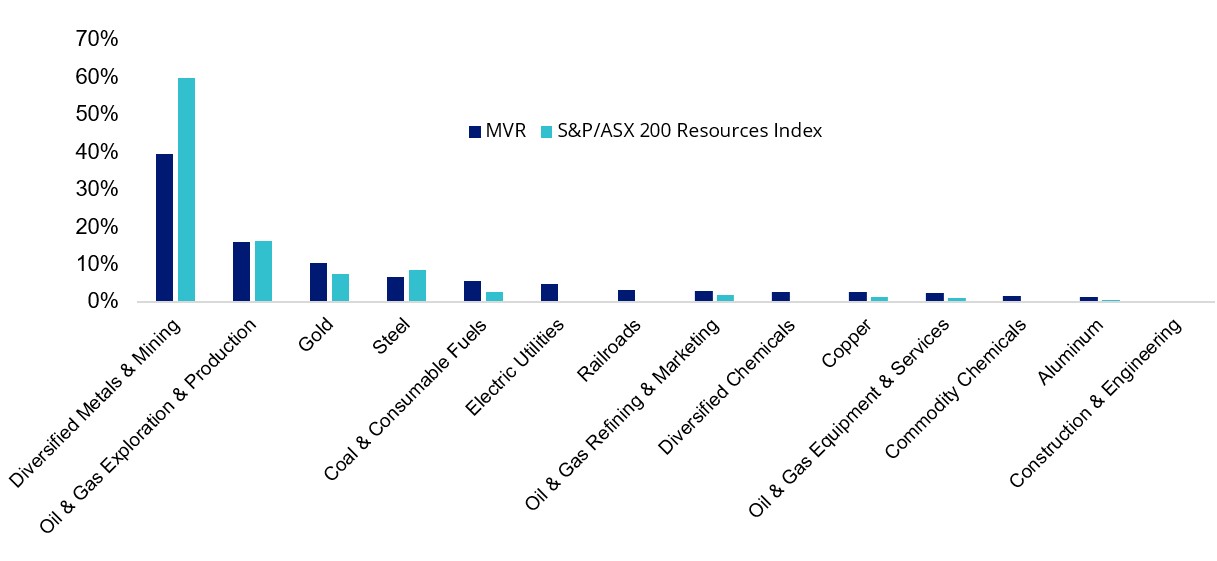

VanEck Australian Resources (ASX ticker: MVR) tracks MVIS Australia Resources Index offering investors broad exposure to the Australian resources sector. The ETF provides overweight exposure to oil, gold, coal, copper and aluminium relative to S&P/ASX 200 Resources index.

Figure 6 – GICs sub industry breakdown: MVR versus S&P/ASX 200 Resources

Source: FactSet; as at 30 June 2022

Key risks

All investments carry risk and an investment in MVR carries risks associated with financial markets generally, individual company management, industry sectors, stock and sector concentration, fund operations and tracking an index. See the PDS for details.