by Julian Howard – Lead Investment Director, Multi Asset Solutions

Review

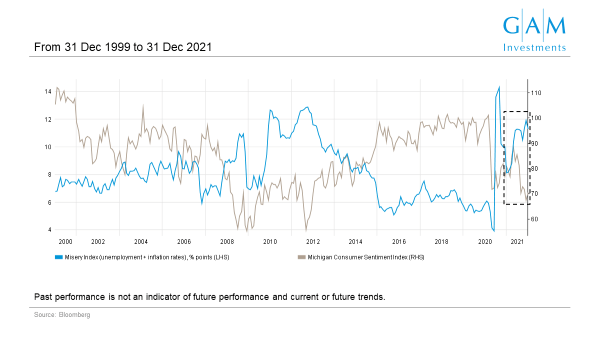

Global equities as measured by the MSCI AC World Index in local currency terms fell by over -3% in the first quarter of the year, bringing to an abrupt halt the progress seen in risk assets since spring 2020 when central banks responded so vigorously to Covid-19. Just as it was becoming apparent that the Omicron variant of the virus was no more serious than previous ones, Russia was amassing military forces on its border with Ukraine which was to culminate in outright invasion. Amid worldwide condemnation, and the threat of sanctions on Russian energy exports, wholesale oil and gas prices spiked. This exacerbated an inflation problem already driven by a combination of post-pandemic response labour market dislocation, structural semiconductor shortages and the continuation of zero-Covid lockdowns in China disrupting supply chains. Central banks, however, continued to see the inflation challenge through the prism of their own limited policy tools, deploying higher interest rates – which of course dampen demand – to deal with an almost exclusively supply-driven issue. Hence both the US Federal Reserve and the UK’s Bank of England tightened monetary policy even as consumers on both sides of the Atlantic were experiencing a precipitous drop in real terms living standards. This in turn raised the prospect of recession, with the US ‘Misery Index’ (the sum of the unemployment and inflation rates) already elevated even before the invasion of Ukraine. In Europe, the risk of recession was especially acute since any sanctions on Russian energy exports into the bloc will deprive highly dependent countries, such as Germany and Hungary, of a key energy source with no immediately obvious means of substitution. In terms of market price action, 10-year US Treasury bond yields spiked to around 2.5% during the review period despite falling growth prospects as investors rushed to price in ever-higher long-term inflation expectations. Shorter-dated bond yields also followed the pattern, creating a structural shift upwards in interest rates across all maturities. This inevitably forced a re-pricing of assets during the quarter, with equities dropping accordingly as their future cashflows lost some of their present value. However, it should be noted that from mid-March there were signs of stabilisation in risk assets as investors reconciled themselves to the apparent certainty of a higher rate environment, at least for the time being.

Chart 1: Misery index elevated, portends a US recession

Positioning

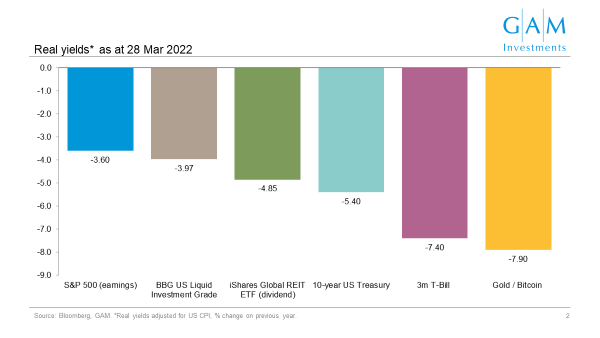

Given the extent of the onslaught described, many investors could be forgiven for rapid rotations in an effort to protect capital. But adjusted for inflation, the real yields on offer – whether from corporate earnings, real estate rents or debt coupons – still favour equities. A cursory assessment reveals that equities’ real earnings yields remain superior to most asset classes bearing an income and of course those speculative ones which do not. Within equities, we continued to favour the growth style, ie firms and indices such as technology which have strong growth and profitability prospects rather than those value stocks which rely on the wider economy to grow. We continue to believe that at some point beyond 2022 a low growth world awaits and that this will place a premium on areas such as technology which can generate independent and resilient revenue streams. Away from equities in capital preservation, we favoured a combination of ‘alt-bonds’ such as mortgage-backed securities and insurance-linked securities (cat bonds). Selected credit and government bond allocations performed less consistently as economic prospects dimmed and long-term rate expectations grew. In alternatives, we are focused on a split between merger arbitrage and convertible arbitrage strategies. Protecting capital in the short- to medium-term against inflation remains challenging but it is worth considering the historical evidence which reveals that one of the best ways to generate real returns is through long-term equity investment, particularly in sectors which can exert pricing power such as consumer discretionary and technology.

Chart 2: All too easy to sell out of equities, but they offer one of the best real yields today

Outlook

A future world of low growth, inflation and low interest rates remains relatively certain in our view given worsening inequality as described recently in the Piketty Lab World Inequality Report, deteriorating demographics as cited by the Organisation for Economic Co-operation and Development (OECD), and the enormous economic impact of climate change explored in detail by the Swiss Re Institute. In addition, the growth impetus of globalisation and associated world trade looks set to recede in the coming years as nation-states and supra-national organisations aspire to become less dependent on each other, particularly where energy is concerned. What is far less certain is at what point the inflationary outcomes of the Covid-19 response and war in Ukraine give way to this longer-term scenario of secular stagnation. One observation worth making on this is that the inflation spike we are seeing today is eminently solvable. Labour markets are normalising in the US, UK and much of Europe as governments belatedly switch to a policy of co-existence with Covid-19. Semiconductor capacity is likely to rise amid a slew of recent announcements of capacity increases by the major manufacturers. In China, the latest Covid-19 outbreaks are seeing more use by the authorities of manufacturing zone bubbling and Pfizer-supplied treatments (though not vaccines) which together should be less disruptive to output. As for high energy prices, the war in Ukraine may well keep up the pressure here though it should be noted that US shale output continues to steadily rise, fuel taxes are being re-examined per the UK reduction of fuel duty and strategic reserves remain an option to be tapped further. While zero carbon emissions remain a worthy long-term goal, few are seriously advocating for a brutal energy-price induced economic depression as a means of getting there, not least governments answerable to electorates facing a cost of living crisis not seen since the 1970s. This suggests that some mitigation will be forthcoming, even before the self-corrective force of consumers simply choosing to use less energy both to keep their costs down and as spring arrives anyway in the northern hemisphere. In the meantime, it makes little sense to radically rotate strategic portfolios for a state of play that may well prove less than permanent. Some adjustments to ‘smooth the ride’ have been described, but we remain overwhelmingly invested for the low growth world that in our view is now all but inevitable.