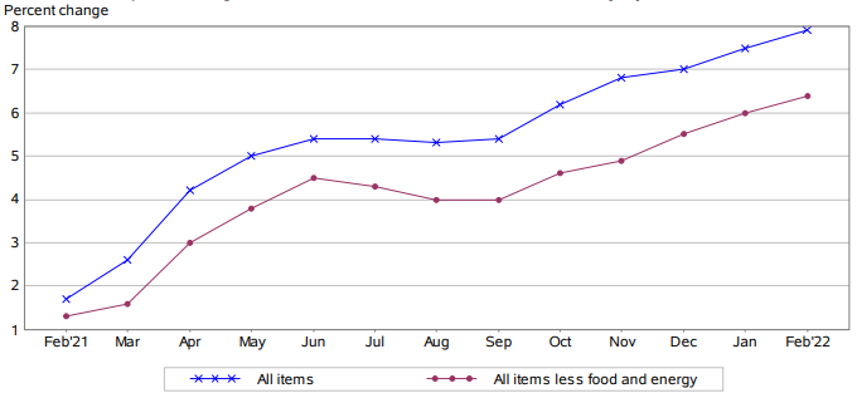

As economists continue to argue as to whether inflation is transitory or permanent, political parties know full well that inflation is disastrous at the ballot box. The US midterms will be held in November and polling doesn’t look good for the Biden administration. While the 2024 full term election is still a while away, inflation is rising. Gasoline price increases are toxic to the US voter and the prices at the pump are already at record levels, recently surpassing the 2008 spike. CPI is almost certainly going to be north of 8-9% year on year over the next few months, which is going to light a fire under the Fed.

Source: U.S. Department of Labor

Inflation is taking off, but the outlook for the global economy remains uncertain. China has just announced a GDP growth target of 5.5% this year, the lowest in more than 30 years. Russian credit has just been downgraded to junk, while global sanctions are already creating material market distortions.

Meanwhile, the effects of higher oil prices are rippling across the economy. We believe those prices are here to stay, due largely to geopolitical events and ESG trends.

Russia is the world’s largest net exporter of oil and gas combined. According to Goldman Sachs, Russia supplies 11% of global oil consumption and 17% of global natural gas consumption (and as much as 40% of Western European consumption). However, the US has banned the import of Russian oil and gas, the UK is phasing out oil imports by the end of 2022, and the EU announced plans to cut imports of Russian gas by two thirds within a year.

The world needs to replace this supply, but OPEC has already announced that it has no plans to increase production in response to the Russia/Ukraine war. US trade envoys have been dispatched to Venezuela, with suggestions that a Saudi Arabian trip is in the planning. Of course, the US has the potential to bridge some of the shortfall by ramping up its own unconventional production; however, that appears unlikely given the US administration was elected on a clean energy platform.

Energy supply was already under pressure from ESG trends. In 2020, BP announced a plan to cut oil and gas production by 40% over 10 years and pivot towards renewables. Last year, Shell announced that its oil production had peaked and would fall 1-2% per annum as it targeted net zero emissions by 2050. This supply shortfall is occurring just as energy demand is returning after the COVID-induced lockdowns of the past two years. There is no easy solution. We do not believe there will be a quick end to the Russia/Ukraine conflict, meaning energy and commodities prices will remain elevated. The resources and energy sectors should generate attractive returns in 2022, with Australia in the box seat to outperform the rest of the world given its stable, resource rich environment.

It’s also worthwhile watching the credit and debt markets, which are so deep and more liquid that equity markets (and often equity investors) overlook the signals these markets provide. The 2yr/10yr year US yield curve is flattening, with credit markets signalling that investors are losing confidence in the economy’s growth outlook. Often it can be difficult to predict the trigger for an economic downturn, but in this case it could be the Fed raising the federal funds rate itself that causes a downturn.

The next Fed is meeting is scheduled for 15-16 March (US time), and commentary provided at the conclusion of the meeting will be critical in setting the stage for equity markets going forward. If the Fed signals a more gradual path of rate rises than the seven 25bp rate rises expected by the market over the next 12 months, it may be enough to see markets stabilise and some of the oversold and heavily shorted sectors stage a bounce. Until then, markets will remain turbulent.

We think Powell has two choices. Firstly, he could do what he has signed up to do and fight inflation by raising rates at a pace and magnitude sufficient to tame inflation. This would certainly put the brakes on inflation, but would risk tipping the global economy into recession and we think the market could quickly revisit its lows.

Alternatively, he could signal a more dovish approach to monetary tightening by slowing the pace of rate hikes. In our opinion, this would likely see a broad market rally, led by the high PE growth names, including technology and loss-making stocks which have suffered such a large selloff in recent months.

Our belief is that he will choose the latter. All eyes on the Fed meeting next week.