Geopolitical turmoil and demand from China are tailwinds for Australian resource companies.

Geopolitical turmoil

Russia invading Ukraine and subsequent western sanctions placed on Russia have contributed to a range of global commodity prices skyrocketing over the past few weeks. Global oil prices surpassed US $125 a barrel for the first time since 2008 with the US considering placing an import trade embargo on Russian Oil. Natural gas prices also hit an all-time high with fears Russian supply routes to Europe will be cut off. Gold price per ounce nudged US $2000 as investors sought the safe haven metal.

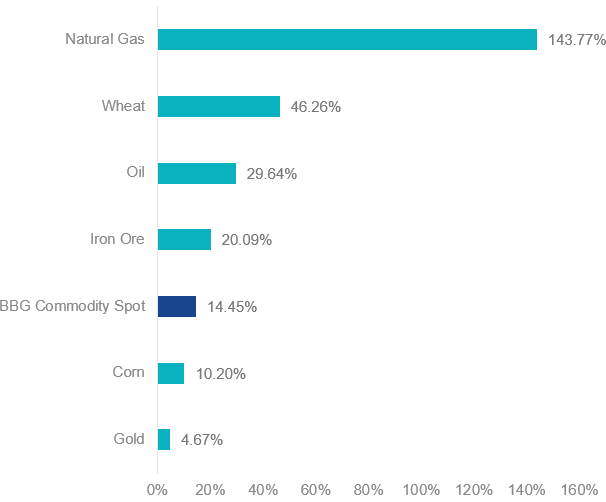

Global commodity price movements since Russia invasion (24 February to 7 March)

Source: Bloomberg. Past performance is not a reliable indicator of future performance.

With no signs of the geopolitical tensions abating soon, commodity prices are expected to remain elevated with Australian resource companies well positioned to benefit from the global supply squeeze.

China iron ore demand

Iron ore prices have also surged, buoyed by growing hopes of improved demand in China after reports of possible easing of covid-19 curbs, bolstering economic activity. Chinese officials this week announced a GDP growth target of 5.5% for 2022, while down from 2021, expectations for more monetary and fiscal measures has increased. Iron ore is Australia’s largest resource export and China is the largest importer.

Iron Ore Spot Price Index 62% Import Fine Ore CFR Qingdao

Source: Bloomberg. Past performance is not a reliable indicator of future performance.

Valuations

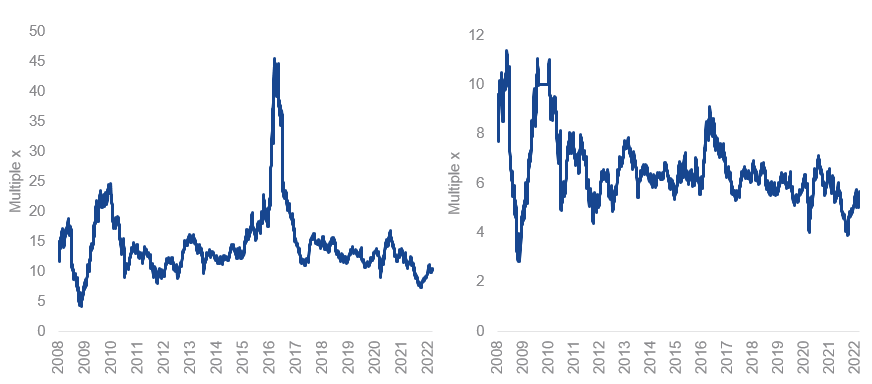

Australian resources are trading at appealing valuations relative to historic levels. S&P/ASX 300 metals & mining index is trading at 10.3x 12m forward earnings.

Metals & mining price to 12m forward earnings (PE) / enterprise value to 12m forward earnings (PE)

Source: Bloomberg, S&P/ASX 300 metals & mining index.

Access to Australian resources

One way to access the resources sector is via an ETF. However most ETFs are dominated by one or two big diversified miners, which is why ‘capping’ may provide a better diversified exposure to the sector. The MVIS Australia Resources Index caps stocks at 8%.

VanEck Australian Resources ETF (MVR) tracks the MVIS Australia Resources Index and is a simple way to gain a diversified exposure to the Australian resources sector.