To date electric vehicle (EV) market share is only ~1% and to achieve a larger global rollout in our life times, costs need to come down fast. Tesla plans to lift battery output from 100Gwh/year in 2022 to 3,000Gwh (3Twh) by 2030. It seems this ambitious target will be achieved through a combination of superior design, manufacturing and supply chain management.

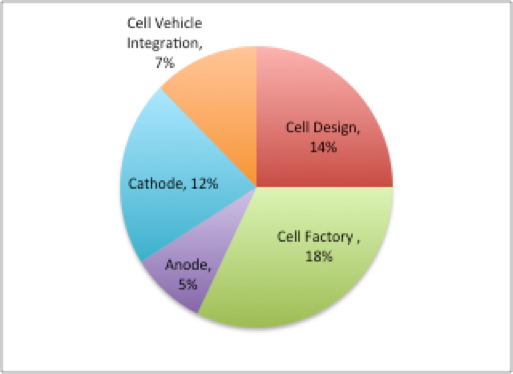

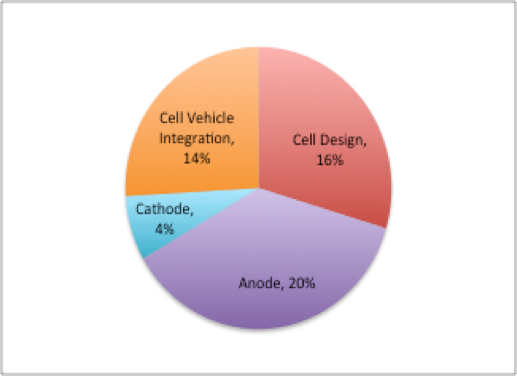

Get this right and Tesla believes the cost/Kwh can come down by 56% at the battery pack level. To back this up, they will produce a US$25,000 fully autonomous EV within 3-years. This will be achieved through better cell design, improved anode and cathode materials and faster cell factory installation.

It seems the new rollout will make this EV cheaper than a new Internal Combustion Engine (ICE) at a cost of~US$100/Kwh, however no costs were provided to enable a direct comparison. Tesla did suggest that in the long-term the ICE would become “a collectors item”.

On the supply chain front, Tesla is looking to contract with projects using clean technology, as it believes lowering the EV and their own carbon footprint is paramount. Tesla also plans to develop the first lithium mine in the US using a newer and greener but unproven lithium extraction technology and to slowly expand the recycling of its returned batteries. The dream is that decades down the line, when EV’s are the norm, recycling will replace the need for mining…as EV batteries will be built, used and then recycled for use again.

To excite all the rev-heads socially distancing in their Tesla’s during the presentation, Musk revealed a new luxury tri motor, all wheel drive model S Plaid. It has a charge range of 520+ miles, can do 0-60mph (100km/hour equivalent) in less than 2-seconds and has a top speed of 200mph with an equally cool price tag of US$134,490. This EV will be the fastest car to 60mph on the planet and orders are being taken with a delivery date, end 2021.

Generally speaking, the presentation was long on future targets but short on specifics and a road map on how these targets might be achieved. However, what was clear is that Tesla, under Musk’s stewardship, is committed to “save the planet”.

Figure – 1 Breakdown of COST Decreases (56%)

Figure – 2 Breakdown of RANGE Increase of (54%)

Source: Tesla Battery Day

Battery Day Presentation highlights include;

Cell Factory – expect battery cell costs to drop by half

• Planning on becoming the largest in-house manufacturer of battery cells. Musk said “Tesla will absolutely be head and shoulders above any one else in manufacturing, that is our goal”

• A future Terafactory (Twh) sized EV plant would have a footprint equivalent to a 150Gwh sized plant today. This smaller footprint/Gwh contributes to a dramatic 69% reduction in investment cost/Gwh

• Tesla plans to lift output of own cells from 100Gwh/year in 2022 to 3,000Gwh (or 3Twh) by 2030…maybe earlier teases Musk

• The challenge will be scaling, as difficulties arise when “building the machine that builds the machine, “referring to the assembly line bots

• Tesla is currently ramping up a 10Gwh battery cell pilot plant at their Fremont factory in New York…ramp up could take a year. This will be a first for the USA.

Comment

Tesla realised the way to quicken the uptake of EV’s, whilst reducing the carbon footprint, and cost to the consumer – is to manufacture battery cells in-house. Tesla will continue to use Panasonic, CATL and LG Chem for battery cell supply but believe they, in combination, will not be able to meet Tesla’s battery demand forecasts.

Cell Design & Vehicle Integration – a breakthrough

Two breakthroughs were announced and include;

1. Battery cells will be integrated into the car. This will provide battery structure by making them part of the drivetrain. This will lead to many fewer parts and a simplified manufacturing process, and

2. A 10% reduction in the mass of the battery would allow for larger battery cells, which would increase energy density. Tesla also envisages a 14% reduction in US$/Kwh and a 16% increase in range, as the batteries power to weight ratio will be greater.

The larger battery cell will be known as a 4680 cell (46mm wide & 80mm long) rather than 2170 presently used. Also, the copper and aluminum tabs at the end of the battery cell will be removed, allowing for a continuous manufacturing motion along the assembly line. This will speed up manufacturing and reduce cost significantly.

A 10Gwh Pilot Plant is underway at its Fremont plant. Musk suggests they need to iron out some kinks, as manufacturing yield is low at the moment. No further details were provided.

The Anode – raw silicon makes a surprise appearance

• Tesla announced they are moving to a silicon rich anode. They plan to stabilise the silicon using an elastic ion conducting polymer coating. Why? Because it has a better ESG score and can store 10x more lithium than graphite. It also yields a 20-40% increase in energy density and a 20% increase in range to give a 5%/kwh cost reduction at the battery pack level

• Rather surprisingly, they also plan to use raw metallurgical grade silicon rather than the processed silicon commonly discussed by participants, as it is simpler and thus cheaper. Tesla believes incorporating raw silicon into its battery anodes could reduce cost to a low $US1.20/kwh compared to nano-engineered silica coated graphite at US$10.2kwh.

Comment

A silicon anode was a surprise as Professor Shirley Meng, a respected materials scientist from San Diego University, recently suggested graphite batteries would be around for some time.

Once again, no timelines or material details were provided. At this stage, we are unsure of graphite’s future in Tesla’s cathodes. Will silicon total 20% or so or will it totally replace graphite as an anode material? It certainly was unclear.

Samsung and Panasonic presently use silica oxide coated graphite on their anodes and no suggested changes have been announced.

The Cathode – Nickel rich with no cobalt

• Tesla will build a cathode plant in North America to secure the cathode supply chain

• Will use a nickel rich cathode, which is lighter and cheaper

• Plan to eliminate cobalt usage. Cobalt is expensive and is used to stabilize nickel. Instead, will use other new coatings to stabilize the nickel but no details were given

• Due to concern around nickel supply a three-tiered approach to battery chemistry was proposed;

1. Inexpensive lithium iron phosphate cathodes for short-range.

2. Nickel/manganese cathodes for medium-range, and

3. High nickel rich cathodes for longer-range vehicles like the Cybertruck and semi

Comment

No volumes, cost or time lines were given for the construction and completion of the cathode plant in North America. In addition the location of the plant has yet to be decided. This plant still seems a few years away but the intent is clear…lithium ion batteries are part of the future and Tesla intends to control the supply chain.

Tesla recently signed a 6,000t/year cobalt offtake deal with Glencore. The cobalt’s source is the Democratic Republic of Congo (DRC). No timeline was given for when cobalt free batteries can be expected. However, given the contract it is likely cobalt usage will feature for some time.

Battery Materials – controlling the supply chain

Getting into Lithium mining

• Tesla recently bought mining rights to 10,000acre lithium clay deposit in Nevada. Tesla plans to extract lithium from the clays using sodium chloride (table salt). No details were provided on how this acid-free and ESG friendly extraction process might work with the clays. Do they the separate the lithium from the chloride or are they looking to use lithium chloride directly in future batteries? Not clear

• As battery cells are presently imported into the US, before being inserted into a battery pack, a US based lithium conversion factory and mine would reduce total miles travelled for cathode materials by a significant 80%. Not only would this directly reduce the EV carbon footprint it would, according to Tesla, reduce lithium costs by 33%

• With improved ESG in mind, Tesla plans to return the overburden, residue clays and precipitate to the ground

• Tesla considers that the resource when developed could electrify the entire US vehicle fleet.

Comment

The US has no operating lithium mine at the moment. It appears the Nevada lithium clay project could contain an extensive potential in-ground resource. The method of using sodium chloride to extract lithium from the clays has not been used before. Clays are notoriously difficult to deal with given high interstitial pressures and permeability to water. However, no details on resource size, costs, volumes or timeframes were provided. As resource delineation is required ahead of a pilot plant, we envisage it will be a few years before development of the resource is likely to proceed.

Nickel mining – talking to suppliers about large volumes

No sign yet of getting directly involved in nickel mining. Rather, Tesla wants industry to step up to meet market demand for nickel. With prices low at this time this will be difficult to achieve. However, as announced prior Tesla is prepared to enter into large contracts to underwrite resource developments. Benchmark Minerals Intelligence forecasts a market shortfall for nickel around 2026.

Small caps – a clean tech approach needed in battery materials space

Perhaps the Aussies will need to focus on Europe, as the US seems to want to go the EV route alone. We imagine debate will pick up around Australia’s ability to capture and produce greener cells and battery packs for domestic usage and export to Europe in particular as needed.

Interesting small cap clean tech stocks remain Novonix (NVX), Neometals (NMT), Lithium Australia, (LIT) Pure Minerals (PM1), CleanTeq (CLQ), Lakes Resources (LKE), Magnis Technologies (MNS) and EcoGraf (EGR).

Lots to digest for sure!