PointsBet Holdings Limited (PBH.AX) is undertaking a $353m capital raising, post announcing a media services agreement with NBCUniversal (NBCU). NBCU is the largest broadcaster of sports in the US, with reach of 184m viewers, and 60m monthly active users on its digital assets. NBCU has reach into 81% of the US sports betting market, and a strong portfolio of rights agreements with major US and international sporting codes.

The Deal

PBH’s US sports book turnover in FY20 was A$321m and earned net revenues of A$7m. PBH claims a 6.25% share in New Jersey, is now also operating in Iowa, and Indiana, and will open in more states as legislation allows.

NBCU will provide marketing for PBH on its media platforms to the value of US$393m over a 5-year period. PBH will partly fund the marketing by issuing equity to NBCU. Subject to shareholder approval, NBCU will be issued shares priced at $6.50 each to the total of 4.9% of issued capital, and 66.88m options, expiring in 5 years with a strike of $13.00. The options are valued at A$105.3m. The residual value of the agreement will be funded by PBH’s cash reserves, which have been boosted by the capital raising. NBCU will also be paid incentives for customer referrals to PBH.

The NBCU deal will help to drive customer acquisition in the US states where sports betting is legal. Several other larger bookmakers have already struck alliances with broadcasters. Flutter (FLTR.UK), who operates sportsbooks in the US under the Fanduel banner (and as Sportsbet in Australia) has allied with Fox Sports, and William Hill (WMH.UK) has partnered with CBS Sports.

The US Sports Betting Market

In a survey of US consumers in 2019, 15% of American adults (38.1m) said they would bet on the NFL that season. Historically, a significant portion of this betting would have been on illegal betting sites. The American Gaming Association has estimated that the illegal market on sports betting was as large as US$150bn in 2017. Until 2018, the only legal sports betting option for US residents was in the state of Nevada. In 2017, Nevada bookmakers earned revenues of US$248m on sports.

The US approach to gambling regulation is akin to Australia, in that the states have the right to legalise gambling (under the Tenth Amendment). However, historically, Federal Legislation prohibited most forms of gambling on sports, and most major sporting codes were also in favour of the prohibition, with concerns around integrity should betting be made legal. The practical reality however was that betting was occurring, but in an unregulated way on offshore websites. Over time, many challenges had been mounted against the various laws, but some argue that the advent of the Trump administration allowed for a more progressive stance on sports betting. In a case determined in 2018, the US Supreme Court held that the principal prohibiting legislation, the Professional and Amateur Sports Protection Act, was unconstitutional as it was contrary to the Tenth Amendment and states’ right to regulate gambling. This freed states to pass legislation allowing sports betting. By August 2020, 18 US states, with a combined population of 100 million residents permitted legal online sports betting. Importantly for these states, over the 12 months to end December 2019, tax revenues on sports betting totalled UDS$225m. The economic incentive to legalise sports betting is even more compelling post-pandemic.

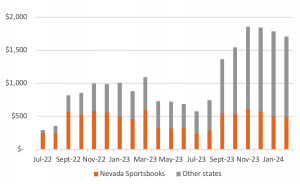

Figure 1: Growth in US Sports betting since July 2018 (Handle, in US$M)

Source: https://sportshandle.com/sports-betting/

Table 1: US Sports betting since May 2018 (to June 2020)

| Pop (M) | Month Commenced | Handle (US$M) | Revenue (US$M0 | State Taxes (US$M) | |

| Arkansas | 3.0 | Jul-19 | $ – | $ – | $ – |

| Colorado | 5.8 | Mar-20 | $123 | $11 | $1 |

| Delaware | 1.0 | Jun-18 | $270 | $37 | $24 |

| DC | 0.7 | May-20 | $1 | $0 | $0 |

| Illinois | 12.7 | Mar-20 | $ – | $ – | $ – |

| Indiana | 6.7 | Sep-19 | $1,033 | $85 | $8 |

| Iowa | 3.2 | Aug-19 | $391 | $28 | $2 |

| Michigan | 10.0 | Mar-20 | $ – | $0 | $0 |

| Mississippi | 3.0 | Aug-18 | $626 | $68 | $8 |

| Nevada | 3.1 | Pre-existing | $9,773 | $591 | $40 |

| New Hampshire | 1.4 | Dec-19 | $79 | $7 | $3 |

| New Jersey | 8.9 | Jun-18 | $7,700 | $532 | $70 |

| New Mexico | 2.1 | Tribal -data not available | $ – | $ – | $ – |

| New York | 19.5 | Jul 2019 (no online) | $ – | $10 | $1 |

| Oregon | 4.2 | Not incl Tribal operations | $116 | $9 | $ – |

| Pennsylvania | 12.8 | Nov-18 | $2,695 | $197 | $52 |

| Rhode Island | 1.1 | Nov-18 | $335 | $26 | $13 |

| West Virginia | 1.8 | Sep-18 | $401 | $33 | $3 |

| Total | 100.7 | $23,543 | $1,634 | $225 |

Source: https://sportshandle.com/sports-betting/

We caution that at present, not every state offers viable commercial opportunities, due to high taxes (e.g. Pennsylvania sportsbook tax rate is 36%, compared to 8.5% in New Jersey), high licence fees, and restrictions on online operations. For example, while sports betting in New York is now legal, it is only permitted at the state’s casinos and racetracks, with the state’s Governor opposed to the legalisation of mobile betting. In most states, bookmakers must partner with existing licensed casino operators, racetracks and/or tribal groups, and licenses only permit betting in-state. Thus, unlike the Australian sports betting market, it is important to seek licenses on a state-by-state basis.

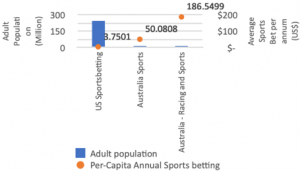

In 2019, the per-capita average annual spend on sports betting in the US was a mere US$4, whereas the per-capita average annual spend on sports betting in Australia was US$50. The lower US market size is not likely due to less enthusiasm, but to less opportunity.

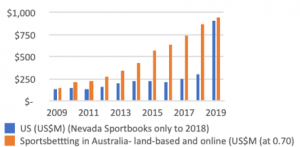

Figure 2: Total Sports betting Revenues in US and Australia (in US$M (A$/US$=$0.70))

Figure 3: Average Sports Bet per person in US and Australia, (A$/US$ = 0.70)

Source: Various Regulatory Agencies, US Census, ABS

In our view, based on Australia’s sports betting market size, the US market could conservatively grow to US$12Bn (from US$0.9Bn in the twelve months to end December 2019). PBH’s own FY20 results presentation indicates estimates of US$30Bn market size at maturity.

This analysis only considers the sports opportunity. PBH has established a partnership with Hawthorn Racecourse in Chicago. The US Racing industry should also benefit from deals with bookmakers as they gain licenses in key states. Some US states Race tracks historically had carve-outs from the ban on digital betting, but despite this, the US Racing market remains smaller than Australia’s, with US 2018 turnover US$11Bn, compared to Australia at A$25Bn (US$18Bn, at A$/US$ = $0.70). As well as sports betting, the Australian Racing betting market grew significantly once corporate bookmakers were permitted to offer online betting.

Combined spending by Australians on Race and sports betting is US$187 per person. At the combined Australian per-capita spend on racing and sports, the total sports and race betting market size in the US could be US$44Bn.

The increased availability of legal sports betting presented by the digital opportunity and the reach of the NBCU platform presents a significant opportunity for PBH to become a major player in this meaningful new market.