The December 31 half and full-year earnings season is over for the ASX 200 – ahead are the January 31 balancing companies like TPG, Soul Patts, New Hope, Premier Investments and Kathmandu.

Their results will not make much of a difference to the season with the bottom line the weakest season for higher profits in more than a decade, while more companies than expected cut dividends.

And very quickly the current June quarter is starting to look weaker than thought with the first of two surveys of Chinese manufacturing activity last month revealing a record plunge in activity from January’s reading of 50 to 35.7. That equates to a deep recession.

The AMP’s chief economist, Dr. Shane Oliver says that “while better than feared it was a bit mixed and the share market reaction in the last week was overwhelmed by global coronavirus concerns.

“The good news was that more companies saw profits rise than fall, dividends are strong, guidance was generally good and consensus expectations remain for modest profit growth this year.”

But that didn’t tell the whole story and the detail had a different, weaker slant.

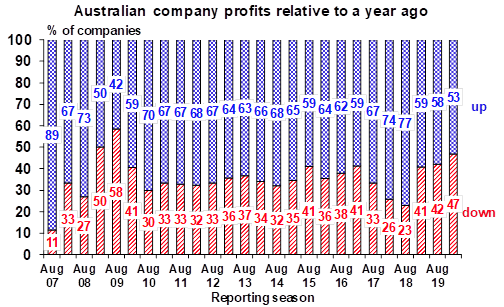

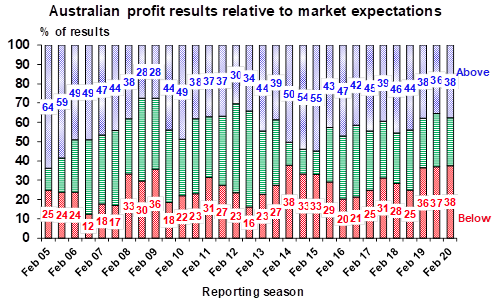

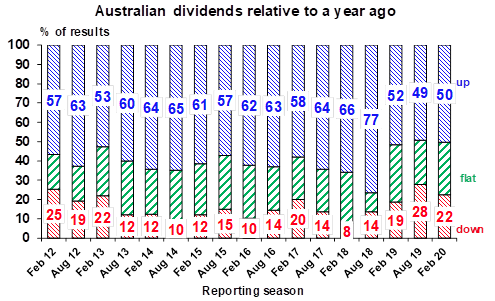

Dr Oliver says that against this though only 53% of companies saw profits rise which is the lowest since 2009 (see the first chart), the proportion of companies surprising on the upside was only 38% which is lower than the norm of 44% (second chart) and only 50% of companies raised dividends which is below the long-term norm of 62% (third chart).

And several companies issued profit downgrades related to the impact of coronavirus (Qantas, Virgin, Air New Zealand and Harvey Norman, to name some recent reporters).

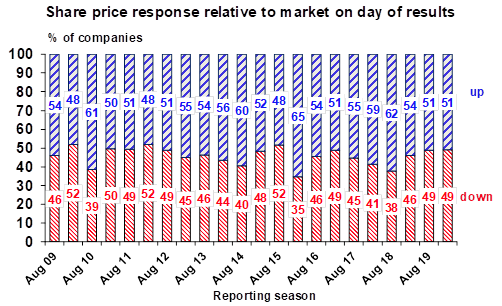

Reflecting the mixed results overall, the proportion of companies seeing their shares outperform the market versus underperform on the day they reported came in at 51% to 49% which was the same as in the August reporting season (fourth chart).

Consensus earnings growth expectations for 2019-20 fell from 3% to 2.3% due mainly to weaker than expected resources profit growth.

Dr. Oliver said that earnings growth is strongest in tech, telcos, general industrials and REITS and weakest amongst utilities, media and insurers.

Source: AMP Capital

Source: AMP Capital

Source: AMP Capital

Source: AMP Capital