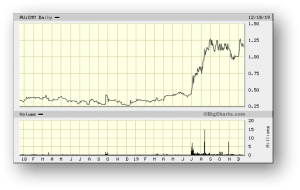

Capricorn Metals – (ASX: CMM, Share Price: $1.15, Market Cap: $390m, coverage initiated @ $0.415 in August 2017 – current gain of 177%)

Key Catalyst

Debt and bank guarantee facility agreements executed with Macquarie Bank for the development of the Karlawinda Gold Project in Western Australia, significantly boosting production prospects.

We initiated coverage of CMM during August 2017 on the back of its flagship Karlawinda Gold Project in Western Australia’s Pilbara region. The results of an Optimisation Study released during mid-2018 led to a significant improvement in overall economics – with pre-tax Project NPV(8) firming by 69% to $243m at an enhanced IRR of 36%, with project pay-back reduced to 2.5 years. Total up-front capital costs were reduced by 10% to $132m, whilst significant improvements to the process flow-sheet were also identified that have resulted in higher planned throughput of oxide and laterite ores, together with lower operating costs. The execution of debt financing facilities with Macquarie Bank completes the funding requirements for Karlawinda and is another major step towards the project’s development. The update of the DFS has progressed to the selection of a cost-effective, robust and flexible plant design.

Latest Activity

Funding Update

CMM has executed debt and bank guarantee facility agreements with Macquarie Bank for the development of its Karlawinda Gold Project. The terms of these facilities have been updated from the December 2018 committed letter of offer, which subsequently lapsed.

Whilst the full terms of the facilities are confidential, the key terms include a Project Loan Facility of $80 million, a Bank Guarantee of $20 million, a four-and-a-half year tenor with a repayment schedule over the term, with the facility able to be repaid early at any time without penalty.

The company’s existing gold hedging comprising 200,000 ounces at a price of A$2,249 per ounce satisfies the mandatory hedging requirement of the facilities. The hedge will be rolled into a delivery schedule covering 10,000 – 12,000 ounces of gold production per quarter from June 2021 to September 2025.

Importantly, the equity raisings completed by CMM during July and August 2019 satisfy the equity contribution requirement of the facility.

Development Update

Work is continuing on the Karlawinda Gold Project, with the key work streams comprising the installation of the 306-man accommodation village, resource infill and extension drilling, and a preliminary update of Definitive Feasibility Study (DFS) parameters and costs.

The village installation is progressing to plan and will facilitate the commencement of construction activities during Q1 2020, with a view to first gold production during Q1 2021. The resource drilling program is expected to be completed within days and will allow an update to the project’s Mineral Resource Estimate and Ore Reserve during Q1 2020.

Plant design work and DFS capital and operating cost estimation updates are progressing, with CMM appointing Mintrex and ECG Engineering to assist with engineering and plant design works.

The major change to the plant design from the 2018 study has been a move to a three-stage crushing circuit and a single ball mill (previous design was single stage crushing feeding SAG and ball mills). This revised configuration is designed to achieve a throughput in the order of 3.5 – 4.0Mtpa in fresh ore (previous design forecast 3.0Mtpa).

This is expected to deliver an average gold production range of 105,000 – 120,000 ounces per annum, representing significant upside to the average life of mine production estimate of 100,000 ounces per annum reported in the 2018 study.

The capital cost estimate resulting from the preliminary update sits within a range of $145 – 155 million. This estimate includes pre-production mining costs (which were not included in the reported 2018 study costs) and the incremental cost of changing to the tertiary crushing/ball mill configuration that provides the throughput upside as described above.

The life of mine all in sustaining cost (AISC) of gold production resulting from the preliminary update is $1,140 – 1,190 per ounce. This provides a strong margin based on the current A$ gold price of $2,157 per ounce.

The company will continue to refine these cost estimates in coming months in conjunction with the Mineral Resource Estimate and Ore Reserve update during Q1 2020.

Exploration Update

CMM maintains a 100% stake in a 2,042 sq km tenement package at Karlawinda that includes the greenstone belt hosting the 1.5 million ounce Bibra gold deposit, along with further significant greenstone areas where little or no drilling has been undertaken.

CMM is in an unique position to control a significant greenstone belt that is endowed with economic gold mineralisation (Bibra >1.5 Moz), yet due to its location within the Pilbara (a region not historically explored for gold), very little modern and meaningful exploration has been completed outside of the immediate Bibra deposit.

The magnitude of the exploration opportunity at Karlawinda is apparent via a breakdown of the total of 267,000 metres of drilling that has been completed at Karlawinda to date. Of this drilling, 259,000 metres (97%) has been completed within a 50 sq km zone covering the immediate Bibra area, with just 8,000 metres (3%) completed within the remaining 1,992 sq km area.

A review of the geological data base is underway and will be completed early during Q1 2020. This review will allow the board to approve an exploration program and budget for 2020 that is expected to be in the order of $5 million, which will target both near-mine (<5km to mill) and regional (5-50km to mill) exploration opportunities.

Summary

The execution of the debt financing facilities with Macquarie Bank completes the funding requirements for the Karlawinda project and is another major step towards the project’s development. The update of the DFS has progressed to the selection of a cost-effective, robust and flexible plant design that provides very significant throughput and production upside for the project. The preliminary update of DFS capital and operating cost estimates suggest that Karlawinda should be a very profitable gold mining operation.