Investors in Australia trying to understand the interest rate securities market will often come across reference to 90 Day Bank Bill Futures. Launched in 1979, the 90 Day Bank Bill was the first interest rate futures contract to be listed outside the US.

The Australian Securities Exchange’s 90 Day Bank Bill Futures and Options product is used as a benchmark indicator for short term interest rates in Australia. Investors use the 90 Day Bank Bill contract as a means of enhancing portfolio performance, reducing and managing risk and outright trading. Investing in 90 Day Bank Bill Futures provides allows investors to gain exposure to the Australian debt markets.

The trading behaviour and liquidity of these instruments means that they can be used for the hedging of short term AUD fixed interest securities and interest rate swaps. The average daily turnover of these contracts in 2012 was 83,000 contracts, seven times the turnover of the underlying cash market.

How to buy and sell 90 Day Bank Bill Futures

Trading in 90 Day Bank Bill Futures and Options is conducted ‘on market’ via the ASX’s electronic platform and ‘off market’ through Exchange for Physicals (EFP) transactions.

Each contract is for $1,000,000 face value. Prices are quoted in yield per cent per annum, multiples of .01 per cent. Contracts exist for the months of March (H), June (M), September (U) and December (Z) up to 20 quarter months or five years ahead. The deliverable product for the 90-day Bank Accepted Bills Futures contract is 90 Day Bank Accepted Bills of Exchange.

A guide to the pricing of 90 Day Bank Bill Futures

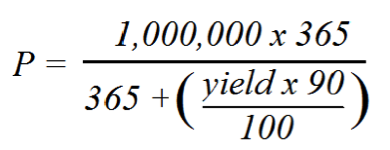

For ASX 90 Day Bank Bill Futures, where the contract value is always $1,000,000, and the term to maturity is exactly 90 days, the bank bill formula can be rewritten as:

where the yield is the futures price deducted from 100.

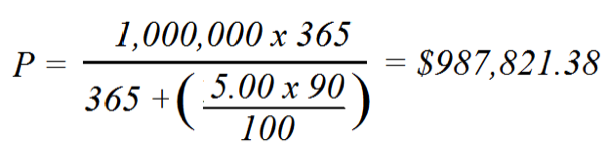

Therefore if a Bank Bill futures contract was trading at 95.00 (i.e. a yield of 5 per cent) the value of the contract would be:

The pricing conventions used for the majority of ASX’s interest rate products is different from that found in other countries where interest rate securities are traded in the cash market on the basis of their capital price.

In Australia the convention is to price these instruments on the basis of their yield to maturity. Due to this convention, ASX’s interest rate contracts are similarly traded on the basis of yield with the futures price quoted as 100 minus the yield to maturity expressed in per cent per annum.

|

Paul McNamara is an editor and journalist with over 20 years’ experience. His career includes spells with the Financial Times, Euromoney, BRW Media, Asia-Inc and Banker Middle East. At present he is editor of YieldReport. YieldReport is a digital newsletter that carries comprehensive pricing and commentary on Australian interest rate securities in a monthly and weekly report. Each issue covers bank bills, cash accounts, term deposits, government bonds, semi-government and corporate bonds, hybrids, ETFs, managed funds and more. Click here for a free trial subscription. |

|