The Australian sharemarket rebounded from last week's sell-off, with the S&P/ASX 200 gaining 0.7% at 7,781.50 by 11:35am, driven by a recovery in the property sector following concerns about US interest rates.

Last week's decline was triggered by strong US economic data, raising worries about prolonged high interest rates, but Wall Street recovered losses as tech stocks surged and consumer price expectations moderated, with US markets closed on Monday for Memorial Day, leading to subdued trading.

The SPI futures are pointing to a rise of 48 points.

Best and worst performers

The best-performing sector is REITs, up 1.39 per cent. The worst-performing sector is Utilities, down 0.07 per cent.

The best-performing large cap is Ramsay Health Care (ASX:RHC), trading 3.18 per cent higher at $50.22. It is followed by shares in Evolution Mining (ASX:EVN) and Endeavour Group (ASX:EDV).

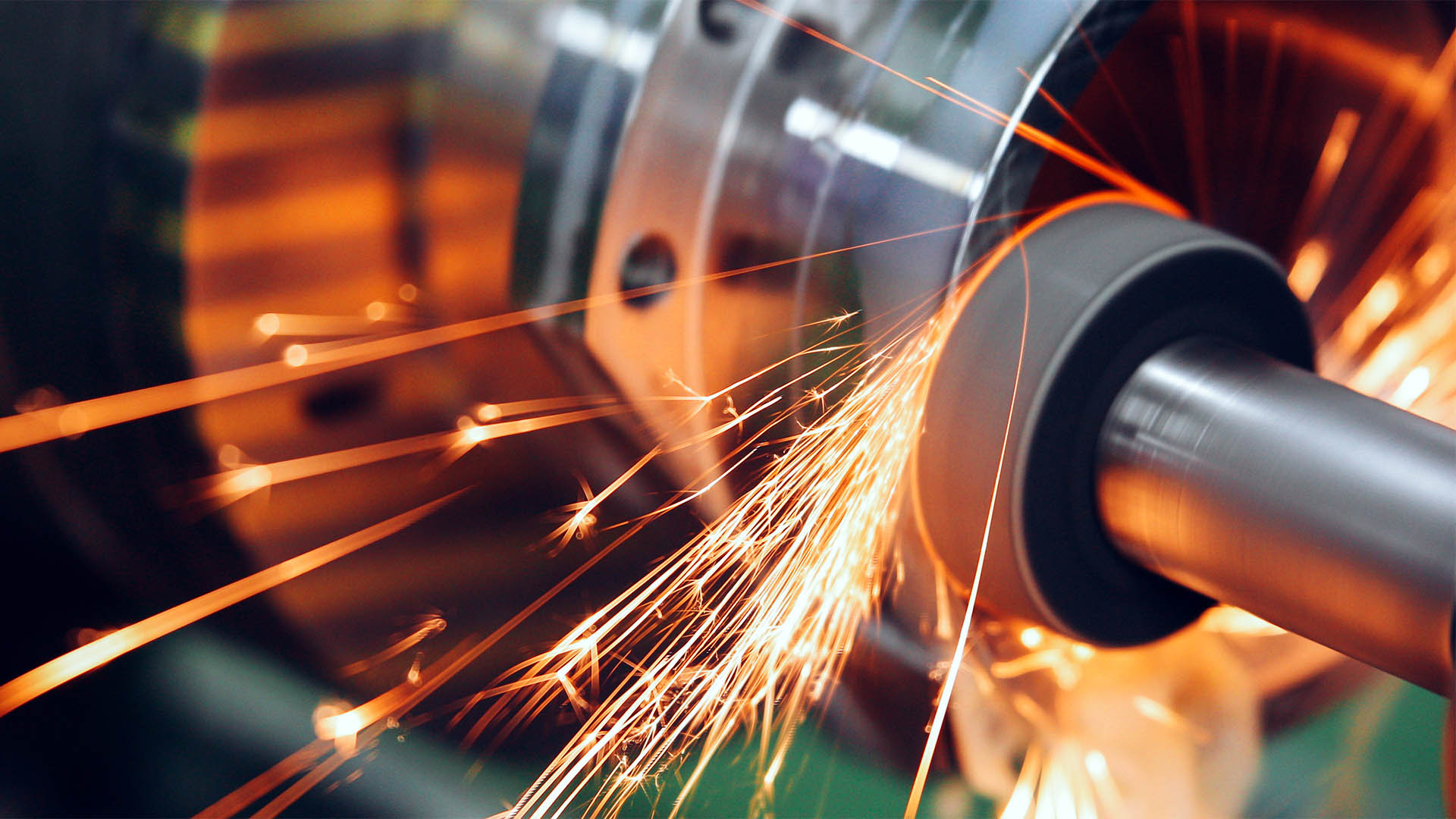

The worst-performing large cap is BlueScope Steel (ASX:BSL), trading 2.08 per cent lower at $21.15. It is followed by shares in IGO (ASX:IGO) and AGL Energy (ASX:AGL).

Commodities and the dollar

Gold is trading at US$2361.90 an ounce.

Iron ore is 0.9 per cent higher at US$120.55 a tonne.

Iron ore futures are pointing to a 0.5 per cent fall.

One Australian dollar is buying 66.33 US cents.