For years, commodities experts have warned of a copper crunch.

And with the recent reopening of China, as well as the ramping up of the transition to renewable energy, demand for the highly conductive base metal has come in for closer scrutiny again. Even more so, given operational issues in Latin America are currently plaguing global supply.

Peru has been rocked by protests since the impeachment trial that led to the removal of former President Pedro Castillo in December. Peru is responsible for 10% of the world’s copper production and, on January 20th, Glencore declared the suspension of activities in its Antapical copper mine in the south of the country, following the destruction of its facilities by looters and arsonists amid the unrest.

Additionally, Chile – the world’s largest copper producer, accounting for 27% of global supply – has seen copper output decrease year on year because of water issues and declining ore grades at major mines.

S&P Global research predicts the world could see a 10-million-ton deficit of the critical metal by 2035, with Bloomberg Intelligence forecasting a 14-million-ton shortage by 2040.

These macro factors pose great opportunities within the Australian equities market. With Australia’s largest pure copper play OZ Minerals likely falling to acquisition by BHP, investors now need to search a little deeper for other Australian companies that can provide the best leverage to copper markets.

Over the past few years, OZ Minerals has been considered by many as the leading ASX-listed company focused solely on copper. For investors who subscribe to the long-term bullish view on copper prices, OZ Minerals has presented itself as a compelling investment opportunity, and its shareholders have reaped the rewards of the company’s strong stock performance and acquisition at a premium price. BHP’s intentions for copper should not be ignored.

Let’s look at some other companies with significant copper exposure.

Note: All figures are from FY2022 unless stated otherwise. Grades are found as an average of the operations.

Producers

Sandfire Resources (ASX: SFR)

Sandfire Resources is an international and diversified sustainable mining company with a focus on copper mining and exploration, exemplified by the successful DeGrussa copper-gold deposit in Western Australia, and the recent acquisition of the MATSA Mining Operations in Spain.

The DeGrussa Copper Operations are located 900km north-east of Perth in Western Australia and include the high-grade DeGrussa and Monty Copper-Gold Mines. Operations at DeGrussa are based on underground mining delivering sulphide ore to an on-site 1.6Mtpa Concentrator producing copper concentrate (also containing gold and silver).

Sandfire acquired the MATSA Copper Operations in February 2022 for US$1.865 billion. The MATSA Copper Operations consist of three underground mines in Almonaster la Real and Calañas, which feed a central processing facility producing copper, zinc, and lead mineral concentrates that are exported from the port of Huelva.

DeGrussa Copper-Gold Operations and MATSA Copper Operations

Proved/Probable Reserves: 39 million tonnes including contained metal: 665kt CU, 84 koz Au, 975kt Zn, 286kt Pb, 43Moz Ag

Total Mineral Resource (Measured and Indicated): 149.3 million tonnes including contained metal: 2183kt Cu, 112 koz Au, 4,381kt Zn, 1,513kt Pb, 188Moz Ag

Copper Grade: 2.9%

Cost of Production (C1 cash cost):

- DeGrussa Copper-Gold Operations: US$1.18/lb of copper

- MATSA Copper Operations: US$1.45/lb of copper

Operations EBITDA: A$807.6M

2022 production (tonnes of copper): 98,368

29 Metals (ASX: 29M)

29Metals is a mining company that primarily focuses on mining copper and precious metals. It possesses a collection of sustainable, operating resources such as Golden Grove in Western Australia (which mines copper, zinc, gold, and silver) and Capricorn Copper in Queensland (which mines copper and silver) as well as a series of organic expansion prospects.

The Golden Grove mine is a mining operation situated in Western Australia, which extracts high-quality copper, zinc, and precious metals. It is among the lowest-cost copper mining operations in the world.

The Capricorn Copper mine is located in Queensland and is a high-quality mining operation that extracts copper and silver from several ore sources. The mine has received significant investments, which has enabled it to establish a stable and consistent production process in the future.

Golden Grove and Capricorn Copper

- (Figures for the year ended 31 December 2022)

Proved/Probable Reserves: 31.1 million tonnes including contained metal: 540kt Cu, 744kt Zn, 330koz Au, 18985koz Ag

Total Mineral Resource (Measured and Indicated): 123.6 million tonnes including contained metal: 2168kt Cu, 2,473kt Zn, 1,284 koz Au, 73476koz Ag

Copper Grade: 1.8%

Cost of Production (C1 cash cost):

- Golden Grove: US$1.62/lb of copper

- Capricorn Copper: US$3/lb of copper

Operations EBITDA: A$176.5M

2022 production (tonnes of copper): 40,700

Aeris Resources (ASX: AIS)

Aeris Resources is a producer of both base and precious metals, operating in the mid-tier range. The company’s portfolio primarily focuses on copper and includes four operational assets, a long-term development project, and a promising exploration portfolio across multiple regions in Australia, including Queensland, Western Australia, New South Wales, and Victoria. Aeris Resources is headquartered in Brisbane.

Tritton Copper Operations is long life, underground copper mining operation located in central New South Wales. It is solely owned and managed by Aeris Resources and is an important part of Aeris’ copper production.

North Queensland Operations is a mining operation in the Mt Isa/Cloncurry region consisting of the Mt Colin copper mine, the Barbara development project, and a large tenement package. It was acquired by Aeris Resources in July 2022 through the acquisition of Round Oak Minerals. Mt Colin was previously an open-cut operation but began producing ore from underground activities in September 2019.

Tritton Copper Operations and North Queensland Copper Operations

Proved/Probable Reserves: 5.33 million tonnes including contained metal: 80kt Cu, 50koz Au, 504koz Ag

Total Mineral Resource: 45.8 million tonnes including contained metal: 427kt Cu, 268koz Au, 3,155koz Ag

Copper Grade: 2%

Cost of Production (all-in-sustaining-cost):

- Tritton Copper Operations: A$3.43/lb of copper

- North Queensland Copper Operations: US$4.47/lb of copper

Adjusted EBITDA:

- Tritton Copper Operations: A$50.63M

2022 Production(tonnes of copper): 22,181

Copper Mountain Mining (ASX: C6C)

Copper Mountain Mining Corp is a copper producer, developer, and explorer with its flagship asset being the Copper Mountain mine in British Columbia, Canada. It currently produces about 100 million pounds of copper equivalent annually and plans to expand to 140 million pounds.

Copper Mountain mine

The Copper Mountain mine is situated 20 km south of Princeton, BC, and covers about 18,000 acres, primarily consisting of crown grants, mineral claims, and mining leases. The mine has a 45,000-tonne-per-day plant that produces copper concentrates with gold and silver credits using conventional crushing, grinding, and flotation. The mill is planned to be expanded to 65,000 tonnes per day, increasing annual production to 138 million pounds of copper equivalent and reducing costs to $1.76 per pound of copper over the first 20 years of the mine’s 32-year life.

Proved/Probable Reserves: 702.4 million tonnes including contained metal: 3,732M lbs Cu, 2,313koz Au, 16,010koz An

Total Mineral Resource: 1.1 billion tonnes including contained metal: 5,467M lbs Cu, 3,366koz Au, 23,376koz An

Copper Grade: 0.23%

Cost of Production (C1 cash cost): US$2.54/lb of copper

2022 Production (tonnes of copper): 29,743

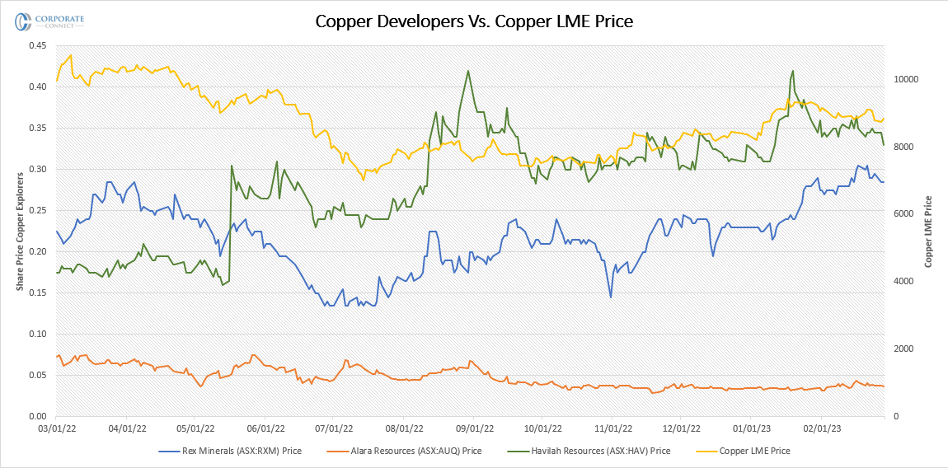

Figure 1: 12-month relative performance of Cu Producers vs. the LME Copper price.

Developers

Rex Minerals (ASX: RXM)

Rex Minerals is an exploration and development company with operations in South Australia and an exploration project at Hog Ranch, Nevada, USA.

Hillside Project (100% owned)

Rex Minerals is actively developing its Hillside Project, situated on the Yorke Peninsula in South Australia, around 12km from the Ardrossan township. The Hillside site is an Iron Oxide Copper Gold (IOCG) deposit in the Gawler Craton region and is fully owned by Rex. It is considered one of the most substantial undeveloped copper projects in Australia, with an estimated Mineral Resource of 1.9 million tonnes of Cu and 1.5Moz of Au. The optimized and updated Feasibility and Definition Phase Engineering Study was finalized in December 2022. Macquarie Capital has been appointed to manage a minority partnering process for Hillside and a Final Investment Decision (FID) is targeted for mid CY2023. The Stage 1 development is envisaged to run for 11 years before moving to Stage 2.

Proved/Probable Reserves: 186 million tonnes including contained metal: 989kt Cu, 834koz Au

Total Mineral Resource: 337 million tonnes including contained metal: 1,897kt Cu, 1,528koz Au

Copper Grade: 0.55%

Cost of Production (C1 cash cost): US$1.52/lb copper

NPV & IRR (Stage 1): A$1,252M (pre-tax), NPV of A$847M (post-tax). Internal Rate of Return (IRR) of 19% (nominal IRR 23%)

Pre-production cost (Stage 1): A$854M

Alara Resources (ASX: AUQ)

Alara Resources Limited is an Australian minerals exploration and development company that has projects in Saudi Arabia and Oman. Its main focus is the Khnaiguiyah Zinc-Copper Joint Venture Project in Saudi Arabia, where it has a strategic partnership with Manajem, and Alara is well-positioned to transition from a developer to a profitable mid-tier producer in the near term.

Wash-hi – Majaza Copper-Gold Project

The Wash-hi-Majaza Copper-Gold Project is in Oman and is a joint venture with Al Hadeetha Resources. With the mine pit, gossan dump, haul road, and drill pad all in the final stages of completion, the project is on track to be finished in Q2 2023. Alara owns a 51% equity interest in the Al Hadeetha Resources joint venture, which is responsible for the development of the project.

Probable Reserves: 9.7 million tonnes including contained metal: 85.4kt Cu

Total Mineral Resource: 16.1 million tonnes including contained metal: 140kt Cu

Copper Grade: 0.61%

NPV & IRR: Alara Resources 51% of the project NPV is A$130.7M. Internal Rate of Return of 33%.

- Assuming a Copper price of US$8,000 per tonne.

Pre-production cost: A$89.1M

Havilah Resources (ASX: HAV)

Havilah aims to develop a portfolio of gold, copper, iron, cobalt, and other mineral resources in South Australia and to build on its successful exploration track record by making new value-adding discoveries. The Company intends to become a new mining force in South Australia, delivering value and tangible benefits to its shareholders, partners and the community in which it operates.

Kalkaroo Project

Kalkaroo is a significant open pit copper deposit in Australia, considered one of the largest undeveloped ones based on a 0.89% CuEq Ore Reserve measurement. It has an estimated mineral resource of 1.1 million tonnes of copper, 3.1 million ounces of gold, and 23,200 tonnes of cobalt across its Measured, Indicated, and Inferred JORC resource categories.

Proved/Probable Reserves: 100.1 million tonnes including contained metal: 474kt Cu, 1,407koz Au

Total Mineral Resource: 245.5 million tonnes including contained metal: 1,096kt Cu, 3,105koz Au

Copper Grade: 0.47%

Cost of Production: Long-term consensus copper metal price of US$3.16/lb

NPV: A$903 million (at a discount rate of 7.5%)

Even with explorers having been excluded from this list due to the numerous steps they face before entering the production phase, there is an abundance of ASX-listed copper producers, developers, and explorers well- positioned to leverage the copper markets and dominate on an international scale. While there’s no doubt the increasing inflationary pressures of opening and constructing new or existing mines will prove a hurdle to be overcome, the expected price strength of the commodity and the increased profits that should generate offers plenty of incentive for them to do so.

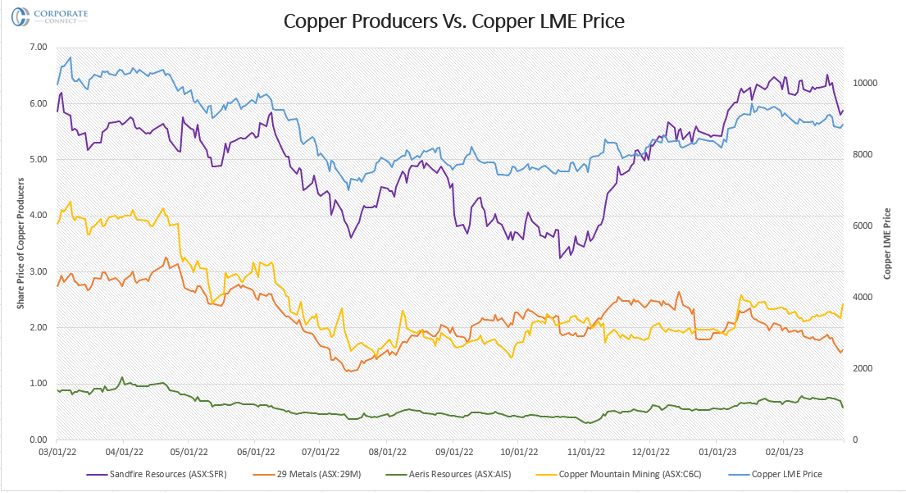

Figure 1: 12-month relative performance of Cu Developers vs the LME Copper price.