by Daniel Sullivan, Darko Kuzmanovic and Tal Lomnitzer, CFA

2022 looks to have been a year of transition for equity markets. At the time of writing, global equities are down more than 18% in US$ terms, but companies in the natural resources sector have performed relatively well with the S&P Global Natural Resources Index up almost 8%.1

The big surprises of 2022 were the Russia-Ukraine conflict, which tightened global energy markets dramatically, choking economic growth and spurring inflation, and secondly the degree to which central banks seem willing to raise interest rates to control inflation. In our view, the rate shock is now well understood, markets have priced in aggressive rate hikes, and are beginning to include the normalisation of inflation and growth into valuations.

In the final weeks of the year, resources stocks and commodity prices look to have turned a corner after bottoming in October. Not all sectors or companies will have enjoyed a smooth recovery. As such, a bottom-up stock picking approach that looks for opportunities across the mining, energy and agriculture sectors in all parts of the supply chain enables a focus on areas with the most attractive fundamentals.

Collateral damage in the war on inflation?

With central banks acting to rein in inflation, economic growth slowed this year. Looking into 2023, inflation looks likely to peak as global economies adjust to tighter monetary policy and resources supply.

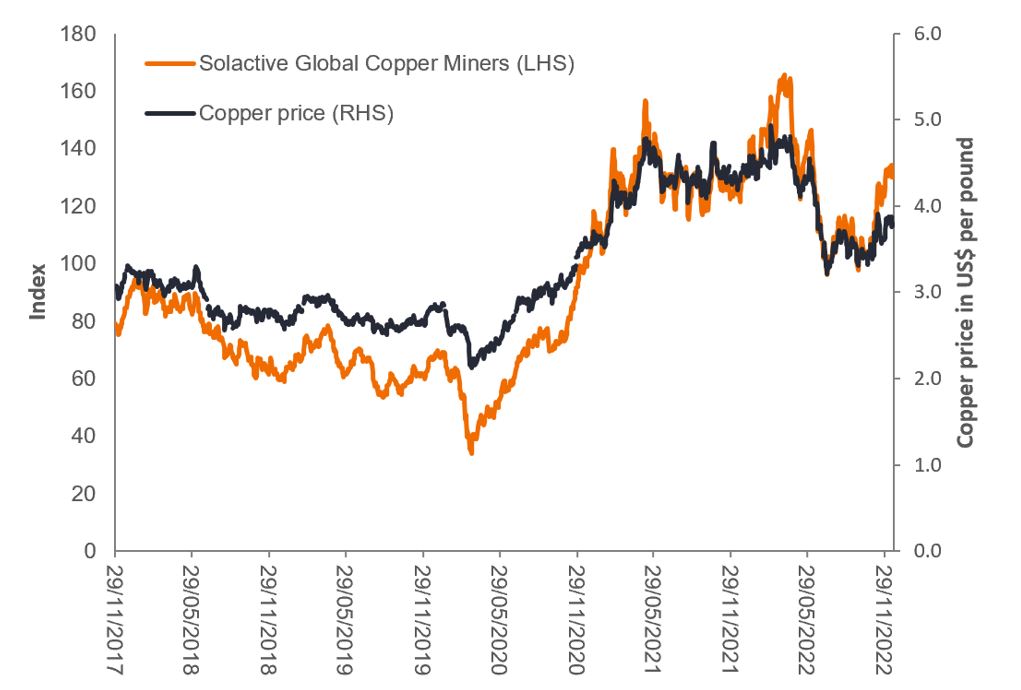

Copper is an economic bellwether. The speed of the economic slowdown saw copper prices decline around 25%; half of this fall has already been recovered at the time of writing. Similarly, copper company share prices fell by more than 50%, with more than half of this already recovered (Solactive Global Copper Miners Total Return Index in figure 1).

In our view this could be a very bullish sign for the global economy and markets, and the resource sector in particular. Demand and the price of another economically-sensitive metal – nickel, remains strong supported by China’s economic re-opening spurring global economic growth.

Figure 1: Copper price (US$) and copper company index

Source: Bloomberg, Janus Henderson Investors. Daily data from 29 November 2017 to 19 December 2022. Past performance does not predict future returns.

While copper prices may fluctuate in the short term, it is one of the building blocks of an electrified economy and central to long-term global renewable energy growth. Key commodities such as copper, lithium, cobalt and nickel are decarbonisation enablers. This represents a fundamental structural change for natural resources and should underpin the demand and supply for these key commodities and many others for many years to come.

An underappreciated theme to watch

A key theme over the coming years will be a focus on the supply side and the need for miners’ capital expenditure (capex) to accelerate. Very low commodity inventory levels and weak supply growth have driven up prices of virtually all commodities. In our view, mining, energy and agriculture companies are not investing sufficient capital to meet the higher levels of current and future demand (figure 2).

What does this mean? When global demand begins to rebound, the resources market will very likely be faced with low inventories and constrained new supply. This could drive commodities prices to levels that boost profit margins and encourage resources companies to ramp up investments in growth and expansion.

Figure 2: Real levels of capital expenditure are at 30-year lows in the mining sector

Source: Jeffries Equity Research, Metals & Mining, 27 March 2022. Data indexed to 100 in 1992. Bloomberg company filings, Wood Mackenzie, ABARE, EIA, China NBS, Johnson Matthey, Jefferies estimates. There is no guarantee that past trends will continue, or forecasts will be realised.

Even if mining companies reprioritise capital spending, a combination of labour constraints, regulatory approvals, slow permitting processes and fiscal uncertainty mean new supply will typically take time to bring on. A premium could emerge for smaller companies with development projects and we would not be surprised to see increased merger and acquisition activity as larger companies seek out new projects from ‘juniors’ that have successfully explored and identified new deposits.

Shareholder returns remain the key focus in mining, energy and agriculture companies’ capital allocation policies. Despite the macro risks, the balance sheets of companies are typically strong with potential for attractive shareholder returns.

Decarbonisation is powering the mining and energy sectors

We expect the long-term decarbonisation theme to accelerate in 2023, driven by a combination of economic incentives and government policy, such as the Inflation Reduction Act in the US.

New wind, solar and hydrogen projects are likely to be announced, and the penetration of electric vehicles should continue to ramp up. These developments support the demand for renewable technology companies, as well as the critical metals vital to achieving a net zero future, such as copper, lithium and low carbon steel.

In response to the intermittent nature of renewable energy (the wind doesn’t always blow, and the sun doesn’t always shine), we expect to see more nuclear projects announced as a reliable foundation to countries’ energy mix. Not without its controversy over the years, in the wake of the energy crisis, nuclear could provide energy security for countries vulnerable other nations for their energy needs.

Short and long-term drivers for the agriculture sector

We see tight agricultural markets for the foreseeable future. ‘Stock-to-use’ ratios for wheat, corn and soybeans have been hammered by a combination of droughts in China, the US and Europe, alongside the Russian invasion of Ukraine, which is a key provider of agricultural products globally.

Assuming a return to more normal weather patterns in the medium term, it could take multiple harvest seasons to rebuild stocks and ease tight markets. Meanwhile, with the world’s population having reached eight billion in November this year, long-term demand for agricultural output to feed the planet will be unrelenting, particularly given the United Nation’s global population projection of 10 billion by 2057. This bodes well for farmer economics and providers of crop inputs like seeds, fertilisers and crop chemicals.

In summary

In 2023, for a broad range of commodities we could see a resumption of strong structural demand coupled with limited supply growth leading to price strength for some key commodities and resource companies. The longer-term themes of decarbonisation and lack of quality growth projects are likely to lead to a tight supply response, and increased merger and acquisition (M&A) activity when demand rebounds.

A rewarding investment approach in resources may be one that is based on bottom-up stock selection, with a focus on companies with world-class assets, low costs, continuous growth, strong balance sheets, good or improving environmental, social and governance (ESG) profiles and quality management teams.

1 MSCI World Index vs S&P Global Natural Resources Index year-to-date total returns in US$ to 19 December 2022. Past performance does not predict future returns.

Daniel Sullivan is Head of Global Natural Resources and a Portfolio Manager at Janus Henderson Investors. Darko Kuzmanovic is a Senior Portfolio Manager at Janus Henderson Investors. Tal Lomnitzer is a Senior Investment Manager on the Global Natural Resources Team at Janus Henderson Investors.