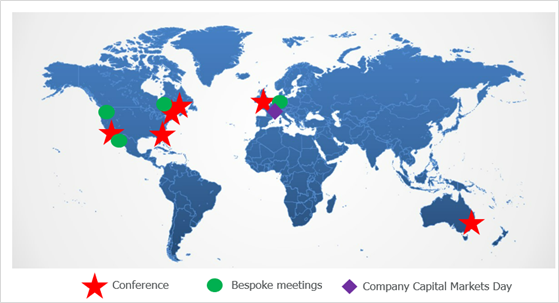

The first half of 2022 has been extremely busy for Alphinity’s five global portfolio managers. Collectively, they have been on 9 overseas investment trips, travelling to 12 cities across 7 countries, visiting existing and prospective portfolio companies. All in, the team have met with over 200 companies face to face over the past 6 months.

Travelling again after two years of Zoom calls is an excellent opportunity to reconnect with corporates, gain valuable on-the-ground insights and find interesting new investment opportunities.

In this note we share the key highlights of their respective trips. Including interesting anecdotal stories, notable fundamental themes, and some company specific insights. You can also visit our website (Insights – Alphinity) for videos with our 5 portfolio managers sharing their key highlights.

Alphinity is not currently invested in all the stocks mentioned in this note.

Alphinity Global Portfolio Management Team

Around the world in 200 meetings across 12 cities and 7 countries

A few anecdotal stories: long queues, missed flights, labour shortages & increased inequality

Global airports, trains, hotels, and restaurants are currently overwhelmed. For every meeting, the team had to navigate long airport queues and of course a much higher price tag to get there. Jeff hit the unwelcome record with every one of his flights delayed or cancelled over a two-week period in Europe.

Across in the US, Trent almost got trapped in Santa Rosa after visiting Keysight. Uber coverage has become very patchy outside of the big city centres. At Starbucks he also got bumped from second in the in-store coffee line to 60th. The “order ahead app” option is clearly the new and better way to go!

Sadly, not all our on-the-ground insights were positive. Mary observed that COVID has exacerbated the income inequality challenge for America as a society. The increased homelessness is now confronting in many major cities such as Seattle. Unionisation movements and worker demonstrations were also a regular occurrence. From smaller companies (Chipotle) to high-profile companies (Amazon andStarbucks) alike.

Fundamental themes across sectors: Supply chains, inventory, labour shortages and a clear delineation between the winners and losers

There were several overarching fundamental themes shared across most of the sectors:

- Inflation, input cost pressures, supply chain disruptions & pricing featured in debates across every company we met. Conversations and opinions varied widely reflecting huge uncertainty and different fundamentals across companies and industries.

- Labour shortages were mentioned across most sectors and wage increases as part of the inflation debate. The pendulum seems to be swinging back towards the worker at this point in the cycle.

- Several unintended consequences have emerged from the Covid-19 pandemic and more recently also the Russia/Ukraine war. Second-round effects are only starting to become more visible now.

- Quality management is critical at this point. Some management teams are executing very well in this tough environment. Others helped by strong industries and market positions with pricing power.

- There is a clear delineation between the winners and losers within sectors. This is particularly relevant across the technology and communications sectors. Stock selection is critical at this point in the market cycle.

- The biggest macro debates were around the global housing market rolling over. The timing of China’s reopening and the impact on supply and demand for products and services. Russian sanctions and energy supplies. FX headwinds and uncertainty around demand expectations.

Sector specific insights

Consumer – New York, Seattle & Europe

Consumer spending has remained resilient to date despite consumer sentiment plummeting to levels last seen in the 1900’s. With pent-up demand focused on travel, leisure, occasion-based spending (weddings), beauty, entertainment, etc. It’s likely that this “revenge spending cycle” won’t last very long after the end of the summer holiday season. Low-end consumers are already struggling post the COVID stimulus withdrawal. Higher mortgage rates and deteriorating jobs data will also start to weigh. We continue to prefer exposure to the more resilient high-end consumer at this point in the cycle.

A few comments on the sub-sectors below:

- General retail: Retailers are facing a perfect storm of challenges: stimulus withdrawal, cycling high 2021 numbers, weather, supply chain, transportation costs, changing consumer preferences etc. There has also been a big inventory build-up during the last few quarters. With either too much inventory or inventory in the wrong places. 2Q22 result misses from bell weathers, Target and Walmart, underscores this.

- Luxury: Luxury companies have immense pricing power and are geographically diverse. China’s impact on demand and supply is important to understand. For example, LVMH is only affected on the demand side. Their decentralised fulfilment structure and direct sale model offset revenue headwinds.

- Staples: Inflationary pressures are impacting all consumer staples players. We prefer companies with structural tailwinds and strong pricing power. Large multi-national companies with many different revenue and cost levers to pull are better positioned to make earnings guidance. And importantly managed by high quality management teams. We were impressed with the management team at Diageo, the owner of iconic brands such as Johnny Walker and Don Julio. They are focused on pricing and cost management, as well as continuing to enjoy structural tailwinds from premiumisation and category gains. The business was a beneficiary of elevated home consumption through the COVID period as consumers sought comfort from ‘affordable luxuries’. On the negative side, Unilever is battling with higher costs and an uncertain demand outlook as they raise prices. And Nomad Foods with higher costs and an uncertain fish supply.

- EV’s & Autos: Transition to EVs is underway and accelerated by higher oil prices. There will be winners and losers from the transition with existential risk for the losers in our view. BMW and Mercedes are best positioned amongst the OEM’s, along with Tesla. We question if smaller players such as Rivian and Lucid can survive.

- E-commerce: It’s difficult to determine the normalised run rate for e-commerce post-COVID. Both supply chain and demand pattern related. Our meeting with Amazon reaffirmed our view that the operating environment continues to be very volatile. E-commerce players in non-US markets (for example Alibaba and MercadoLibre) could be better opportunities going forward.

Financials – Europe, UK, and Canada

Financials are facing significant macro challenges. Tailwinds from higher interest rates are offset by growing concerns about slower economic growth, difficult capital markets and potentially higher credit risks. We have recently reduced our exposure to banks on falling earnings momentum, such as Bank of America. We prefer financials that are less geared to rates and offer more defensive characteristics.

A few comments on the sub-sectors below:

- Banks: Higher interest margins and revenues are increasingly a ‘known known’. The forward-looking risk is that developed markets are entering a non-performing-loan cycle, which is not reflected in current earnings estimates. The Net-Zero Banking Alliance (NZBA) is creating a significant ESG/Sustainability push among banks that have signed up. We were particularly impressed by the Bank of Nova Scotia and Royal Bank of Canada on their lean-forward approaches to sustainability.

- Housing & Mortgages: Globally banks have seen strong mortgage growth during the recent period of low rates. Loan-to-value ratios have remained low to date. Spiking mortgage rates, falling consumer confidence and a less buoyant labour market could taper loan growth and see non-performing-loans rise. The correction in the housing market will have implications across multiple sectors. Not only banks with significant mortgage exposure, but also building materials, construction etc. We exited our exposure to home improvement retailer Lowes earlier in the year as a result of these concerns.

- Non-bank financials: Insurers, stock exchanges and asset managers are not immune to the macro risks mentioned above and we will be watching for a disorderly unwind of credit markets and private valuations. We currently prefer defensive stocks with exposure to higher interest rates and relatively low credit risks, such as insurer Chubb and financial exchange Deutsche Boerse.

Technology – San Francisco and Boston

There is also a clear delineation between the winners and losers within the technology sector. Or in the current tech market, we should describe it as the big losers and the lesser losers. Companies exposed to Cloud, 5G and Security are holding up better (Microsoft, ASML). The businesses where the model depended on free and almost limitless external capital, are the big losers (Buy-now-pay-later players, such as Affirm for example).

A few comments on the sub-sectors:

- Software: Spending has remained resilient in Cloud and Security. With less capital available for Covid winners such as payments, creative applications, workforce collaboration. The market moving is to “must have” vs “nice to have”. This shift in capital cost and capital availability are having severe impacts on unprofitable/unproven tech businesses. Enterprise spend is looking more resilient than consumer spend. Security is a huge focus given the heightened threat environment and the expansion in connectivity points. Microsoft remains a standout given their growth engine of cloud platform Azure.

- Hardware & equipment: 5G underpins a fundamental shift in capability; allowing a proliferation of use cases to continue. On the other hand, the PC and smartphone market (focused on China and low-end models) is exhibiting weakness. Our team was once again impressed by Keysight’s 5G growth and sustainability.

- Semi’s: Memory markets are weakening due to PC and smartphone softness. Datacentre demand and auto & industrial demand remain solid. Industry positioning for power semi shifting to Silicon Carbide.

Industrials – Europe and UK

Supply chains and inventory are front and centre for the industrial players. Feedback from the road suggested that the situation overall remains challenging and highly uncertain, although with some incremental improvements in certain areas. For example, truck manufacturers talked about being back at full production.

Despite current cyclical headwinds, it was interesting to note that several sub-industries continue to enjoy strong structural trends. These include decarbonization, electrification, factory automation and, more recently, defence. Ironically the big issues causing a lot of the cyclical headwinds appear to be strengthening the longer-term fundamentals for some of the companies exposed to these thematics.

For example, Schneider Electric have seen increased demand and shrinking payback periods for their energy efficient products. Their CEO noted that many of the secular tailwinds underpinning growth are stronger than what they were in January. Companies like ABB, Schneider and Siemens are all beneficiaries of electrification and industrial automation (including robotics).

On the sub-sectors:

- Electrical equipment: Demand for equipment driving electrical efficiency remains strong. Order books are buoyant, and supply remains the key bottleneck. Renewable equipment manufacturers and developers continue to be under pressure due to supply chain pressures and cost escalations and issues with permitting.

- Aero and Defence: Globally governments are increasing defence spending in response to recent geopolitical events.

- Machinery: Given the backdrop of a strong commodity cycle, mining equipment demand remains solid for now. We are alert to the risks that double ordering has occurred in mining consumables. Infrastructure segment growing well, and engineering remains robust

Health Care – Los Angeles

After attending the Health Care conference in LA, we maintain our view that the fundamentals of the overall sector remain good, especially relative to the rest of the market. The underlying sub sectors within Health Care have very diverse challenges and drivers. Besides the usual ongoing policy risks (new US reconciliation bill for example), there are also significant FX headwinds for the sector. Multiples also still reflect some growth expectations.

On the sub-sectors:

- Pharmaceuticals: Global leaders such as Merck are still in a good position. The outlook for earnings remains intact and is largely insulated from a weakening economic cycle, Fed tightening, Russian war & Chinese COVID lockdowns.

- Life sciences: Still in good shape from an earnings perspective driven by strong underlying demand in bioprocessing and lab equipment. Some risks around China lockdowns (global presence) and USD headwinds. Danaher remains our preferred exposure with strong structural demand, cashflows and balance sheet.

- Hospitals: We continue to see headwinds for this space, including slower normalisation of medical procedures post COVID and higher staffing costs, including nurses. We have previously owned HCAas a COVID beneficiary but see earnings risks as elevated in the current environment.

- Medical Technology: An interesting sub-sector with good fundamentals, high returns and strong cashflows. The sub-sector has gone through a tough time recently and we see short term headwinds from supply chain issues and rising raw material costs. Intuitive Surgical, Edwards Lifesciences, Boston Scientific are all high-quality businesses where the long-term earnings outlook could end up under appreciated by the market, and we are watching upcoming earnings updates closely.

We are happy to be on the road again. The world has changed in positive and negative ways since pre-COVID but we are committed to using on-the-ground meetings and travel insights to hone our understanding of the markets and find exciting, good quality stocks in which to invest.

Hear more about Alphinity’s world tour

In this short 5 part video series, the team share the key highlights from their overseas trips, interesting anecdotal stories, fundamental theme and some company specific insights.