by Michelle Dunstan

Commodities, by virtue of their fungibility and broad uses, have infiltrated nearly every facet of human life, making the world enormously reliant on their ready availability. But as climate change advances—and the effort to slow it gains momentum—this vital relationship will be affected in wide-ranging ways—some obvious at the surface, others not.

Climate risk is broadly measured in two ways: The first is physical risk, such as rising seas that endanger physical plants and facilities or warmer temperatures that can alter crop yields. The second is transitional risk from the evolution toward a carbon-free economy, such as changing consumer preferences, evolving regulation, legal issues and new technologies.

Tackling the full scope of climate change’s impact on commodities would require a much longer format. So, this piece focuses on distinguishing the supply and demand impacts on key commodity categories. For both forces, the impact of climate change is transmitted through both physical and transitional channels.

The Demand-Side Impact

As the world gears up for the push to reduce carbon emissions, one segment of the commodity world under the spotlight includes coal and fossil fuels. Simply put, as the world weans itself from heavy-carbon-emitting fuel sources, demand for these energy stalwarts will steadily decline. This process will eventually knock higher cost producers out of the mix, with real prices—and profitability—falling.

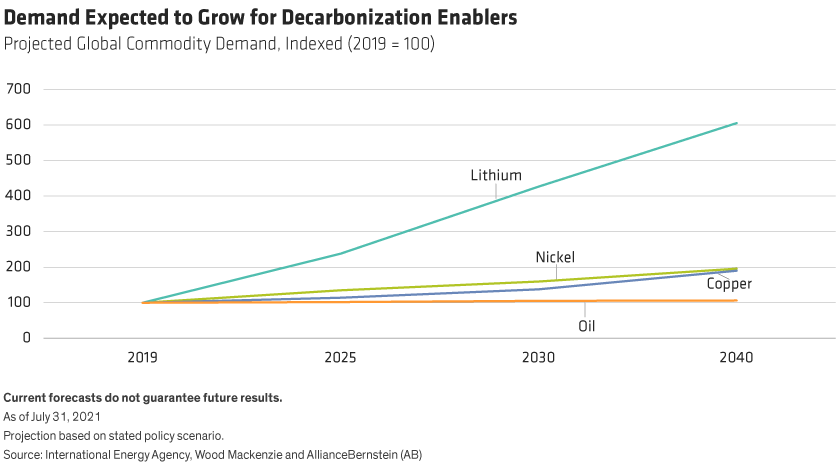

On the other side of the transitional-demand coin, some commodity segments will benefit, as demand rises for inputs that enable decarbonization (Display). For example, industrial metals such as lithium and copper, critical in enabling the low-carbon transition, will see growing demand, even as oil demand flattens. The world will need more of these metals, which may force buyers to higher-cost sources, putting upward pressure on prices.

Many factors will play a role in shifting commodity demand: sovereign agreements to reduce carbon emissions, the regulatory landscape and fiscal commitment to support the transition. Changing preferences among consumers will also fundamentally alter demand to favor more climate-friendly products.

For example, as the larger global consumers of soy—food producers and protein producers—become more conscious of the impact of their supply chains on the environment, they are increasingly demanding proof that their soy is not being sourced from areas subject to deforestation. And they’re willing to change suppliers and increase their costs to avoid that climate impact.

Over the short to medium terms, we actually see solid support even for “dirty” commodities such as coal and oil. For one thing, capital is generally being withdrawn from the fossil fuel industry faster than the current reduction in demand. For commodities whose availability is declining the fastest, such as oil liquids and natural gas, this process could drive price spikes.

Investment in the clean-energy transition will provide another demand support pillar for fossil fuels, because the transition will require sizable amounts of steel and cement, whose processes contribute to carbon emissions. A lot of marginal diesel fuel is needed to move those heavy materials around, too.

If we also include the necessary capital expenditure to protect physical plants and supply chains against higher temperatures and rising sea levels, building materials could see a big demand boom.

The Supply-Side Impact

From the supply-side perspective, a major transitional risk for some commodities is rising costs, both capital costs and operating costs, driven by the growing focus on protecting the environment. For example, commodity producers are required to pay taxes on carbon emissions in an increasing number of jurisdictions, and those taxes are likely to head in one direction only: up.

Notwithstanding prior rollbacks in the US, regulatory mandates to protect resources are intensifying. Chile continues its effort, for example, to enact a glacier protection law, along the lines of an earlier Argentinean legislation. It would require a broad inventory of geo-forms, and would forbid activities—namely major Andean copper mining projects—that would negatively impact them. Many firms face the prospect of often-costly equipment upgrades or replacements to reduce carbon emissions.

This increasingly forceful regulatory environment will continue to raise supply costs. Current and proposed carbon regulations in Europe, for example, could raise the prices of some animal proteins by as much as 41%.1 Fines and penalties for environmental damage are presenting greater risks: in 2020, the US Department of Justice and Environmental Protection Agency fined a concentrated animal feeding operation nearly $3 million for Clean Water Act violations—a record for fines in this category.

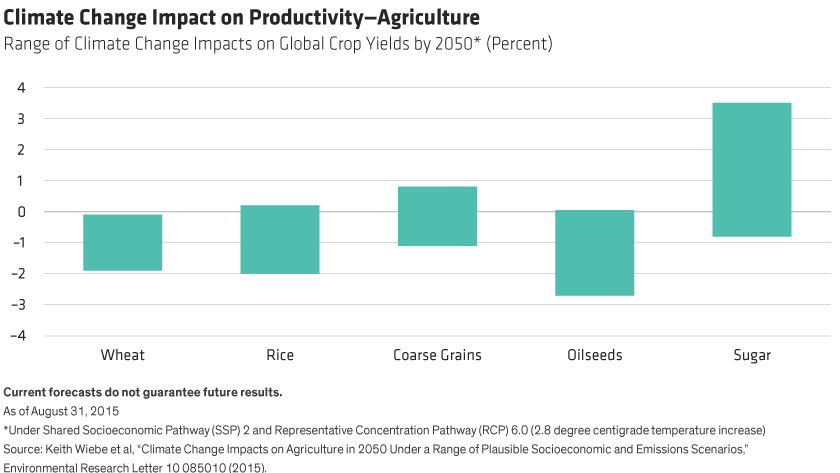

The physical risks of climate change are having expansive effects on agriculture. Agricultural operations impact climate change as land use changes and carbon is produced, and climate change in turn affects agriculture. Crop productivity (Display) is at the mercy of rising temperatures and extreme weather patterns. In fact, we’ve recently seen extreme weather events simultaneously impact wheat harvests in Canada, Australia, China, Russia and Ukraine. Producers may adapt where and how they grow crops, but costs will still rise.

Heat waves, drought and disease have impacted coffee and chocolate producers. Numerous studies point to coming shrinkage in land area suitable for growing these crops as climate change intensifies. Suppliers are exploring drought-resistant crops, but pressures loom. Côte d’Ivoire and Ghana, for instance, supply about 60% of the world’s cocoa but have high deforestation rates, which doesn’t augur well for supply.

The impacts on commodities from some physical risks are less obvious. Despite recent historic flooding on the Rhine River, low water levels in Germany’s vital conduit over the past few years forced barges to operate at limited capacity, curtailing chemical production and restricting supply. Similarly, intensifying tropical storms threaten Gulf of Mexico oil production and refining as well as the chemicals and liquid natural gas industry in low-lying areas.

In mining, which is critical for electrification, flooding is a major problem, with more frequent heavy rainfall posing challenges for open pit mines in tropical and semitropical areas. The problem is particularly acute in coal operations in Australia and Indonesia, but likely hurts production and boosts prices more broadly, too.

The Big Picture

Diagnosing the potential impact of climate change on the financial condition of commodity and commodity-related issuers requires extensive fundamental research and—in some cases—creative detective work to uncover factors that may not appear obvious at the surface.

And because commodities are so ubiquitous globally, the hand of climate change reaches far broader, touching the supply chains of countless industries. We mentioned earlier that animal protein producers face higher transitional costs from efforts to curb carbon emissions; the physical climate risks to grain, the central input in raising livestock, are likely to make that commodity pricier, too, further raising operating costs.

Wherever possible, it’s likely that each member of the supply chain will attempt to pass rising costs through to its clients. So, consumers at the end of the chain may face ever-higher prices for certain energy sources, food items, and other important products and services. These trends will affect both investment decisions and day-to-day spending behaviors.

Michelle Dunstan is Chief Responsibility Officer and Portfolio Manager of the Global ESG Improvers Strategy at AllianceBernstein (AB).

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

1Céline Bonnet, Zohra Bouamra-Mechemache and Tifenn Corre , “An Environmental Tax Towards More Sustainable Food: Empirical Evidence of the Consumption of Animal Products in France,” Ecological Economics 147 (May 2018): 48–61.