Introduction

This note covers the main questions investors commonly have regarding the investment outlook in a simple Q&A format.

Is the global economic recovery on track?

Yes. We anticipate global growth around 5.5% this year on the back of reopening sustained by vaccines, fiscal stimulus, easy money and pent-up demand as evident in double digit household saving rates. Global business conditions are strong. The global rebound was led by China but looks like being led by the US this year reflecting rapid vaccine dissemination and massive fiscal stimulus. Expect stronger growth in Europe and Japan in the second half as vaccine dissemination there speeds up. Emerging market growth is also likely to be strong.

Are vaccines working? What about new variants?

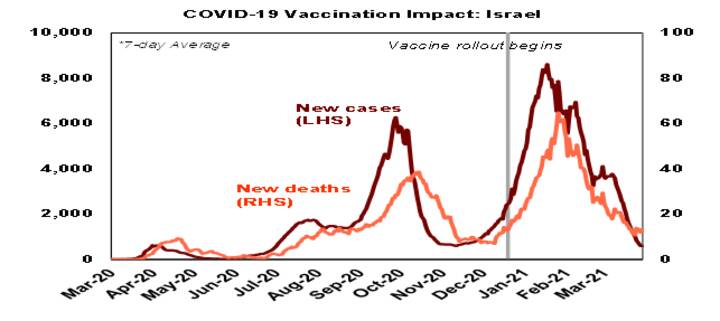

Yes. There are now five western vaccines along with vaccines from Russia and China. The evidence from numerous trials and results from Israel (where 58% of the population have received at least one dose) and the UK (where 45% have received at least one dose) indicate that the various vaccines are around 75% plus effective in heading off infection and 100% or near effective in preventing serious illness, hospitalisation or death (including for new variants). This is evident in a sharp fall in new cases, hospitalisation and deaths in Israel, the UK and US (where “only” 29% have received at least one dose but about 3 million people a day are now being vaccinated).

Source: ourworldindata.org; AMP Capital

Protection against hospitalisation and deaths though is key in providing confidence in a sustained reopening. There may still be occasional new waves of cases until herd immunity is reached and uncertainty remains around how long vaccines last, and this may require top ups. Europe has seen a resurgence in new cases but is lagging in vaccination (10% having received one dose) as are emerging countries and Australia. Vaccine production is ramping up rapidly though so most developed countries will approach some degree of herd immunity (70% plus vaccination) in the second half (mid-year in the US) and emerging countries through next year.

Will the ending of JobKeeper derail the Aust recovery?

This is doubtful. The best guide to those vulnerable to job loss from JobKeeper’s end is those working zero hours and this was only running around 70,000 above normal in February which is down from 720,000 in April last year – the loss of 70,000 jobs would push unemployment up but only by around 0.5% and from a much lower than expected level of 5.8% in February and don’t forget that nearly 90,000 jobs were created in February; another 100,000 above normal were working reduced hours but they are more likely to see a reduction in income rather than job loss; various measures of job vacancies are running around 15% above year ago levels suggesting that job losses in travel and CBD-related service businesses should be made up elsewhere; JobKeeper’s injection into the economy has already dropped from $12bn a month last September to $2.5bn a month in March and yet the economy has continued to recover; and its removal will be partly offset by other forms of stimulus such as personal tax cuts and investment incentives. We expect the Australian economy to grow by around 5% this year.

What about the ongoing snap lockdowns in Australia?

These are disruptive and a huge barrier to making domestic travel plans, but providing they remain short, the overall economic impact will be minor (as they have been lately). Faster vaccine rollout (with CSL production kicking in) should end them later this year once herd immunity is reached. Of course, if the Brisbane’s snap lockdown (or any other) turns out to be long then the Government may have to consider reinstating JobKeeper or something similar for areas affected.

Will US fiscal stimulus cause the US to overheat?

President Biden’s $US1.9 trillion coronavirus rescue package coming on top of $US600bn in stimulus paid out early this year will swamp last year’s $2.3trn stimulus. More stimulus focussed on infrastructure and climate is also on the way, but this will be spread over many years and will be partly paid for by corporate and high-income tax hikes. Combined it will amount to around $5trn or 23% of GDP over two years, the biggest stimulus since the New Deal. With reopening this is all likely to push US GDP growth to around 8% this year and see GDP rise above its pre- covid trend. The Biden Administration is clearly trying to deal with years of social division, but there is an obvious risk that this amount of stimulus causes the economy to overheat.

Is inflation going to become a problem?

Annual inflation is likely to rise towards 4% in both the US and Australia in the months ahead as last year’s price falls drop out, higher commodity prices along with goods supply bottlenecks impact and flood driven rises in fresh fruit and vegetable prices in Australia impact. However, this is likely to be temporary as distortions drop out, goods supply picks up & demand swings back towards services and as wages growth likely remains low.

Beyond the next 2 to 3 years though the risks on inflation are likely to swing to the upside as spare capacity is used up and ultra-aggressive monetary policy ultimately pushes up inflation at a time when the disinflationary impact of globalisation is starting to fade, and governments are becoming more interventionist in their economies. In other words, we appear to be at a similar juncture to the peak in inflationary pressures seen in the early 1990s – but in reverse.

What are the best hedges against higher inflation?

Sustained higher inflation will ultimately mean upwards pressure on the yield structure in the economy which could be negative for investments that have benefitted from years of low and falling interest rates like high PE tech stocks. The best protection against sustained higher inflation would be inflation linked bonds, real assets like commodities and parts of the share market that will see stronger earnings growth.

When will interest rates start to rise?

Both the Fed and RBA are signalling no rate hikes until 2024 at the earliest as they see it taking this long before labour markets are tight enough to sustain inflation at or just above target. We think it could come a bit earlier in 2023 but that’s still a long way off. Europe and Japan are even further away from raising rates. Note though that fixed mortgage rates take their que from long term bond yields and so have already started to bottom out.

Will massive levels of public debt cause a problem?

This could become an issue, but a major crisis should be avoided. First, public sector borrowing costs are still ultra-low. Second, Japan has had high public debt for years without a major problem. Third, it’s conceivable that if a problem did arise, governments could cancel the bonds that their central banks now own. Finally, in Australia public debt is relatively low.

What is the risk of a share market crash?

Shares have had a strong rebound from their pandemic lows a year ago and so are vulnerable to a decent correction and this could be triggered by an ongoing sharp rise in bond yields or new coronavirus waves ahead of heard immunity. While a crash is always a risk it’s not our base case. First, it’s normal for share market returns to slow in the second 12 months after a bear market low as markets are no longer cheap and they become dependent on higher earnings. Second, while the rise in bond yields this year has been sharp it reflects the bond market playing catch up to the economic recovery that share markets started to anticipate last year. Third, share markets still offer a strong earnings yield premium relative to bond yields in contrast to in the year 2000 when bond yields rose were above earnings yields. So shares are not overvalued. Fourth, earnings expectations have been revised up sharply so far this year on the back of the improving growth outlook. Fifth, we are still not seeing the sort of economic overheating, monetary tightening and investor euphoria seen at major market tops. Finally, in relation to the US share market being at a record high – markets are often at all-time highs as shares rise over time.

What share markets/sectors are likely to outperform?

US growth has been given a boost lately by massive additional fiscal stimulus and its fast vaccine rollout and this has helped US shares and the $US. However, we remain of the view that this year will see a rotation away from last year’s relative winners (like tech stocks and US shares) towards more cyclical markets (like resources, industrials, tourism stocks and financials). Vaccine deployment outside the US is starting to ramp up which in the second half will see a growth catch up in Europe and Japan, some of the US stimulus will leak out of the US benefitting the global economy, higher bond yields will weigh on tech stocks and tax hikes to finance Biden’s second stimulus package will weigh relatively on US shares.

Will Australian shares start to outperform?

As the global economy recovers and bond yields move higher this will likely benefit cyclical sectors and financials to which the Australian share market has a relatively higher exposure. This combined with a rapid rebound in Australian dividends this year taking the grossed-up dividend yield to 5% will ultimately see the Australian share market outperform US shares. We continue to see the ASX 200 ending the year at around 7200.

Will the $A resume its upswing?

After briefly hitting $US0.80, the rise in the $A has stalled as the $US rebounded. But with non-US growth likely to accelerate with vaccine deployment, Chinese growth likely to remain strong and some US stimulus leaking globally commodity prices are likely to be strong and safe haven demand for the $US will continue to fall so the upswing in the $A is likely to resume, seeing it end the year above $US0.80.

Should investors invest in Bitcoin?

It’s hard to see Bitcoin becoming digital cash – its transactions are slow and high cost, it’s highly volatile and it’s a massive user of electricity – and it’s not an asset generating cashflows. All of which makes it hard to justify other than as something to speculate on! Of course, this is not to say that it can’t go up a lot further (or down) as more jump on (or off) its bandwagon.

How big a threat are tensions with China?

For now, the impact on the Australian economy (as opposed to individual sectors) by the tensions with China has been muted by strong commodity prices, the ability to redirect some exports to other markets and China’s practical short-term difficulties in replacing Australian iron ore (there is basically not enough other supply sources). But it’s an issue to keep an eye on.

Why is there another boom in Australian house prices?

Economic recovery, the strengthening jobs market, ultra-low interest rates, buyer incentives and FOMO are driving a new boom in property prices. Home prices in March look to have seen their fastest gain since the 1980s. With ultra-low mortgage rates this could run for another 18 months with prices rising by a further 20% or so. Several things are likely to eventually slow it down though, particularly from the second half:

- government housing incentives are likely to be curtailed;

- the RBA and APRA are expected to reach yet again for macro prudential controls to slow housing lending. While they don’t target house prices, past experience indicates that surging house prices leads to a deterioration in lending standards and increasing financial stability risks, so it makes sense to start taping the lending standards’ brake soon. First thing to do would be to increase interest rate buffers.

- the recovery in immigration once international borders are reopened is likely to be gradual, resulting in an underlying oversupply of dwellings;

- it’s likely that the 30-year tailwind for the property market of falling interest rates has now run its course and longer dated fixed rates are starting to rise; and

- poor affordability is starting to become a constraint again.