BHP Billiton’s iron ore operation in Western Australia is one of the world’s great businesses. The return on capital employed usually exceeds 45% – and it only falls to 20% when the iron ore prices are low. Accounting for more than 50% of earnings, BHP Billiton’s Pilbara operation is a business that anyone would like to own.

Any bad news to account for when assessing this world-class stock? There are a couple of things. The first is that although supply-demand dynamics seem favourable now, iron ore is a commodity, and high commodity prices eventually beget higher supply. That’s why we like the diversified nature of BHP Billiton’s asset suite compared with some of its peers that rely more on a single commodity.

The other bad news is that previous management took a fair portion of the mountainous cash flow and made poor investment decisions. The good news is that financial discipline has returned under the current management.

All up, BHP Billiton is in strong financial shape and generating significant free cash flow. The miner’s share price has lagged its peers; however, we think BHP Billiton’s balance sheet, commodity exposures and reinvestment options make it a compelling investment proposition judged on the way COVID-19 has barely impeded the company, key metrics such as inventories held by China are favourable, and so too is valuation. Let’s look at each three things in turn.

So far during the COVID-19 crisis, BHP Billiton’s business has proved relatively resilient. China has the biggest impact on demand for iron ore and, hence, price. Emerging from lockdown, the Chinese are returning to work, the country’s monetary conditions are easy and more fiscal stimulus is likely that will boost demand for commodities. The iron ore price has been remarkably resilient and at these levels, the major producers are printing cash, even more so that currencies are moving in their favour. Importantly, with a strong balance sheet (net debt to earnings before interest, tax, depreciation and amortisation is about 0.5 times), BHP Billiton is well placed for whatever comes next. The big COVID-19 risk for the company is that one of its mining sites hosts a virus breakout. We understand the company is working hard (distancing, testing and quarantining) to mitigate this risk.

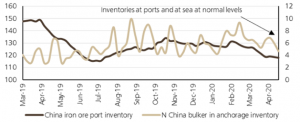

The key metric for BHP Billiton is iron ore inventories in China. While BHP Billiton is a diversified mining company, its most profitable commodity remains iron ore. China is by far the most important customer for this commodity, hence investors watch inventory levels there – as the oil market shows, any large jump in inventories can savage prices.

The good news for BHP is that iron ore inventories in China remain at normal levels. A reduction in China’s steel production due to covid-19 is being offset by only modest supply growth from the major producing countries, particularly Brazil.

Source: UBS Evidence Lab, Thomson Reuters, Steelhome, Bloomberg, UBS

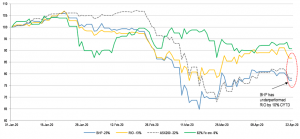

Valuation paints another favourable reason for investing in BHP Billiton. Since the start of 2020, the company’s shares have underperformed key peer RIO Tinto (the yellow line in the chart) as well as iron ore (green line).

Source: J.P. Morgan estimates, Bloomberg

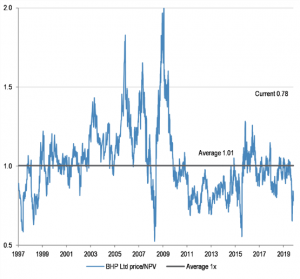

Below is a valuation chart based on net present value, which captures earnings through a full cycle in commodity prices. The chart shows that BHP Billiton over the long term has traded around its net present value. Yet the stock is trading these days at about a 20% discount.

Source: J.P. Morgan estimates

In our experience, market dislocations like the one we are experiencing throw out some rare opportunities to buy high-quality businesses at attractive prices. For us, BHP Billiton is one of these.