In my last column on April 3, I highlighted that there were three main categories of investors and that I was the lonesome person in the camp of a “V-shaped” recovery for markets and we have witnessed an aggressive rally from the low that still hasn’t convinced the bears the lows are in yet.

Unfortunately for the bears at this point I don’t think they understand several factors:

1) “Whatever it takes”. This was a famous line by ECB President Mario Draghi on July 26th, 2012 that he used to tell markets the central bank would do whatever necessary to backstop the economy and support financial market liquidity. The German DAX from that moment has never, ever been lower. This very same line has been used by Mnuchin and Powell to get the message across that they will do whatever necessary to support the US economy.

2) Don’t Fight The Fed. This is proven again and again that stimulus and money printing moves asset prices. This time is not different, except for the fact that it is larger than ever before. By the end of this stimulus program the Federal Reserve will have a balance sheet approaching $8 Trillion. That money has to go somewhere and it will lift equity prices (especially those companies with lower debt levels, large cash levels and solid growth outlook – translation – technology). Gold will also be a beneficiary.

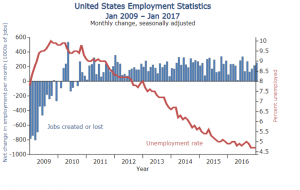

3) Unemployment levels are largely irrelevant. The chart below shows US employment back to 2009. Unemployment didn’t peak until 2010. The first consecutive monthly job gain was not until April 2010 and the unemployment rate didn’t begin to meaningfully decline until almost 2011. Employment statistics are an awfully primitive and backward way of assessing stock market direction. Furthermore, the comparisons to the GFC shows that by the time the employment picture stopped getting worse, the market had recovered its entire Lehman Brother’s sell-off. Markets look 12 -18 months in advance. So the question is where is the economy in mid-2021? That is the question the market is answering.

4) Capitulation selling. The chart below shows the max exodus from equity funds. Ask yourself who did the buying? The smart money wasn’t selling. They already did that before the high. Sovereign wealth funds were the buyers, deploying hundreds of billions. Why were they prepared to step up? Because of the above three points.

5) Markets move a lot faster now. All that selling creates what I call a “selling vacuum”, where after the panic occurs, there is no selling left. Volumes are light and lunch money can move stocks by huge amounts. This also creates the notion of FOMO – Fear Of Missing Out. If you were not prepared to buy during the eye of the panic you have missed out on the majority of opportunities the recovery presented. As a result you are either praying for another sell off to give you the opportunity to buy (like all fund managers are hoping for now) or you are left to buy the garbage that hasn’t bounced yet.

I could continue onto another hundred reasons the dynamics of markets and economic forces continue to point to markets continuing to recover. There will be speed bumps along the way and the bears will roar during this period (the same ones you didn’t hear from at the highs!). Dips will continued to be bought by those desperate to get back in and those covering shorts.

I am not stupid enough (or at least I don’t think I am) to be a blind bull. The risk of a second wave of Covid-19 shutting down the economy again after being re-opened is a risk. But the question is where could equity markets be by the time that occurs, if it ever does? The answer I give to that question is the same I give to all those bearish millennials – #newhighs