Minotaur Exploration – (ASX: MEP, Share Price: $0.06, Market Cap: $20m, coverage initiated @ $0.06 in Sep 2015).

Key Catalyst

Catch up with MD Andrew Woskett and Exploration Manager Glen Little in Sydney, overview of upcoming QLD exploration activity, including drilling of the Hastings anomaly at the Windsor JV.

MEP is actively exploring IOCG-style targets within Australia and specifically northern Queensland, where geophysics can identify sub-surface anomalies prospective for copper-gold mineralisation, along with other targets prospective for base metals such as zinc, lead and copper. MEP has begun to recapture market interest and share price momentum following the recommencement of its 2019 field campaign during April. Over the past six months, MEP’s share price has firmed from a 12-month low of $0.038 to a recent high of $0.076 – a gain of 100%. Of particular interest has been the resumption of fieldwork at the company’s flagship Jericho copper discovery, which forms part of the Eloise joint venture with OZ Minerals (ASX: OZL) near Cloncurry in Queensland. There is clear potential for a significant mineral system at Jericho, with the J1 and J2 parallel mineralised structures extending for more than 3km along strike.

Latest Activity

I had the opportunity to catch up with MD Andrew Woskett and Exploration Manager Glen Little in Sydney on Day 2 of the Resource Stocks Conference, who took me through the latest with respect to MEP’s current exploration priorities.

Windsor JV Project Update

The current highlight for MEP is its Windsor joint venture project near Charters Towers in Queensland, where MEP can earn an 80% stake from a private group.

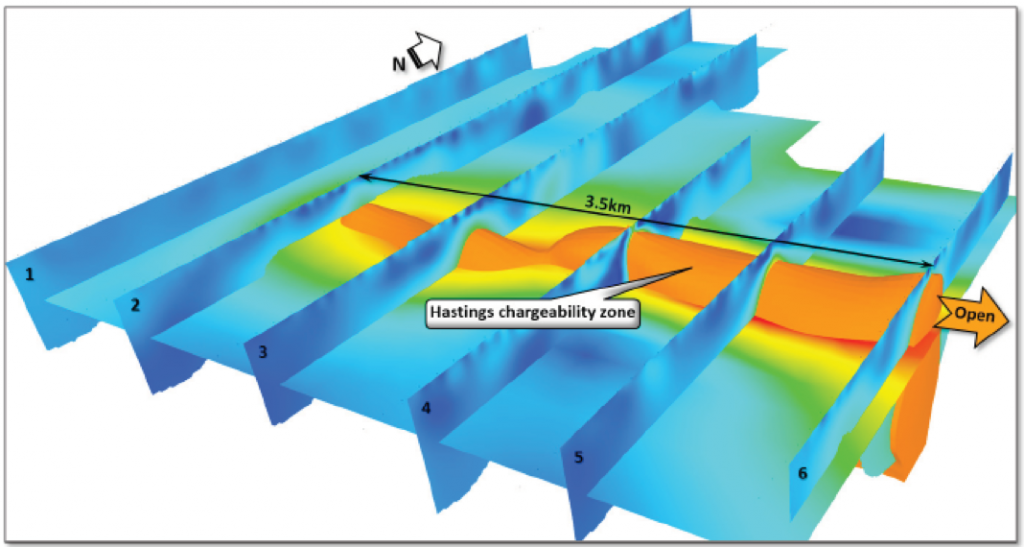

MEP will shortly embark on a drilling program, following the recent release of highly encouraging IP (Induced Polarisation) geophysical survey results. The survey has identified a large, very strong IP chargeability anomaly – known as Hastings – defined under thin cover along more than 3km of strike.

Figure 1: 3D image of Hastings IP anomaly showing IP inversion model sections (1-6) and coherent chargeability zone

Technical Significance

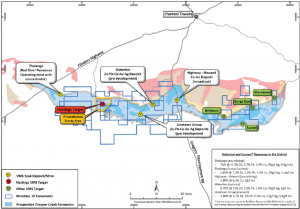

The placement of the IP survey was guided by a basement interpretation that hypothesised the same stratigraphic horizons hosting the Thalanga, Highway Reward and Waterloo VMS deposits that occur within the general vicinity of the survey area (refer to graphic below).

The Windsor JV area includes 175 sq km of the Trooper Creek Formation, which is host to numerous high-grade base metal VMS occurrences – including the Thalanga and Highway Reward deposits. The discovery of Thalanga in 1975 generated intense exploration activity through until the early 1990’s, however only limited exploration has since taken place. In particular, little effort has been directed to the covered portions of the project area. Extensive tracts were typically avoided because the highly conductive nature of the cover sequence rendered redundant electrical geophysical techniques of the era, due to their inability to see through the cover into basement.

Part of MEP’s strategy for target generation across the Windsor JV area is that substantial portions of highly prospective basement therefore remain untested. Importantly, modern electrical geophysical systems are now better suited to these types of terranes and hence provide an opportunity to investigate areas of basement not previously explored.

This approach has proven highly successful for MEP in the Cloncurry district, as demonstrated by the discovery of the Jericho copper-gold deposit during late 2017, which is also located under conductive cover where the basement has an otherwise indistinct geophysical signature.

Figure 2: Windsor JV tenements with prospective Trooper Creek Formation, VMS occurrences, and Hastings target

In terms of the strike length of VMS deposits within the district, mineralisation at Red River Resources’ (ASX: RVR) zinc-rich Liontown VMS discovery occurs along approximately 1.5km of strike, while the high-grade zinc-rich Thalanga deposit group comprises several discrete lodes along 4km of strike, from West 45 in the west to Orient in the east. The Hastings IP anomaly is modelled along at least 3km of strike.

Next Steps

The Hastings chargeability anomaly has substantial scale (strike length and dip extent), intensity (very high chargeability) and it appears to lie in a favourable stratigraphic position. MEP therefore regards it as a highly prospective VMS base metals target, worthy of drill-investigation. Accordingly, field activities have commenced in preparation for drilling.

Project Overview

The Windsor Joint Venture is located in northeast Queensland and encompasses 631 sq km. Having achieved its initial expenditure obligation of $400,000 MEP can may proceed to earn up to an 80% interest in the tenements through total expenditure of $4 million over a five-year earn-in phase.

Summary

MEP will shortly embark on a drilling program, following the recent release of highly encouraging IP geophysical survey results. The survey has identified a large, very strong IP chargeability anomaly – known as Hastings – defined under thin cover along more than 3km of strike. The Hastings chargeability anomaly has substantial scale (strike length and dip extent), intensity (very high chargeability) and it appears to lie in a favourable stratigraphic position. MEP therefore regards it as a highly prospective VMS base metals target, worthy of drill-investigation. Accordingly, field activities have commenced in preparation for drilling.

Apart from Hastings, there is a lot of work going on regionally at Cloncurry with respect to potential prospects as part of the company’s exploration alliance with OZL, as well as in its own right. MEP is stock where share price performance reflects underlying exploration activity.