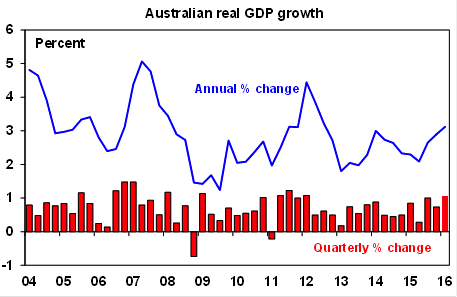

Australian economic growth hit a 4-year high in the three months to March 31.

Figures out yesterday showed growth accelerated in the three months to March, rising 1.1% from the December quarter’s 0.7% (revised up from 0.6%), while annual growth rose significantly to 3.1% from the restated 2.8% in the 2015 calendar year (the annual figure was revised down from the 3% first reported in the December quarter national accounts).

The growth came from a rise in exports, as well as a stronger performance in service-based industries. The result was well ahead of expectations — the market had been looking for annual growth of 2.8%, and the news had the Aussie dollar rise three-quarters of a cent to just under 73 US cents.

The AMP’s chief economist Dr Shane Oliver said yesterday, "3.1% annual growth is far better than growth seen in other advanced countries, viz 2% in the US, 1.5% in the Eurozone and 0.5% in Japan. So on the growth front Australia remains a star performer compared to other developed countries.”

In fact the real story of the quarter is that just as in the March and September quarters of 2015, the economy was able to withstand the impact of a nasty slide in commodity prices early in the quarter, which helped push the terms of trade down nearly 2% across the three months — not to mention a rocky start to the year for local and global financial markets.

It also survived another quarter of sliding resource investment: private gross fixed capital formation fell 2.2%, driven by falls in new engineering construction (-6.4%) and new buildings (-6.9%). That’s the tenth successive quarterly fall in new engineering construction spending as the end of the mining investment boom works itself through the economy.

Australian real GDP growth booms on net exports

Source: AMP Capital, ABS

But the good news from the quarter was that the fall was almost offset by a 6.2% positive contribution from mining production, which contributed to the 4.4% growth in exports.

In fact, mining has contributed significantly to growth in the past 15 months, powering the 0.8% (revised down from the 0.9% rise first reported) in GDP in the same quarter of 2015, and the 1% (revised down from 1.1%) in the September quarter of last year.

The ABS said that service-based industries were the other big contributor to growth with finance and insurance (1.8%), retail trade, accommodation and food services (1.5%), and arts and recreation (0.9%) all increasing. Household spending rose 0.4%, unchanged from the December period. Household consumption rose a solid 0.7% in the quarter.

The only slight concern is disinflation. “Broad based price falls were evident across the economy,” the ABS said, “as shown in the Consumer Price Index (CPI) which fell 0.2 per cent. The GDP price deflator, which shows the overall price movement in the Australian economy, fell 0.6 per cent in the March quarter.”

The terms of trade fell 1.9% after their 3.2% fall in the three months to December 31 in the March quarter and fell 11.5% through the year, which was a tiny bit better than the 12% fall recorded through calendar 2015.

The net savings ratio was 8.1% in the quarter compared to the 7.6% reported in the December three months. And, importantly, trend real net national disposable income was flat — that’s a good sign compared to the negative territory that indicator has been in for some quarters.

Dr Oliver said, ”Thanks to the export volume boom flowing from the final phase of the mining boom along with the rebalancing of the economy away from mining investment to consumer spending and housing, Australia is continuing to avoid the recession that some have feared over the last few years. This is likely to remain the case and is very good news.”