Online savings accounts have not been immune to the long slow grind downwards that has affected both term deposits and cash accounts.

Because online savings accounts can generally be opened and managed online, they involve less bank staff interaction than other savings accounts and consequently cost the banks less to administer. Notionally, these savings are passed on to the customer in the form of interest rates that are higher than can be found in normal savings accounts and term deposits. Another general feature of these accounts is that they have no, or low, fees associated with them.

In many cases these online savings accounts come with special headline ‘honeymoon’ rates to lure savers in and pay extra interest for a limited period of time and many also come with additional terms and conditions that cover things such as minimum and maximum balances, the requirement that savers deposit a minimum amount each month as new money, a cap or a floor on the amount that can be kept in the account, a limit on the number of such accounts that savers can have and so on.

Online savings accounts have also been used aggressively by the banks themselves as a means of attracting new customers from the competition as well as for retaining existing customers by stopping them switching providers. They can also be a useful way for banks to simply lift their deposit base in a post-Basel III world.

In recent months, however, as term deposits and cash accounts have come under increasing pressure with the cash rate remaining at a stubbornly low 2.50 per cent, many online savings accounts have seen the same drop in rates.

But it is not just about the falling cash rate. It is also tied up with the new Basel III liquidity standards that came into force this month (see YieldReport 15-19 December). In December, Guy Debelle, RBA assistant governor for financial markets said, "Banks have an incentive to reduce the amount of liabilities that roll off in less than 30 days. Deposits which are deemed to be subject to high run-off rates and those which are callable within 30 days will be more expensive for banks. Banks are therefore working towards converting many of these less stable deposits into a more stable deposit base. Interest rates offered on new or existing deposit products which are deemed to be more stable are rising relative to interest rates on products deemed to be less stable. These types of changes appear to have accelerated recently as we draw closer to the implementation of the LCR Liquidity Coverage Ratio and probably still have some way to run."

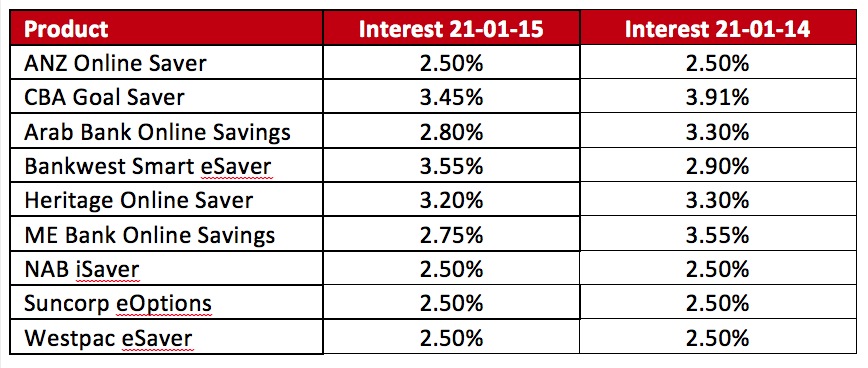

The table below gives an indication of how some Australian online savings accounts have fared over the past year, but the trend has generally been a downward one and, with a further cut to the cash rate in February being priced by the market as a 75 per cent likelihood, savers can expect rates on these savings accounts to come under further pressure as the year wears on.

|

Paul McNamara is an editor and journalist with over 20 years’ experience. His career includes spells with the Financial Times, Euromoney, BRW Media, Asia-Inc and Banker Middle East. At present he is editor of YieldReport. YieldReport is a digital newsletter that carries comprehensive pricing and commentary on Australian interest rate securities in a monthly and weekly report. Each issue covers bank bills, cash accounts, term deposits, government bonds, semi-government and corporate bonds, hybrids, ETFs, managed funds and more. Click here for a free trial subscription. |

|