Australian investors have been blitzed over recent years by newspaper headlines talking about hybrid securities. Many of these hybrids have been issued by high street banks, which can give investors a sense of comfort when it comes to overcoming their concerns about an asset class that can be perceived as risky. Because of this, it can be easy for investors to overlook the risk involved in hybrids in general if they are issued by well-regarded and well-known institutions. Hybrids carry risks that other investment instruments do not.

What is a hybrid?

Hybrids got their name because they have characteristics of both equity and debt: they are a hybrid of the two. The new breed of hybrids that we have seen issued in Australia have been developed to allow banks to shore up their core capital in times of stress. These new ‘Basel III compliant’ hybrids behave very much like regular debt instruments, such as bonds, except when the issuer gets into financial difficulty when they can convert into equity.

As readers of YieldReport will know, the Australian Prudential Regulatory Authority (APRA) can decide to force a bank to convert its hybrid into ordinary shares if it thinks the bank is in trouble. This is called a non-viability trigger and this is the risk that is probably best understood by investors.

But one risk that can be overlooked by investors is that when a new hybrid issue comes along, the prices of the older hybrids drop as smart investors switch into a better yield. This is an issue that investors should fully understand before investing in hybrids.

Some hybrids have maturities of 10 years or even 30 years although many have a call date of five years. This makes them fairly liquid and it is presumed that they will be refinanced every five years. But this is not a given. The fine print often allows issuers of hybrids to do whatever they like, stopping payments or not redeeming them at all. It is important for investors to read the investment prospectus thoroughly and understand the nuances behind the hybrid they are about to buy.

Are hybrids good value?

One question that consumes the market is whether or not investors get the right level of reward for the risk they are taking. If the hybrid is a retail product, as many are, they are generally unrated and this can provide clues of how risky they are.

More recently there has been a trend towards financial institutions issuing hybrids for a purely wholesale audience. Bendigo & Adelaide Bank was the first issuer of a Basel III-compliant hybrid targeted at institutional investors rather than retail clients. Since it was an institutional issue it was given a credit rating. The bank itself is rated A-/A2/A- by the three major ratings agencies while the hybrid was rated ‘BBB’ by S&P, two notches below the bank’s issuer rating.

Since that issue, both Westpac and ANZ have issued hybrids targeted at the wholesale, institutional market. In recent weeks Westpac came to market with a $750m hybrid that was upsized to $1bn and then again to $1.31bn showing that, from the institutional angle, there is a lot of demand.

In Australia there is a growing acceptance that these new instruments are now the norm and the market will come to accept them and incorporate their risks into their thinking. The expectation is that Tier 2 capital will be increasingly placed with institutional investors while higher-margin, more deeply subordinated Additional Tier 1 securities will go to retail investors.

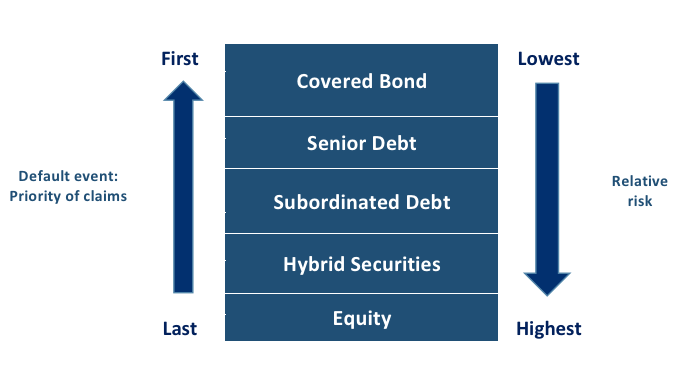

In a market that is increasingly dominated by low-yield investments, the extra yield offered by hybrid instruments can be very appealing. Increasing numbers of investors are using them to add an extra dimension to their portfolio but investors should know where hybrids fit into the capital structure of a company so that in the event of a default there is an understanding of how and where the losses will be applied. The above chart shows that equity has the highest risk followed closely by hybrids. The crucial thing for any investor contemplating buying a hybrid is simply that they understand what they are buying, what the risks are and, whether the returns being offered are commensurate with that risk. This should start with understanding and reading the prospectus document.

|

Paul McNamara is an editor and journalist with over 20 years’ experience. His career includes spells with the Financial Times, Euromoney, BRW Media, Asia-Inc and Banker Middle East. At present he is editor of YieldReport. YieldReport is a digital newsletter that carries comprehensive pricing and commentary on Australian interest rate securities in a monthly and weekly report. Each issue covers bank bills, cash accounts, term deposits, government bonds, semi-government and corporate bonds, hybrids, ETFs, managed funds and more. Click here for a free trial subscription. |

|