Don’t forget the rise in petrol prices this month (up by 20c a litre on some days in some markets) when assessing if the mostly moderate Consumer Price Index data yesterday for the June quarter might allow the Reserve Bank to cut interest rates at its next meeting on August 6.

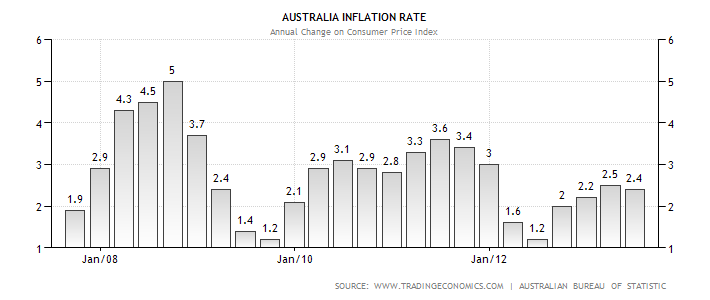

The June quarter CPI came in a touch lower than forecast at 0.4% (from the March quarter) for an annual rate of 2.4% (down from 2.5% in the March quarter).

On the face of it, that fits the case most economists have set for another cut in the cash rate by the RBA (to an all time low of 2.5%). And, seeing petrol prices fell 3.1% in the June quarter, you’d think there might be room for one more cut.

But since late June, petrol prices have risen sharply, thanks to that combination of year highs in global oil prices and the 12% slide in the value of the currency.

The RBA has already mentioned that it has noted how the outlook for inflation has been changed by the fall in the value of the dollar, so inflation has moved up the bank’s check list of important issues for the economy.

And, while CPI is another indicator, to go with weak retail sales and jobs market data that might allow another rate cut, the data also tells us the economy is still growing under its trend line figure of around 3% to 3.25%, and is not as weak as many analysts claim.

CPI expected to support rate cut?

The AMP’s Dr Shane Oliver is one economist who reckons a rate cut is possible, if a Federal election isn’t called before the August 6 meeting.

He wrote yesterday that the CPI "showed that inflation remains benign. Headline inflation actually came in a bit weaker than expected at 0.4% quarter on quarter or 2.4% year on year and the underlying inflation measures showed an average gain of 0.6% quarter on quarter or again 2.4% year on year. The bottom line is that inflation is comfortably contained in the RBA’s 2 to 3% inflation target range and we view the benign outcome as clearing the way for the RBA to cut interest rates again next month.

"The only complication is that if the Government declares an August 31 election, the RBA may prefer to wait till September, but either way interest rates in Australia are likely headed lower."

The RBA’s favoured measures, the Trimmed Mean and the Weighted Median however showed a hint of emerging price pressures – not much, but enough to have the RBA watching prices closely in coming months after they referred to the "slightly higher" outlook for inflation coming from the weaker dollar in the minutes of the July board meeting.

The ABS reported that, "The trimmed mean rose 0.5% in the June quarter 2013, compared to a revised rise of 0.4% in the March quarter 2013. Over the twelve months to the June quarter 2013, the trimmed mean rose 2.2% compared to a revised rise of 2.3% over the twelve months to the March quarter 2013.

"The weighted median rose 0.7% in the June quarter 2013, compared to a rise of 0.5% in the March quarter 2013. Over the twelve months to the June quarter 2013, the weighted median rose 2.6% compared to a revised rise of 2.5% over the twelve months to the March quarter."

And while the deeper inflation measures are mostly moderate, non-tradable inflation (that’s in the part of the economy not facing import competition) was up 4.3% in the year to June, up from 4.2% in the 12 months to March. The RBA takes note of that measure and has been referring to it off and on in the past year.

And we have to remember that for the first time in quite a long time, the RBA used the word "substantial" in the July board minutes to describe the amount of monetary stimulus administered to the economy in the past 20 months.

"Given the exchange rate adjustment that was occurring, and with the substantial degree of monetary stimulus already in place, members assessed the current stance of policy to be appropriate for the time being. The Board also judged that the inflation outlook, although slightly higher because of the exchange rate depreciation, could still provide some scope for further easing, should that be required to support demand," the minutes’ final paragraph read.

There was nothing in the CPI data yesterday or the latest figures from China, that would force the bank to reassess those comments ahead of the August board meeting.

We saw more continuing weakness in the Chinese economy in yesterday’s release of another weak early report on manufacturing activity. That will be noted by the RBA but won’t force a rate cut. After all, Australian iron ore imports to China are still growing, even as the economy is slowing.

What the RBA will be watching closely is the performance of the housing sector where ABS approvals and finance data confirm there’s a rebound now well under way. (The Housing Industry Association has already pointed out that starts are running at an 18 month high.) The CPI data shows that in the June quarter, new dwelling purchase costs for owner–occupiers rose 0.9%, pushing up overall housing costs.

And over the past year, new dwelling purchase costs for owner–occupiers rose 3.6%. While that’s no boom, it’s still well above the rate of growth in the CPI, and the RBA doesn’t want to see that get out of control so it will be keeping a close eye on housing.

With the ”substantial” amount of monetary policy stimulus to the economy already in place, plus the gathering housing rebound and the way petrol prices have risen this month, another rate cut is well down the central bank’s ‘to do’ for the economy at the moment.