Copper prices reached an eight-month peak on Wednesday following an agreement among Chinese smelters, who account for half of global copper processing, to collectively reduce production.

China's 18 major copper smelters convened in Beijing, announcing a symbolic reduction in loss-making production without specifying exact volumes or timing.

Each smelter will independently determine the extent of reduction they plan to implement, as reported by Reuters.

The news prompted Comex copper to spike to over $US4.66 a pound before settling just above $US4.05, marking its highest level since late July.

Meanwhile, on the LME, the three-month metal touched $US8,799 a tonne, its highest since early August, before moderating to close up 0.86% at $US8,563 a tonne.

Analysts suggest that the government-influenced decision may prompt several smelters to undergo early and extended maintenance shutdowns, effectively reducing output to restore supply-demand equilibrium.

Similar to the steel industry's strategy of purchasing low-grade iron ore to compensate for shortages, copper companies are expected to increase the use of copper blister as a substitute for scarce concentrate.

Western analysts remain skeptical of the news and the ensuing price surge due to the absence of concrete figures.

Shortages in mined copper concentrates have intensified competition among smelters, leading to a significant decline in income to decade-low levels as they slash TC/RC (Treatment and Refining Charges) to attract business.

Chinese spot copper treatment charges (TCs) plummeted to $US1.20 per tonne on Friday, marking a 76% drop in two months and the lowest level since 2013.

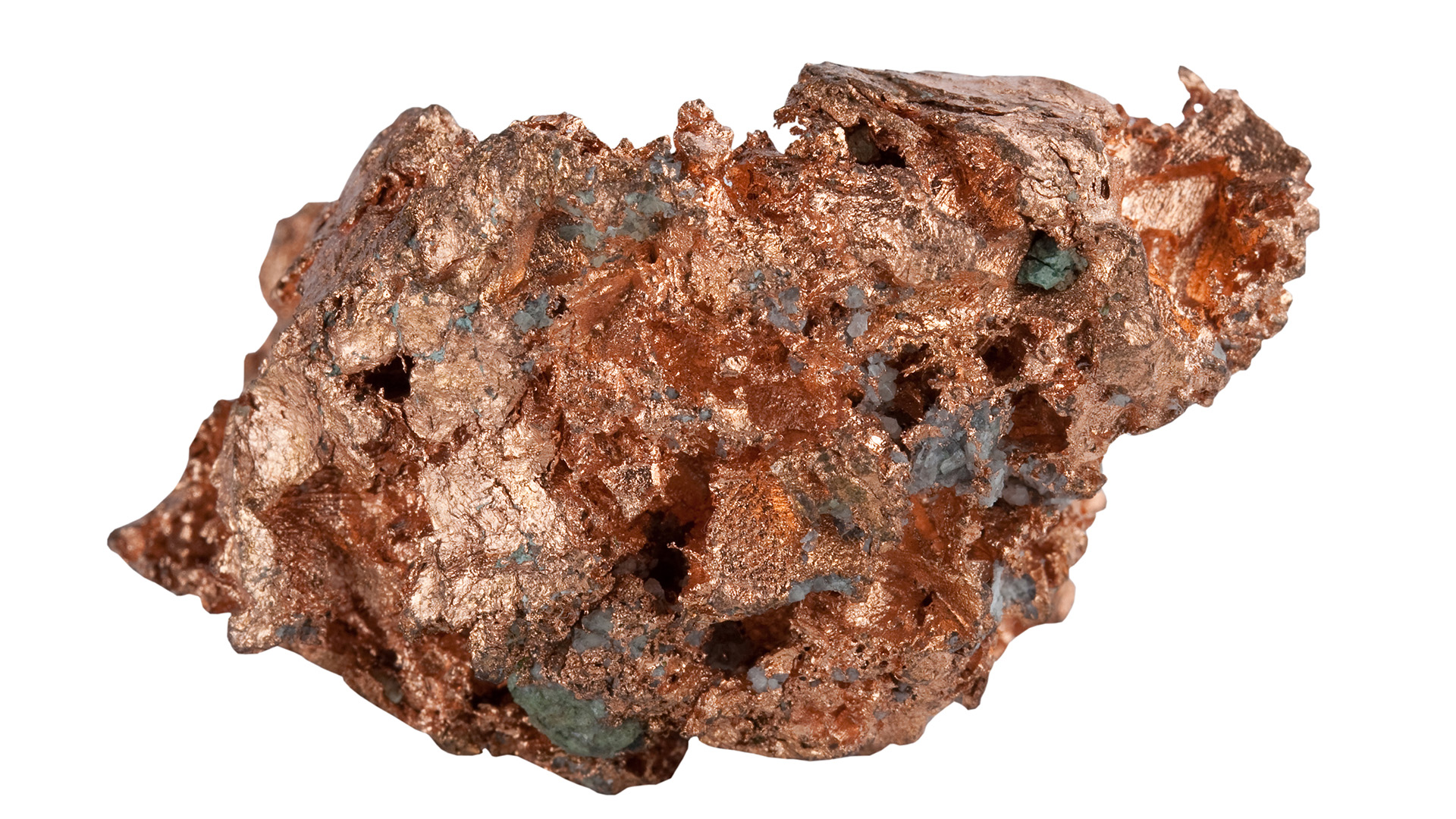

Chinese smelters and refiners control approximately half of the global annual copper production of 13 million tonnes. However, supply constraints persist due to closures of major mines such as First Quantum's Cobre Panama and reductions in production by Anglo American, alongside operational issues in Chilean and African mines.

With a new Indian smelter set to enter the market, competition for concentrate supply is expected to intensify further.

Notably, Chinese companies, led by Jiangxi Copper Corp, are reportedly experiencing significant financial strain amid the current market dynamics.