A sequel to our recent Investment Perspectives, Is the Aussie residential market bottoming?, this article explores how residential markets have fared in the US, UK and Canada, and assesses the medium to long-term outlook for housing.

Is FORA (fear of renting again) driving global residential markets?

In March, Australia, the US and Canada recorded their first monthly increase in residential prices. UK house prices have been increasing since January. This has all been in the face of a record pace of interest rate increases in each market. Yet most market pundits tell us real estate is simply an interest rate play.

So, what’s going on?

The US housing landscape

In our October 2022 article, A closer look at US housing, we explained how the housing situation is in a much stronger position relative to the pre-GFC period – with low levels of variable (ARM) mortgages, higher credit standards, stronger household balance sheets and historic housing undersupply. Now, let’s consider how the situation has evolved since then.

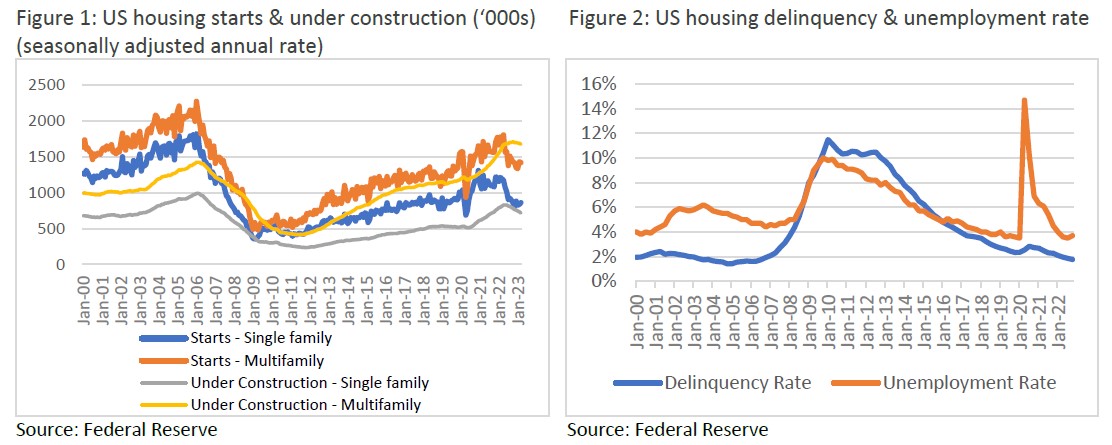

Figure 1 below shows that, as expected, despite the slight uptick in recent months, housing starts remain well below the levels prior to the Fed rate hikes. Falling starts have also led to a decrease in housing under construction. However evidently, as shown by the yellow and grey lines, the theme of structural undersupply of single-family housing and the near-term elevated multi-family supply (particularly in the sunbelt) remains unchanged.

Furthermore, despite the rate hikes, US mortgage delinquency rates and the US unemployment rates remain at historically low levels, as seen in Figure 2. As we argued in our October paper, it’s unlikely that there will be a wave of distressed selling.

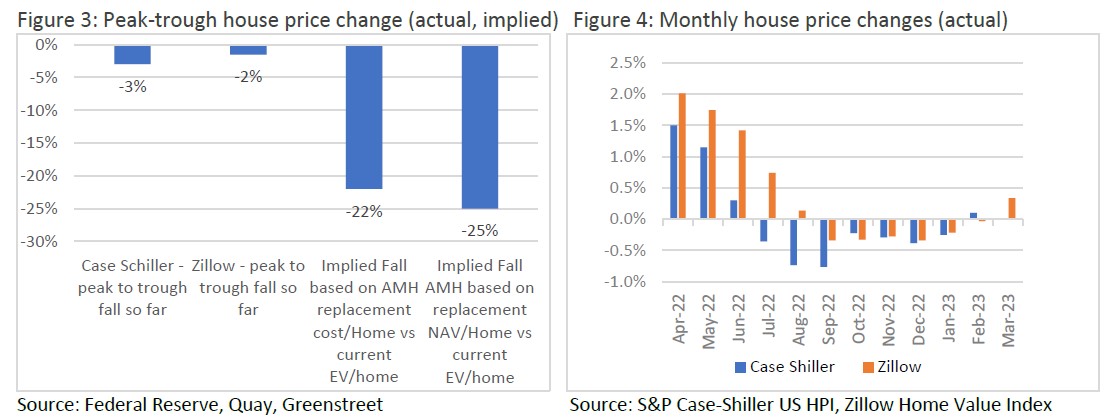

To date, house prices peak to trough, have fallen only -3% based on the seasonally adjusted Case Schiller Index and -2% according to Zillow (Figure 3). Contrast this with the implied fall in house prices based on AMH’s (listed US single-family landlord) current valuation. We estimate AMH is trading -22% below replacement cost/home and -25% below net asset value (NAV)/home. In fact, Zillow’s house price index (Figure 4) recorded a positive +0.3% growth in single-family house prices in March ’23. Although quite delayed, the Case Shiller Index reported a +0.1% gain for the month of February, which appears broadly consistent with the Zillow data.

Either NAV investors have oversold the downside risk to housing prices, or the Zillow data for March is a blip, and there are more falls in house prices to come. We’re not so sure the latter will be the case.

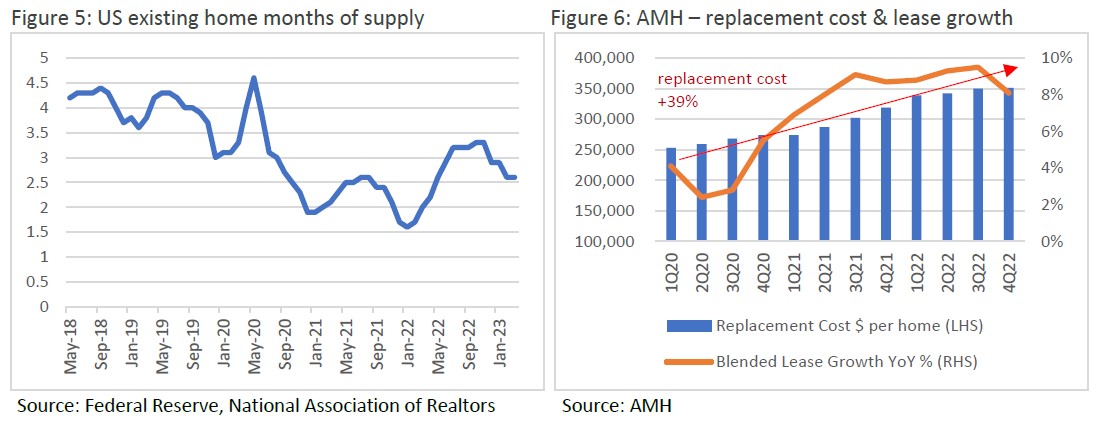

Figure, 5 below, shows that US existing home months’ supply has not only been falling in recent months, but is below pre-COVID levels. This means homeowners are not distressed (especially with US unemployment and loan delinquency remaining at historically low levels) to flood the market with supply, and/or buyers are not holding out for further price falls before transacting. Nevertheless, for a cashflow-based investor, high rental growth (Figure 6) – and in particular, the durability of high rent (structural undersupply) – is exciting news, particularly as replacement costs growth continues to underpin long-term valuation.

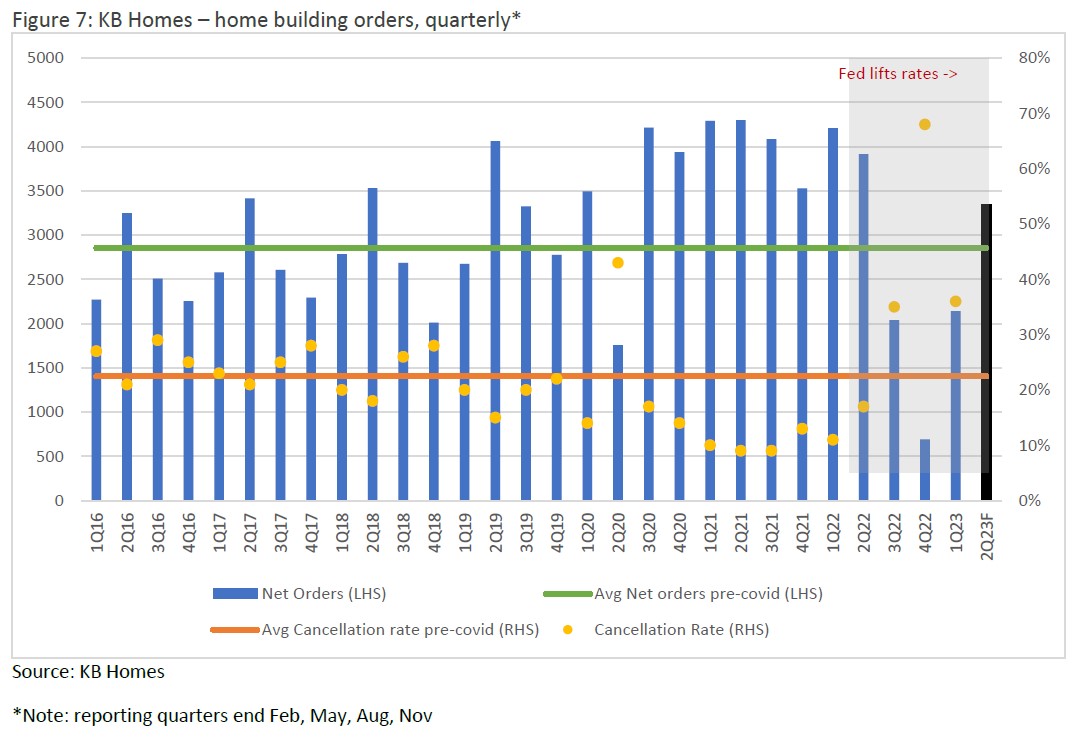

Another interesting angle to consider is those at the front line of the housing market – US homebuilders. Figure 7 shows the historical net order volumes reported by KB Homes, one of the largest homebuilders in the US. The period encompassing the Fed’s rate hike cycle is shaded in grey. During this period, we see a sequential, dramatic fall in KB’s net order volumes and a spike in cancellations, peaking at 68% in late 2022. Interest rates and sentiment around house prices clearly hit prospective buyers’ appetite to commit to, or proceed with, building a new home.

Interestingly, KB reported a stronger-than-expected result in the first quarter of 2023 – net order volumes and cancellation rates improved from the previous quarter (albeit still well below prior years). Management noted improving buyer confidence, perhaps due to the stabilising mortgage interest rate environment, helping to drive order activity and decrease cancellations. This trend continued post-quarter end, and management forecasted 3,300-3,700 net orders for the second quarter of 2023, as shown by the black column in Figure 7, which is higher than the average quarterly net orders in the pre-COVID era.

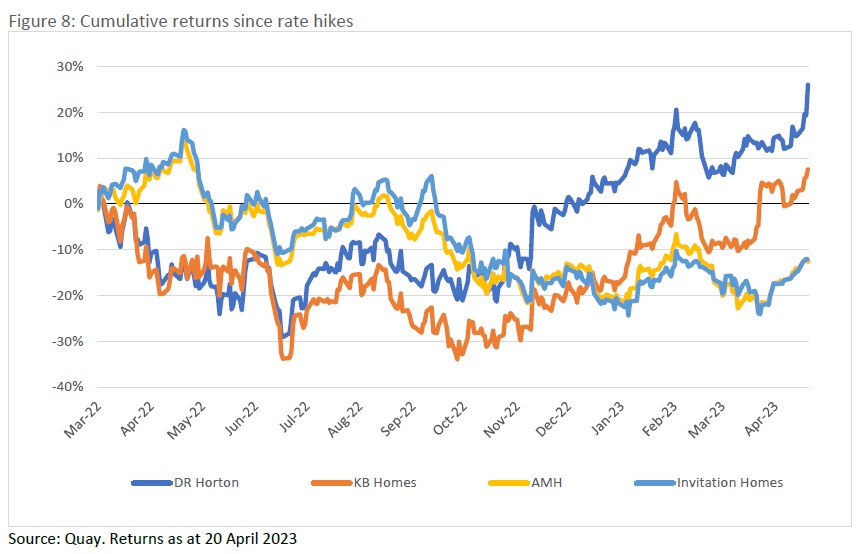

The market has clearly responded to this recovery. KB and its homebuilding peers’ share prices are shown in Figure 8. In the period from the March ’22 rate hikes to now, homebuilders have significantly outperformed listed landlords, Invitation Homes and AMH. To be sure this isn’t just reversion of prior underperformance, two year returns to 28 Feb ‘22 was +60% for DR Horton, +54% for the Dow Jones US Homebuilder Index, +18% for KB Homes, +47% for AMH and +32% for Invitation Homes. In our opinion, this adds further fuel to the argument that listed single-family landlords have been oversold.

Canada housing landscape

Much like their neighbours across the border, the rental market in Canada is tight. However, it’s more nuanced, as most provinces have rent control measures. Rent increases on lease renewals are capped at a certain % (rules vary depending on province), with landlords unable to charge a market rent until the unit is vacated. Over time, this has a potential to, and indeed has, created a material gap between in-place rents and market rents. This, however, allows landlords to still increase in-place rents on renewals, even when market rents are falling. On the other hand, it slows the uptake of market rents when growth is booming.

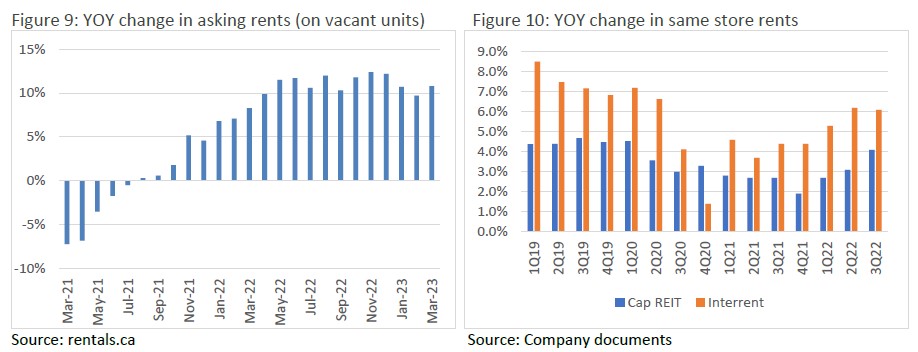

We see this dynamic illustrated in the charts below. Market rents in Canada were negative (Figure 9) until the government began relaxing COVID restrictions in Jul ‘21, including allowing the return of fully-vaccinated foreign students and foreign nationals. Since that date, year-over-year (YOY) asking price growth has accelerated, and has been consistently around the +10% mark.

Comparing this to the same store rent growth of two listed Canadian apartment REITs (Figure 10), we can see rent growth has been more stable with lower highs but no negative periods.

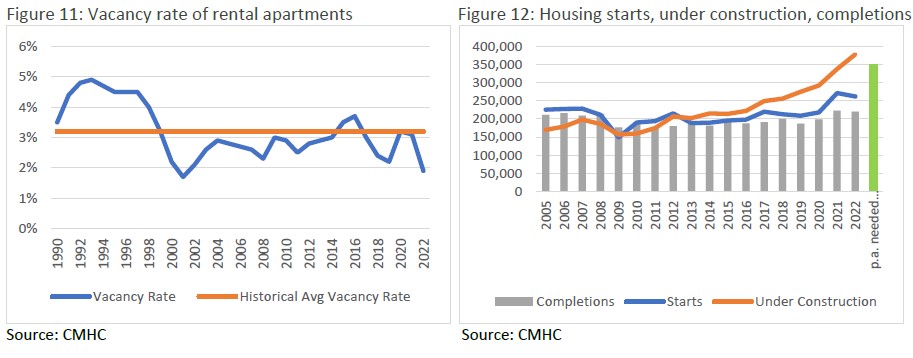

Vacancy rates in Canadian apartment rentals are at the tightest level they’ve been in decades – 1.9% as of Dec ‘22, almost half the historical average level of 3.3% (Figure 11). Accordingly, market rent growth has been strong.

Indeed, there is no relief in sight. Housing in Canada remains structurally undersupplied – with completions averaging about 200,000 p.a. between 2013-2022 (Figure 12). A study published by Canadian Mortgage and Housing Corporation (CMHC) in 2022 estimated that 350,000 units p.a. would need to be built in the next 10 years in order to meet projected demand.

The interest rate hikes have also led to housing starts falling in 2022 from 2021 levels, well below the 350,000 required. The shortfall is more acute in Ontario – with CMHC estimating 150,000 completions p.a. are required in the province in the next 10 years versus the 70,000 p.a. completed in the previous 10 years to 2022.

And how is the for-sale housing market faring?

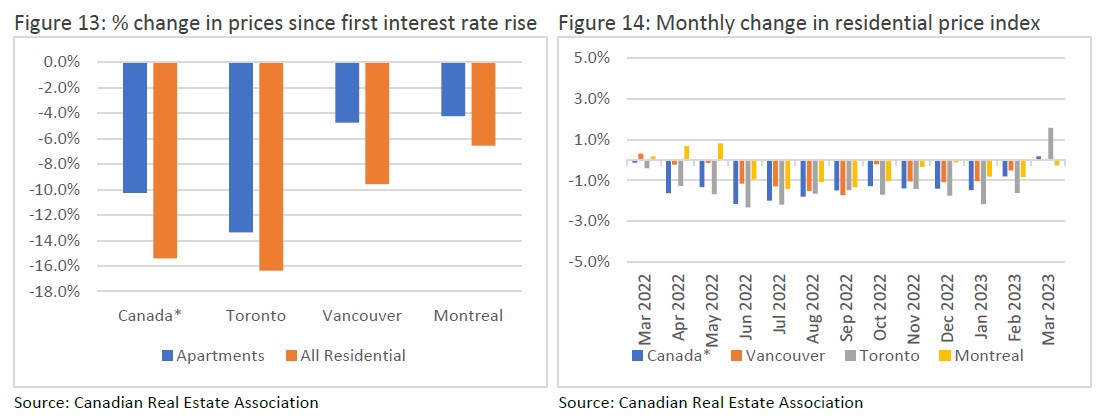

The Bank of Canada began their hiking cycle in March ‘22, lifting the interest rate from 0.25% to 4.50% by Feb 2023. This has clearly hit residential prices in the short term, with property prices down 15% in Canada, and apartments down 10% (Figure 13) in the year to March ‘23. Falls have been slightly more pronounced in Toronto.

Interestingly, consistent with Australia and the US, we saw the local Home Price Index record an increase in March ‘23 (Figure 14). This is despite foreign buyers being banned from acquiring residential real estate from 1 January 2023 for a period of two years.

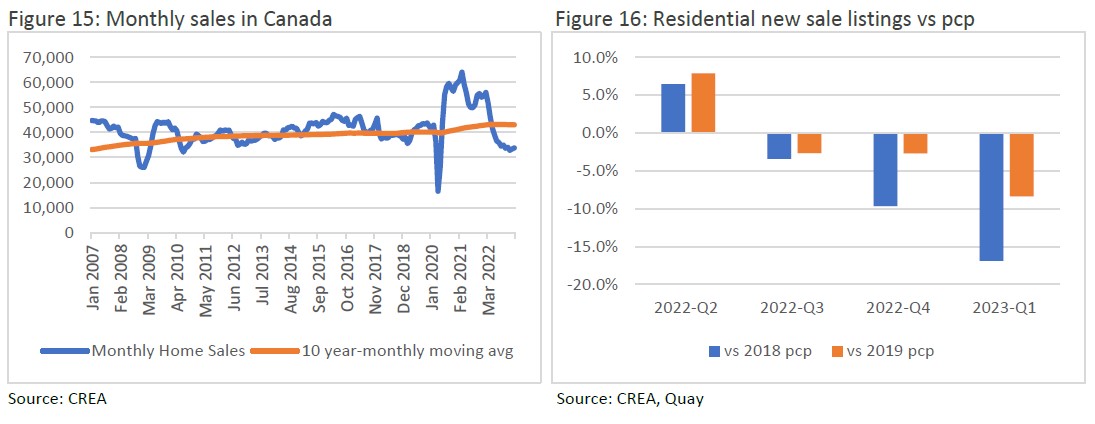

Home sales, which have fallen dramatically since the hiking cycle began, also experienced an uptick in March ‘23 (Figure 15). However, it’s still tracking more than 20% below the 10 year historic monthly moving average. New sale listings continue to fall (Figure 16), now tracking -17% and -8% below 2018 and 2019 levels (i.e. pre-COVID).

Buyers and sellers look to be in a standoff in Canada too. Although it’s early days, perhaps the phenomenon of FORA is at play here.

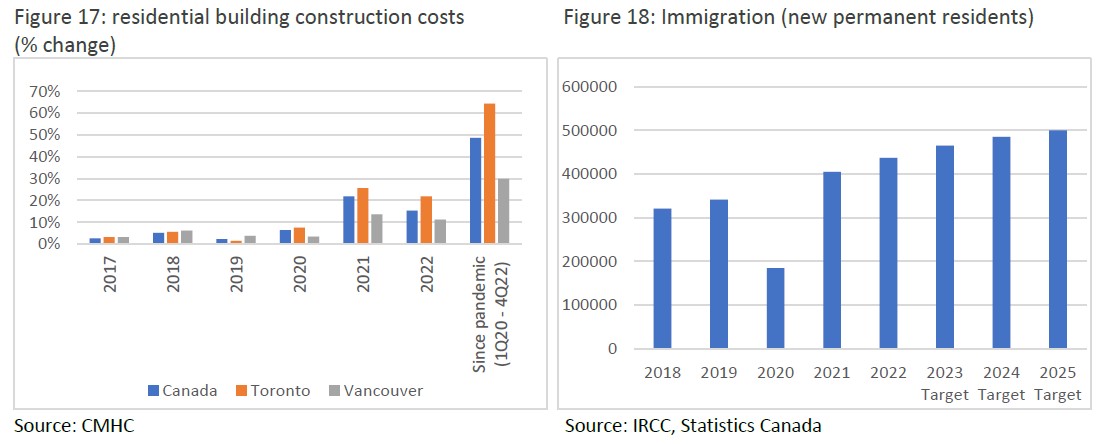

Thinking longer term, many tailwinds will support housing valuations. Large cost inflations, particularly since the COVID period (Figure 17), should anchor valuations going forward. The Canadian government’s immigration policy, which has driven record new permanent residents, should further support house prices and rent.

UK housing landscape

The UK central bank began lifting the cash rate in Dec ‘21 from a low of 0.1% to 4.25% by Mar ‘23. Despite the potential short-term impact of interest rate rises on sentiment, UK house prices have been resilient to date.

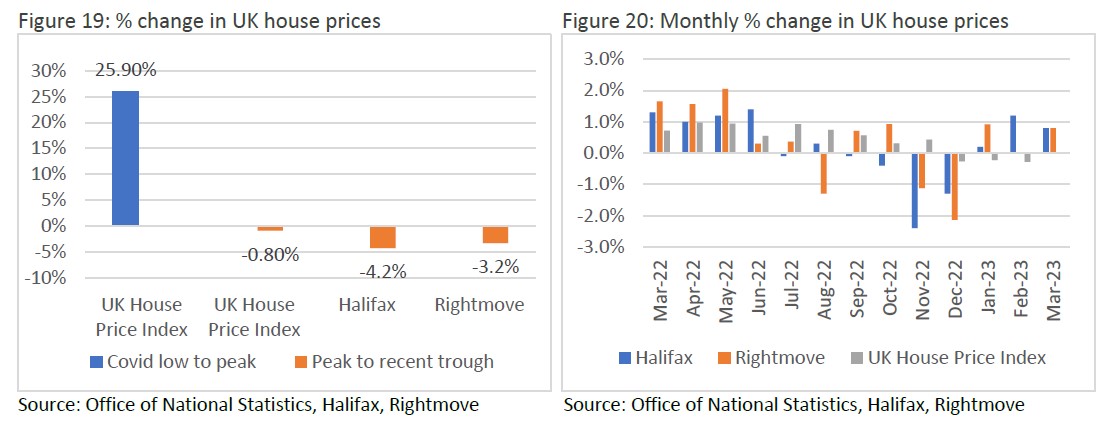

Based on the official index published by the Office of National Statistics (Figure 19), UK house prices rose to a peak of +26% from COVID lows. Despite the interest rate hiking cycle, the Index has recorded a fall of only -0.8% off the peak to date. This index is the most accurate, as it’s calculated based on completed sales sourced from the government land registry. However, it’s lagged as it based on settlement date.

More timely measures, such as Halifax (based on real time sales from their database of mortgage approvals) and Rightmove (based on vendor asking prices), indicate only a fall of -3% to -4% from its peak. Consistent with observations in Canada, the US and Australia, the UK indexes have recorded positive growth month-on-month since January ‘23 (Figure 20).

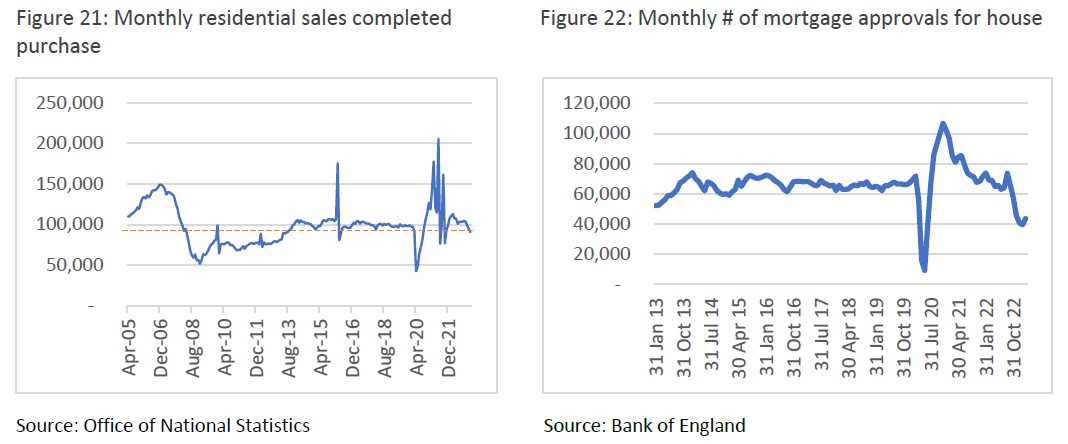

Despite the minimal impact on prices so far, interest rates have had significant impact on residential sales volumes (Figure 21). Recent monthly sales transactions are, on average, down approximately 30% from the levels seen in late 2020 to the middle of 2021, and over 50% down from June ‘21. This downtrend has accelerated in the last three months, with volumes now below the pre-COVID three year average of 100,000 sales per month.

Mortgage approvals for house purchases data from the Bank of England shows a similar trend (Figure 22). Rising interest rates have dampened home buying appetite. However, the most recent release in Feb ‘23 showed an increase month on month in mortgage approval activity. This was the first monthly increase since Aug ‘22. Mortgage approval data for house purchases is a leading indicator of homebuyer appetite, so if this trend continues, it’s positive for transaction activity going forward.

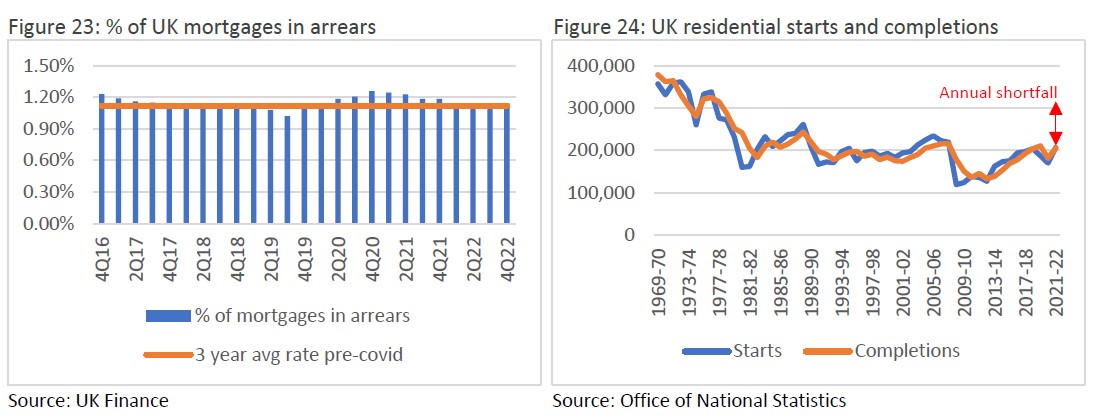

Limited price falls, despite lower buyer demand and lower sale volumes, indicate that vendors are under no pressure to sell at lower bids. This is supported by mortgage arrears data (Figure 23 on the following page), which shows that there’s currently no sign of elevated distress despite the level of interest rate hikes over the past 12 months. The latest mortgage arrears rate of 1.1% is in line with the three year average rate pre-COVID. In fact, the chart shows that even during the worst COVID period, mortgage arrears only reached a peak of 1.26% of total mortgages – a testament to the strength in lending standards. This suggests to us that there is unlikely to be a flood of upcoming distressed listings that would put downward pressure on house prices.

Additionally, a high interest rate environment is acting as a handbrake on future residential supply. As Figure 24 shows, housing starts and completions are tracking at ~200k p.a. This is well below the UK government’s target of 300k p.a., which was the estimated amount required to close the demand gap. This demand/supply imbalance in housing supply will support house prices in the medium to long term.

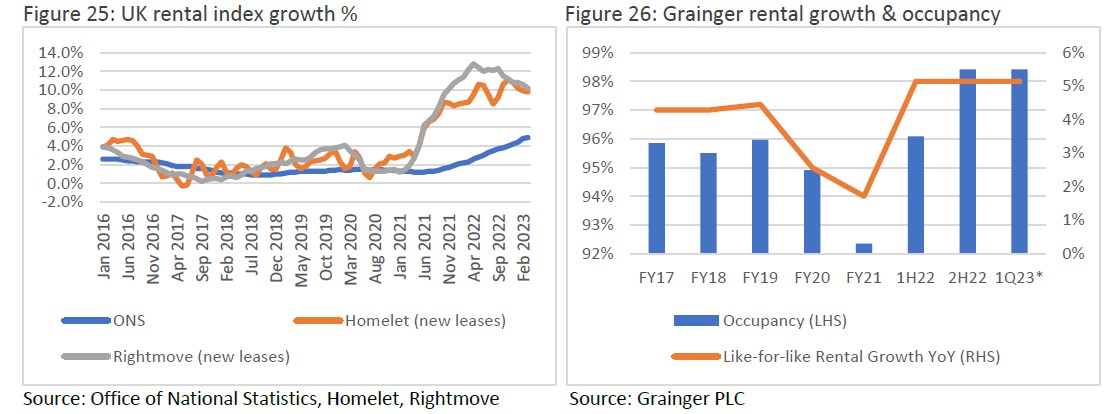

Evidence of this imbalance can be seen in the rental market. New lease asking rents have accelerated over +10% year-on-year (Figure 25), although some deacceleration has been seen recently.

Official rents measured by the ONS, which is based on rent changes in the whole system (i.e. ‘stock’ – hence less volatile than new lease index ‘flow’), continue to accelerate, with the latest print at +5% YoY.

Figure 26 shows the rental growth and occupancy of Grainger, the only listed UK apartment landlord. Occupancy is at a record high of 98%, after having fallen to 92% during the worst of the COVID period. Like-for-like growth is printing +5% year-on-year, which is in line with the national rent index.

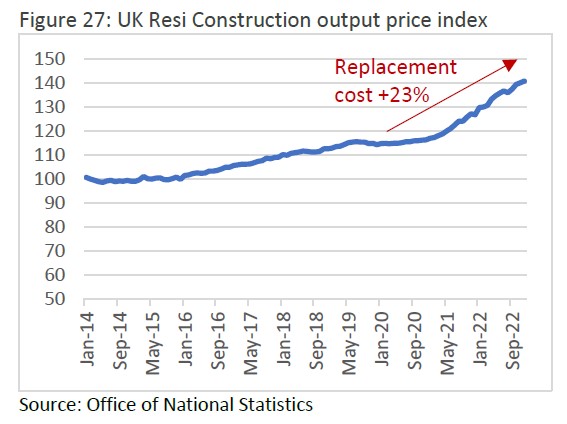

Turning to replacement costs, the rise in the cost of building materials and the growth in labour costs have driven up building costs in the sector. Since COVID, replacement costs are estimated to have increased +23% (Figure 27). In the long term, this will underpin UK residential valuations.

Quay’s takeaway

We have long argued that interest rates do not drive residential prices in the medium to long term. Market pricing of the listed residential sector, at least in the case of the US, UK and Canada, appear to be pricing in worst case scenarios for house price valuations and are creating a significant investment opportunity. This is despite record growth in the underlying cash flows. Recent house price data suggests that these worst case scenarios may not eventuate. In our view, long-term undersupply in these countries, and the growth in replacement cost, will underpin values in the future.

Our global index-unaware approach allows us to focus on investing in sectors such as residential that have long-term secular tailwinds. Of course, equally important is a sensible balance sheet, exceptional management and discount to replacement cost, and the potential of strong plough back growth. We’ll continue to monitor the situation as it evolves.

For more information about Quay, visit https://www.quaygi.com/